Key Takeaways

- Heavy reliance on select regions and single-family homes leaves M/I Homes vulnerable to local downturns and shifts in consumer housing preferences.

- Elevated mortgage rates and aggressive sales incentives are pressuring gross margins and earnings, with inflation and affordability concerns posing ongoing risks.

- Margin pressures, geographic concentration, and limited pricing power heighten vulnerability to market shifts, rising costs, and consumer demand changes, threatening profitability and earnings growth.

Catalysts

About M/I Homes- Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

- While M/I Homes is well-positioned to benefit over the long term from the persistent undersupply of homes and favorable demographics driven by ongoing population growth and household formation in many of its key markets, the company continues to face acute near-term demand volatility related to persistently elevated mortgage rates, which could further depress new contracts and revenue growth if affordability remains constrained.

- Although the company's expansion within high-growth Sunbelt and Midwest regions aligns with shifting population trends and suburbanization-which should support community count and top-line growth over time-their heavy exposure to select regional markets leaves them vulnerable to localized economic slowdowns, potentially resulting in outsized swings in revenues or asset write-downs if certain geographies underperform.

- Despite the development of entry-level and first-time buyer product lines to capture broadening demand, the company's continued reliance on aggressive mortgage rate buydown incentives to stimulate sales is compressing gross margins, and as long as market rates remain high or demand stays choppy, further margin erosion and pressure on net earnings are likely.

- While operational efficiency initiatives and cost controls have supported margin improvement in recent years, the inability to fully offset rising land costs and potential future increases in materials or regulatory expenses may undermine sustained margin expansion, directly threatening profitability and return on equity if inflationary pressures persist.

- Even as industry consolidation and scale advantages could favor larger builders like M/I Homes in winning market share, the lack of meaningful product diversification outside single-family homes may limit adaptability to evolving consumer preferences, putting longer-term revenue and earnings growth at risk should demand shift toward multi-family or alternative housing models.

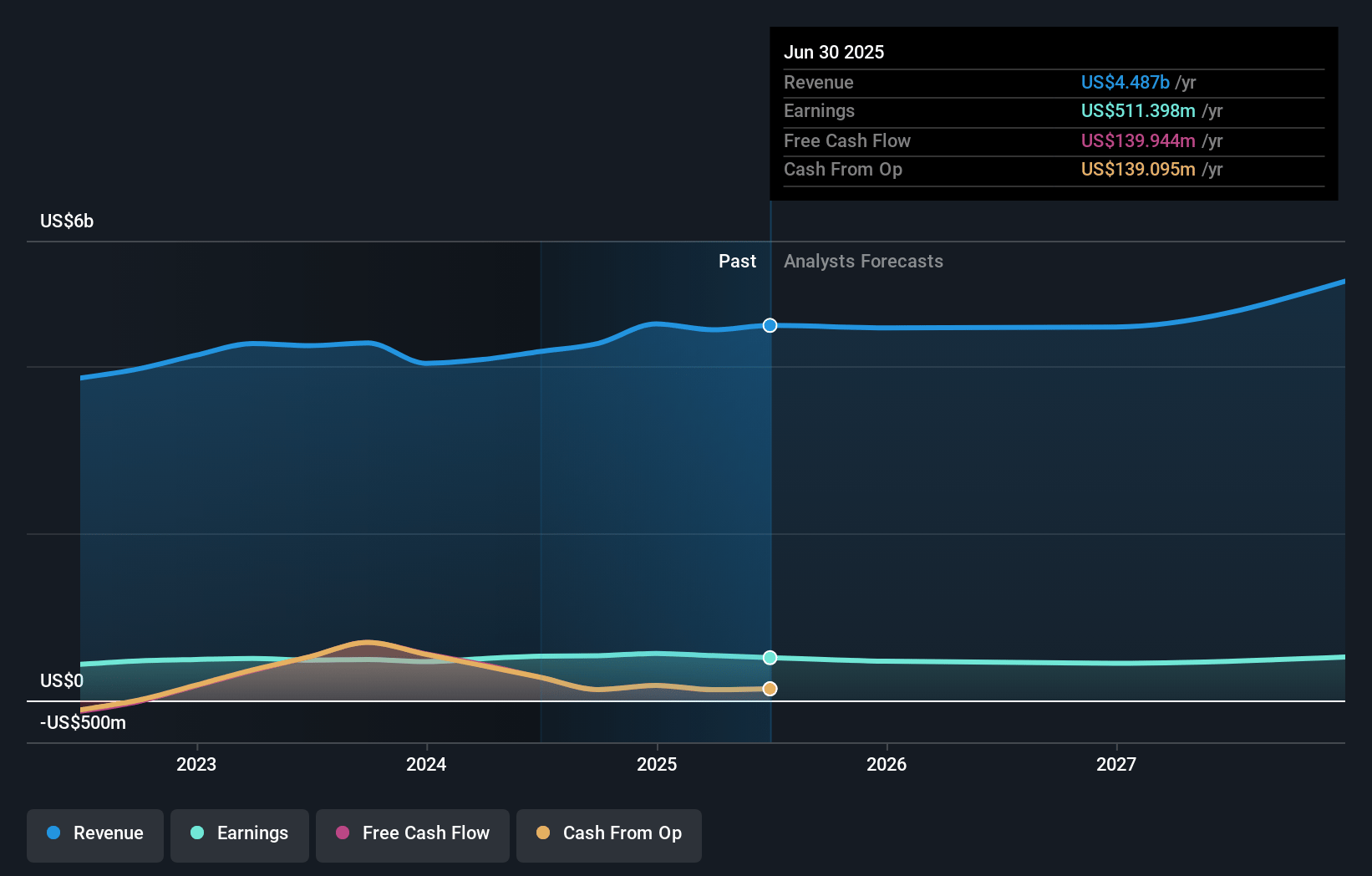

M/I Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on M/I Homes compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming M/I Homes's revenue will decrease by 0.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 12.1% today to 8.0% in 3 years time.

