Key Takeaways

- Strategic positioning in high-growth regions and strong vertical integration support outperformance in revenue growth, margins, and market share as demographic tailwinds intensify.

- Disciplined inventory management and tech-driven efficiencies could deliver accelerated earnings and structurally higher profitability compared to industry peers.

- Geographic concentration, affordability issues, and rising costs heighten M/I Homes' exposure to economic shocks, shrinking margins, and volatile revenue amid shifting market and demographic trends.

Catalysts

About M/I Homes- Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

- While analyst consensus sees rate buydowns as primarily stabilizing near-term revenue, a more bullish case recognizes that, as interest rates inevitably decline and pent-up buyer demand is released, M/I Homes is uniquely positioned to rapidly expand both volumes and margins due to its disciplined spec inventory and internal mortgage platform; this could drive a step-function increase in revenue and earnings power well above consensus.

- Analyst consensus projects community count growth to drive steady revenue increases, but with M/I Homes' leadership positions in core Midwest and Sunbelt markets, plus the ability to scale to 12,000 to 14,000 annual deliveries per management comments, the magnitude of future growth could be significantly higher, with potential for outsized gains in both market share and top-line revenue.

- M/I Homes' concentrated exposure to high-growth, affordable Sunbelt and Midwest markets aligns precisely with ongoing generational migration and demographic tailwinds-this strategic geographic footprint positions the company to benefit disproportionately as Millennials and Gen Z shift into prime homebuying, supporting long-term, above-market revenue growth.

- Continued vertical integration, including expansion of high-margin mortgage and title services, is driving record capture rates (now over 90% of buyers use M/I Financial), boosting ancillary income streams and providing a material uplift to net margins over time.

- Ongoing adoption of advanced construction technologies and digital sales processes is reducing cycle times and build costs, further increasing operating leverage and ROE; as scale continues to rise, this efficiency gain may drive structurally higher margins and earnings versus peers.

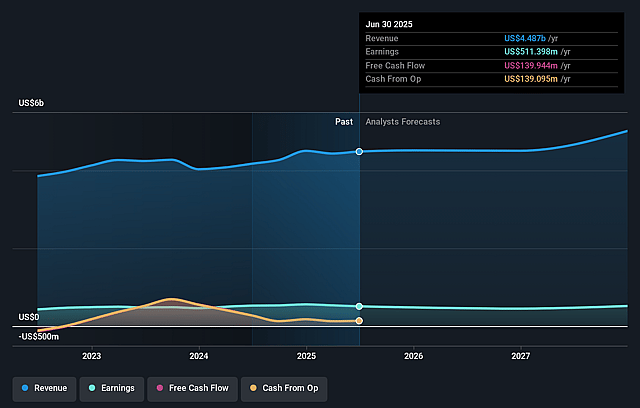

M/I Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on M/I Homes compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming M/I Homes's revenue will grow by 2.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 12.1% today to 10.0% in 3 years time.

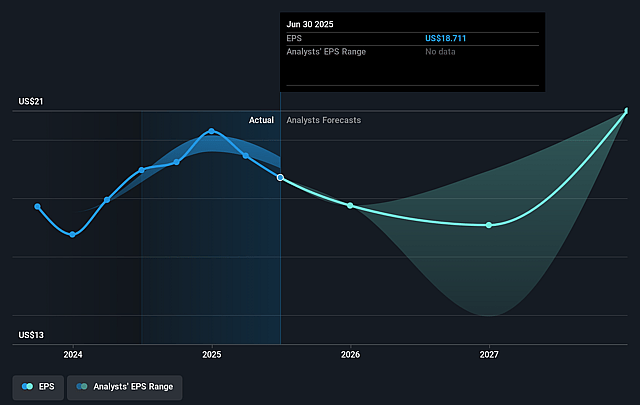

- The bullish analysts expect earnings to reach $483.4 million (and earnings per share of $19.09) by about July 2028, down from $536.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, up from 6.2x today. This future PE is greater than the current PE for the US Consumer Durables industry at 10.4x.

- Analysts expect the number of shares outstanding to decline by 2.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.35%, as per the Simply Wall St company report.

M/I Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent declines in U.S. population growth and household formation could reduce long-term housing demand, directly limiting M/I Homes' potential to grow unit volumes and future revenue.

- The company's reliance on rate buydowns to stimulate sales has already pressured gross margins, and prolonged elevated mortgage rates or a continued affordability crisis may require further concessions, thus reducing net margins and earnings over time.

- M/I Homes' heavy geographic concentration, especially in Southern markets like Texas and Florida, increases exposure to localized economic downturns, demographic shifts, or natural disasters, all of which could cause significant volatility and unpredictability in revenue and earnings.

- Rising construction and land development costs due to labor shortages, escalating regulatory and environmental constraints, and potential increases in lumber tariffs may squeeze already declining gross margins, thereby diminishing profitability and net income.

- The company's focus on first-time and move-up buyers, along with a relatively smaller scale versus national peers, leaves it more vulnerable to economic shocks, changing consumer preferences, and competitive pressures from larger or more innovative builders, posing risks to both sales volumes and long-term margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for M/I Homes is $185.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of M/I Homes's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $185.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $483.4 million, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 8.4%.

- Given the current share price of $123.33, the bullish analyst price target of $185.0 is 33.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.