Last Update07 May 25Fair value Decreased 1.08%

Key Takeaways

- Expansion of membership-based boat sharing and demographic shifts are fueling recurring, high-margin revenue growth, supporting demand for premium brands and aftermarket sales.

- Investments in vertical integration and marine technology innovation are increasing operational efficiency, enabling higher margins, market differentiation, and broader long-term demand.

- Shifting demographics, alternative ownership models, rising tariffs, and economic headwinds threaten Brunswick's core sales, margins, and revenue stability while exposing overcapacity risks.

Catalysts

About Brunswick- Designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally.

- Expansion of Freedom Boat Club and membership-based boat sharing continues to deliver strong, steady growth in trips and membership revenue, supporting recurring, high-margin income streams and introducing new customers to Brunswick’s portfolio, which enhances revenue predictability and overall net margins.

- As the population ages and baby boomer wealth increases, more consumers are seeking recreational and wellness-oriented activities like boating—this broadening demographic is likely to drive sustained demand for Brunswick’s premium and core brands, leading to higher unit sales and increased aftermarket parts and accessories revenue.

- Ongoing vertical integration across engines, parts, accessories, and complete marine solutions positions Brunswick to capture operational synergies and increase higher-margin aftermarket sales, which helps stabilize earnings and expand gross margins even during cycles of economic uncertainty.

- Investment in electric propulsion, digital marine electronics, and autonomous boating technologies continues to differentiate Brunswick’s products and accelerates new product adoption and upgrade cycles—supporting pricing power, improved gross margins, and potential market share gains as environmental regulations and consumer preferences shift toward innovative, sustainable solutions.

- Continued growth in remote work and flexible lifestyle trends is enabling a wider range of people to participate in boating and marine activities, increasing utilization rates of Brunswick’s products and services—which in turn supports long-term demand growth and a larger addressable market, driving both top-line revenue and customer lifetime value.

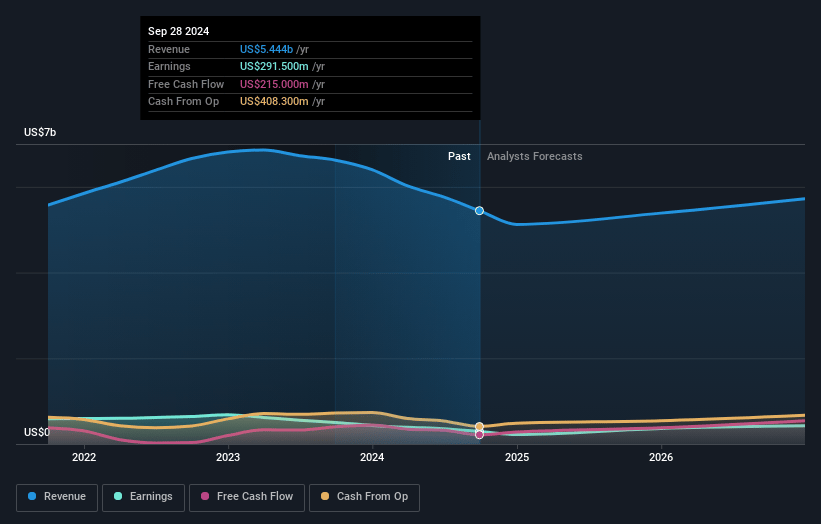

Brunswick Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Brunswick compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Brunswick's revenue will grow by 4.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.0% today to 10.0% in 3 years time.