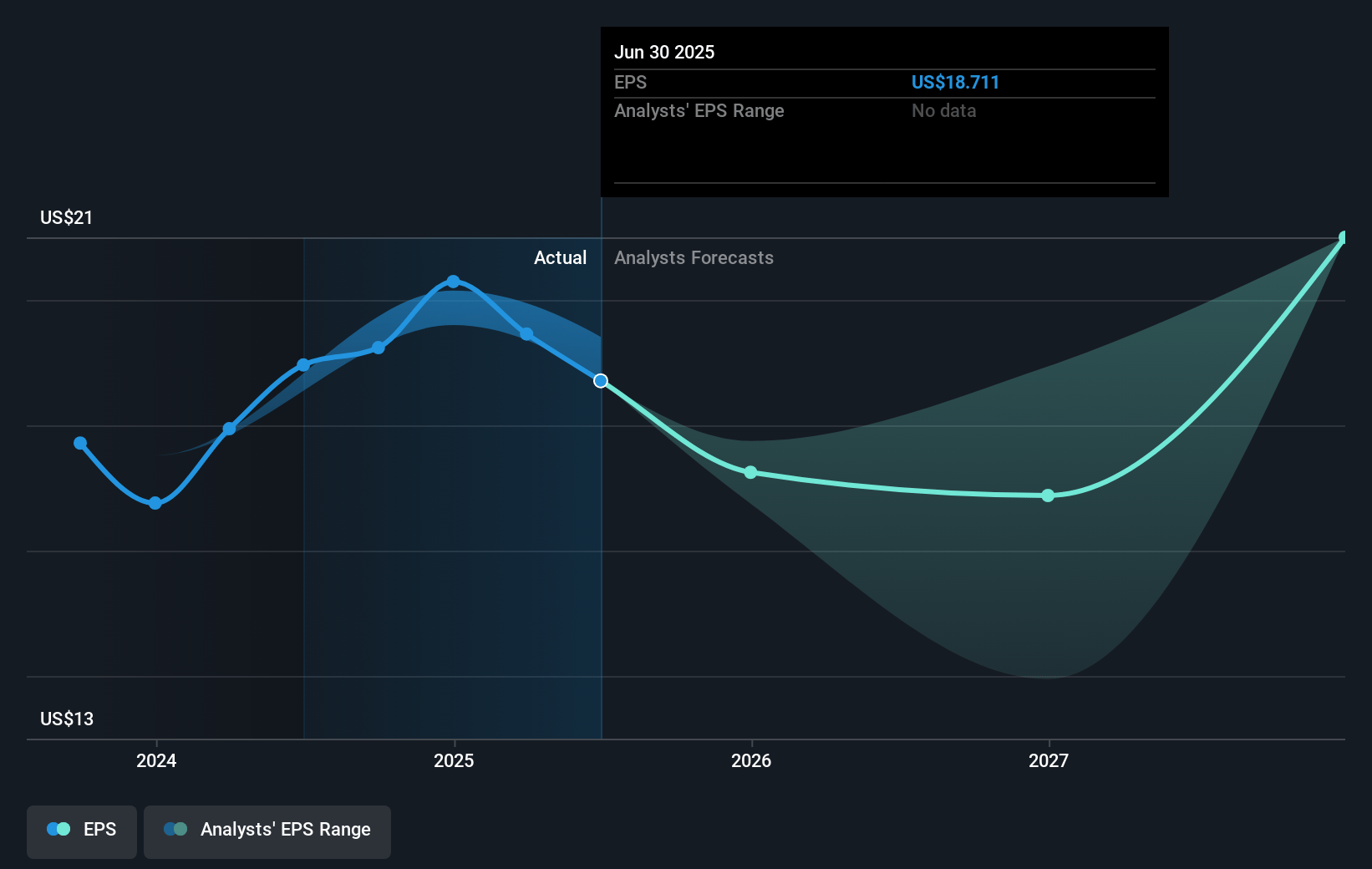

- The bearish analysts expect earnings to reach $347.1 million (and earnings per share of $12.87) by about July 2028, down from $536.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 5.8x today. This future PE is greater than the current PE for the US Consumer Durables industry at 9.6x.

- Analysts expect the number of shares outstanding to decline by 2.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.36%, as per the Simply Wall St company report.

M/I Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on mortgage rate buydowns to stimulate demand signals persistent affordability challenges; if higher interest rates or structural tightening remain, M/I Homes may face continued pressure on both revenues and net margins as these incentives erode overall profitability.

- New contracts and homes delivered both saw year-over-year declines, with contracts down 10% and deliveries down 8% in the first quarter, highlighting risks of stagnating or declining sales volumes and revenue if demand does not recover sustainably.

- Gross margins are trending downward year-over-year, dropping by 120 basis points from the prior first quarter and likely to remain below last year's level, making M/I Homes vulnerable to further margin compression from rising input costs or reduced pricing power, which would impact net earnings.

- A heavy concentration of owned and controlled lots in the Southern region (about 60% of total) exposes the company to geographic risks; underperformance in these markets could cause significant revenue volatility and impair asset values if those regions soften.

- Despite strong land holdings, there is very little true pricing power in most communities (estimated less than 10%), and reliance on spec home sales at lower margins increases the risk that a shift in consumer preferences or an uptick in resale inventory will further compress margins and reduce earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for M/I Homes is $140.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of M/I Homes's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $185.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.4 billion, earnings will come to $347.1 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of $115.35, the bearish analyst price target of $140.0 is 17.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives