Key Takeaways

- Persistent affordability issues and cost pressures may constrain buyer demand and compress margins, limiting future revenue and earnings growth.

- Geographic concentration and evolving consumer preferences expose the company to volatility and restrict its ability to fully capitalize on market opportunities.

- Elevated mortgage rates, regional concentration, high spec home exposure, and rising costs are pressuring margins and earnings, increasing risk if market or demand conditions weaken.

Catalysts

About M/I Homes- Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

- Although M/I Homes is positioned to benefit from the ongoing U.S. housing undersupply and expected household formation growth, persistent affordability issues caused by high home prices and interest rates continue to limit the pool of eligible buyers, which may keep new contract volume and absorption rates under pressure, impacting future revenue growth.

- While Millennial and Gen Z demographics entering peak homebuying years should support long-term demand, rising regulatory and environmental requirements, along with potential increases in building material tariffs-such as on Canadian lumber-could drive up construction and compliance costs, further compressing gross margins over time.

- Despite the company's deep lot pipeline and expansion into the Sun Belt, geographic concentration in select regions like Texas and Florida exposes M/I Homes to potential outsized impacts from localized downturns or oversupplied markets, increasing revenue and margin volatility relative to more diversified peers.

- Although supply chain investments and operational efficiency improvements are targeted to sustain operating margins, wage inflation, land development cost growth, and ongoing SG&A expense increases tied to rising community count may offset much of these gains, pressuring net income over the mid

- to long-term.

- While the industry is likely to see some benefit when mortgage rates normalize, a sustained shift among younger consumers toward renting and urban living, coupled with a slow adoption of new construction technologies, may limit M/I Homes' ability to capitalize on evolving housing preferences and restrict longer-term earnings growth.

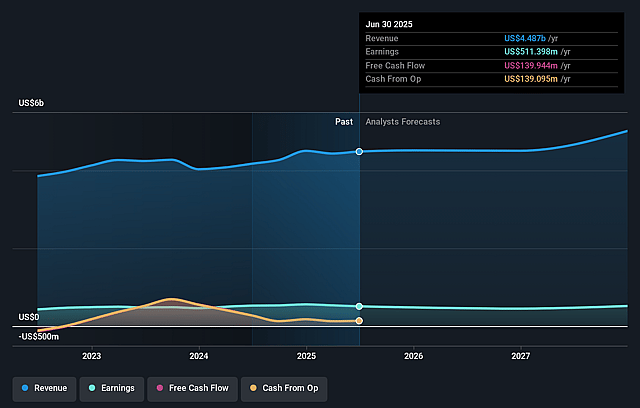

M/I Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on M/I Homes compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming M/I Homes's revenue will grow by 4.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 11.4% today to 10.0% in 3 years time.

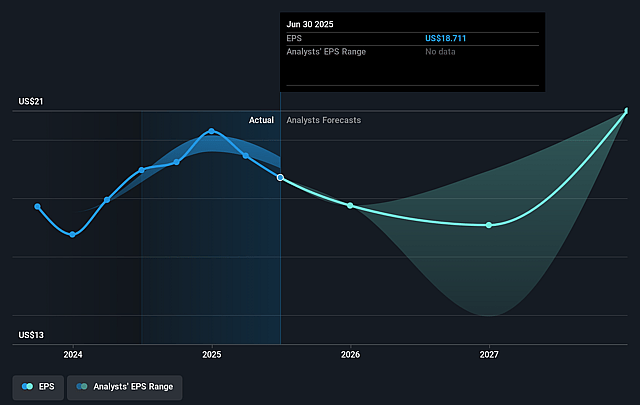

- The bearish analysts expect earnings to reach $512.4 million (and earnings per share of $21.17) by about September 2028, up from $511.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.1x on those 2028 earnings, up from 7.8x today. This future PE is lower than the current PE for the US Consumer Durables industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 2.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.88%, as per the Simply Wall St company report.

M/I Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent elevated mortgage interest rates are impacting buyer confidence, requiring the company to implement regular mortgage rate buydowns to incentivize sales, which is directly pressuring gross margin and could further weigh on net earnings if rates remain high for an extended period.

- Gross margin has declined by over 300 basis points year-over-year, and management anticipates potential further erosion toward the lower 20% range, which, if sustained, could materially reduce net profitability even if top-line revenue remains stable.

- Community and regional exposure is heavily weighted toward the Southern U.S. (Texas and Florida), making the company more vulnerable to localized oversupply, economic downturns, or climate-related risks in those markets, which could result in sharper fluctuations in revenues and operating margins.

- A rising share of inventory and spec home sales (70% of closings from specs) exposes the company to greater risk from rapid market shifts or unsold inventory, and these homes tend to generate lower gross margins, potentially compressing earnings in periods of demand softening.

- Ongoing SG&A growth from expanded community count and headcount, while necessary for scale, may not be offset by revenue growth if sales pace or pricing falters, leading to deteriorating operating leverage and constraining long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for M/I Homes is $150.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of M/I Homes's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $185.0, and the most bearish reporting a price target of just $150.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.1 billion, earnings will come to $512.4 million, and it would be trading on a PE ratio of 9.1x, assuming you use a discount rate of 8.9%.

- Given the current share price of $151.4, the bearish analyst price target of $150.0 is 0.9% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.