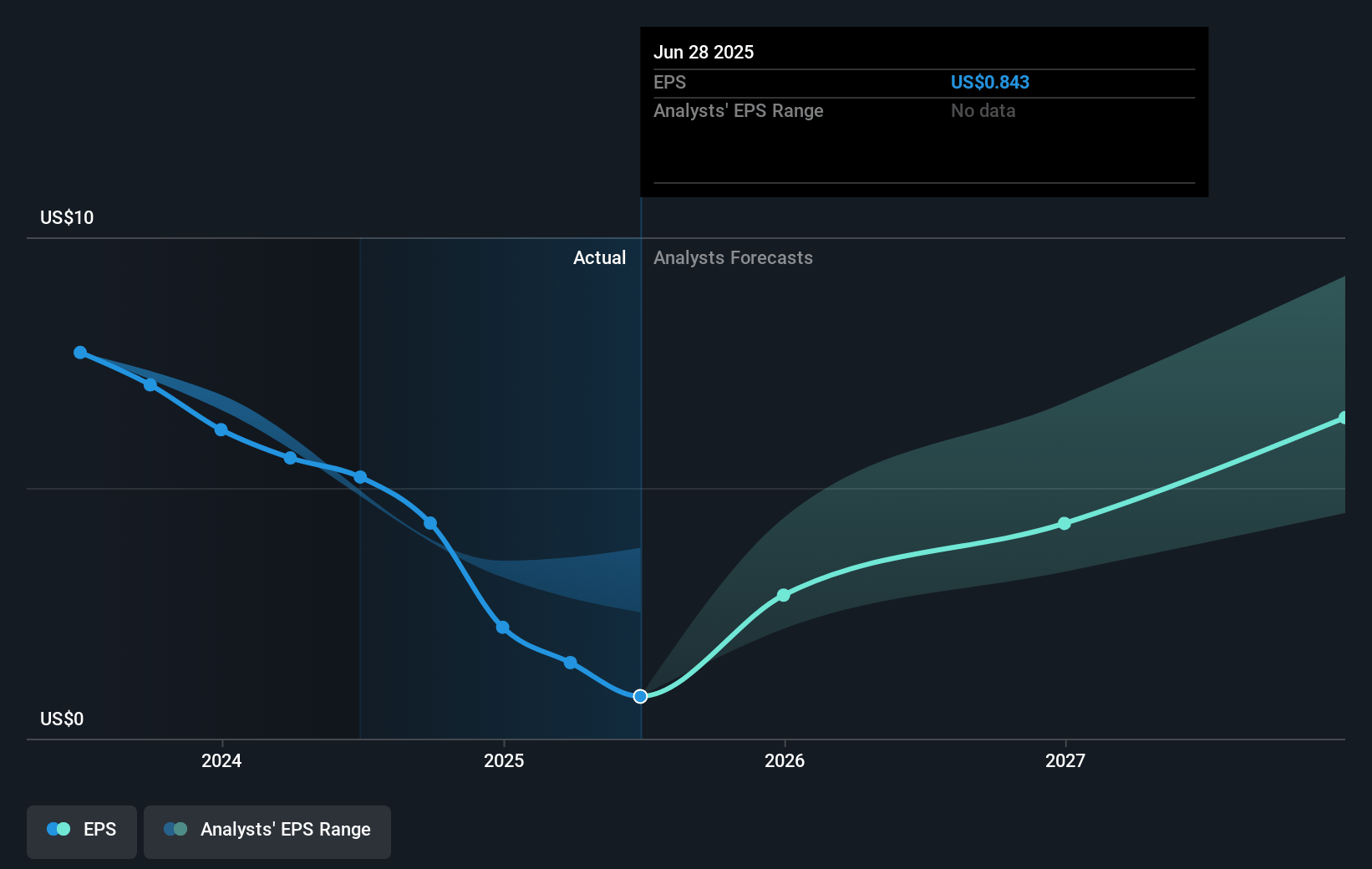

- The bullish analysts expect earnings to reach $581.8 million (and earnings per share of $9.23) by about May 2028, up from $101.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.3x on those 2028 earnings, down from 29.7x today. This future PE is lower than the current PE for the US Leisure industry at 17.9x.

- Analysts expect the number of shares outstanding to decline by 2.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.49%, as per the Simply Wall St company report.

Brunswick Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Entry-level boat sales are experiencing persistent weakness and Brunswick is streamlining offerings in this segment, signaling that long-term demographic shifts and declining participation rates among younger buyers may further reduce the company's core customer base, impacting future revenue and earnings growth.

- The emergence and growth of alternative participation models like Freedom Boat Club, which Brunswick itself is expanding, reflect the broader industry shift toward shared access and subscription models, potentially cannibalizing outright boat sales and pressuring long-term revenue.

- Continued high tariff rates are driving substantial increases in costs, with management indicating $100 million to $125 million in incremental tariff expenses for 2025 alone, and persistent or retaliatory tariffs could erode net margins and constrain earnings if mitigation efforts fall short.

- There are signs of industry-wide inventory management challenges, with Brunswick reporting reduced wholesale shipments and ongoing pipeline reductions; this may point to a risk of continued overcapacity and inventory glut across the industry, leading to discounting and long-term margin erosion.

- OEM orders from marine and RV partners were pressured and both retail and dealer sentiment remain highly sensitive to macroeconomic volatility, indicating Brunswick’s exposure to cyclical downturns; a sustained contraction in discretionary consumer spending could lead to significant revenue and net earnings volatility for the company.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Brunswick is $88.29, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Brunswick's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $88.29, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.8 billion, earnings will come to $581.8 million, and it would be trading on a PE ratio of 11.3x, assuming you use a discount rate of 7.5%.

- Given the current share price of $45.66, the bullish analyst price target of $88.29 is 48.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.