Narratives are currently in beta

Key Takeaways

- Strong aviation and Bell segment backlogs, supported by new orders, suggest robust future revenue growth as Textron capitalizes on substantial demand.

- Focus on innovation and shareholder returns, evidenced by product updates, eVTOL progress, and share repurchases, positions Textron for long-term growth.

- Financial performance is pressured by strike impacts, market softness, leadership transitions, and revised outlook, affecting revenue, profit, and future earnings potential.

Catalysts

About Textron- Operates in the aircraft, defense, industrial, and finance businesses worldwide.

- Textron's Aviation backlog grew to $7.6 billion, with demand supported by over $1 billion in new orders. This indicates strong future revenue growth as the company works through this substantial order book.

- Bell segment achieved a $2.3 billion growth in backlog, now totaling $6.5 billion, partly due to the approval of Milestone B for the FLRAA program. This is expected to bolster future revenue as the company progresses with design and manufacturing phases.

- Textron Aviation announced Gen 3 updates for multiple aircraft, signaling continued investment in the product portfolio. These updates can potentially lead to higher pricing and improved revenue from newly enhanced offerings.

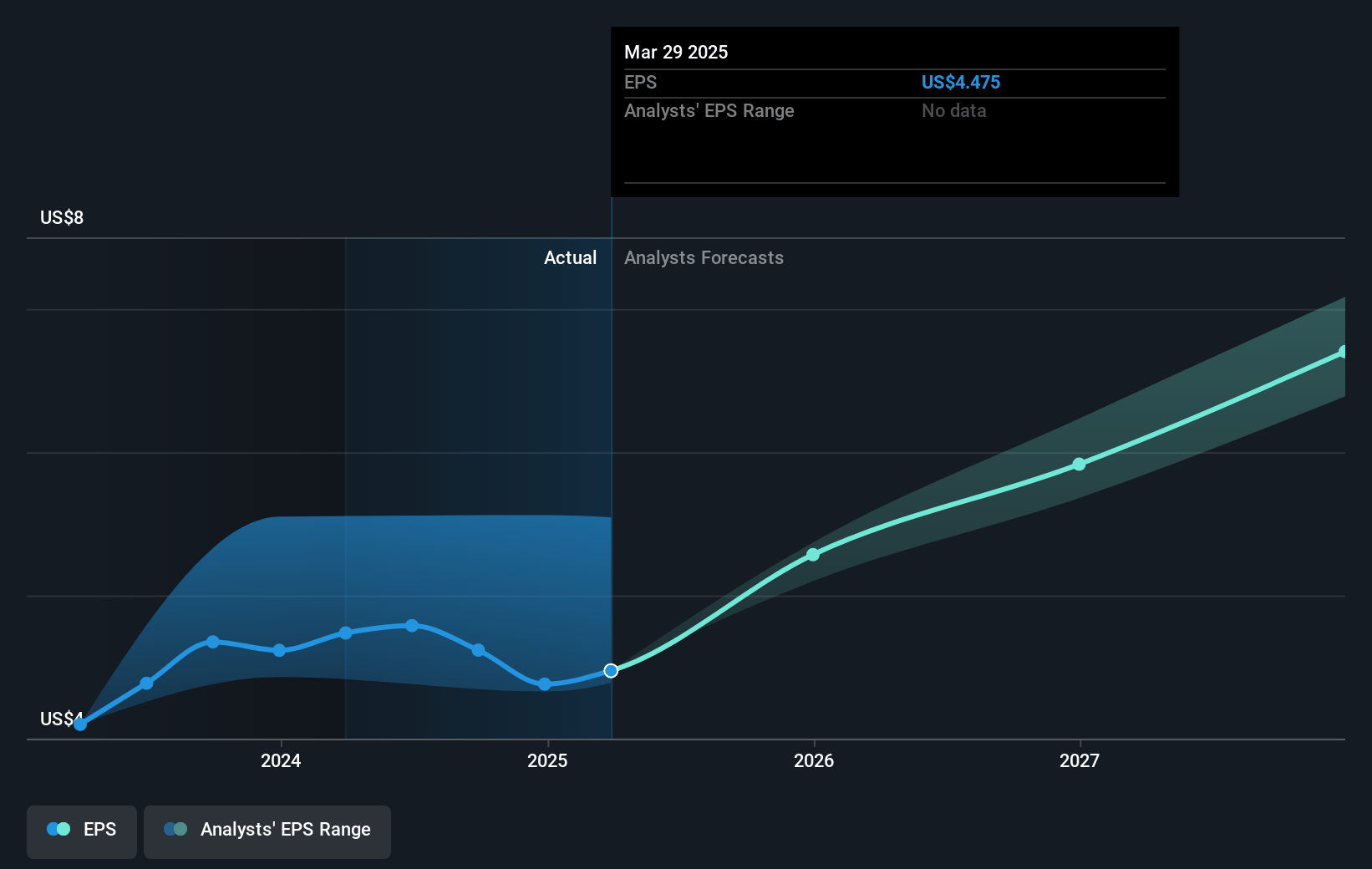

- Textron repurchased approximately 10.1 million shares year-to-date, returning $890 million in cash to shareholders. This indicates a focus on shareholder value, which could enhance earnings per share (EPS) as the number of outstanding shares is reduced.

- The upcoming first hover flight of the Nuuva 300 and continued progress on the Nexus eVTOL program in 2025 highlight Textron’s commitment to innovation, which could support revenue growth through entry into emerging aviation markets.

Textron Future Earnings and Revenue Growth

Assumptions

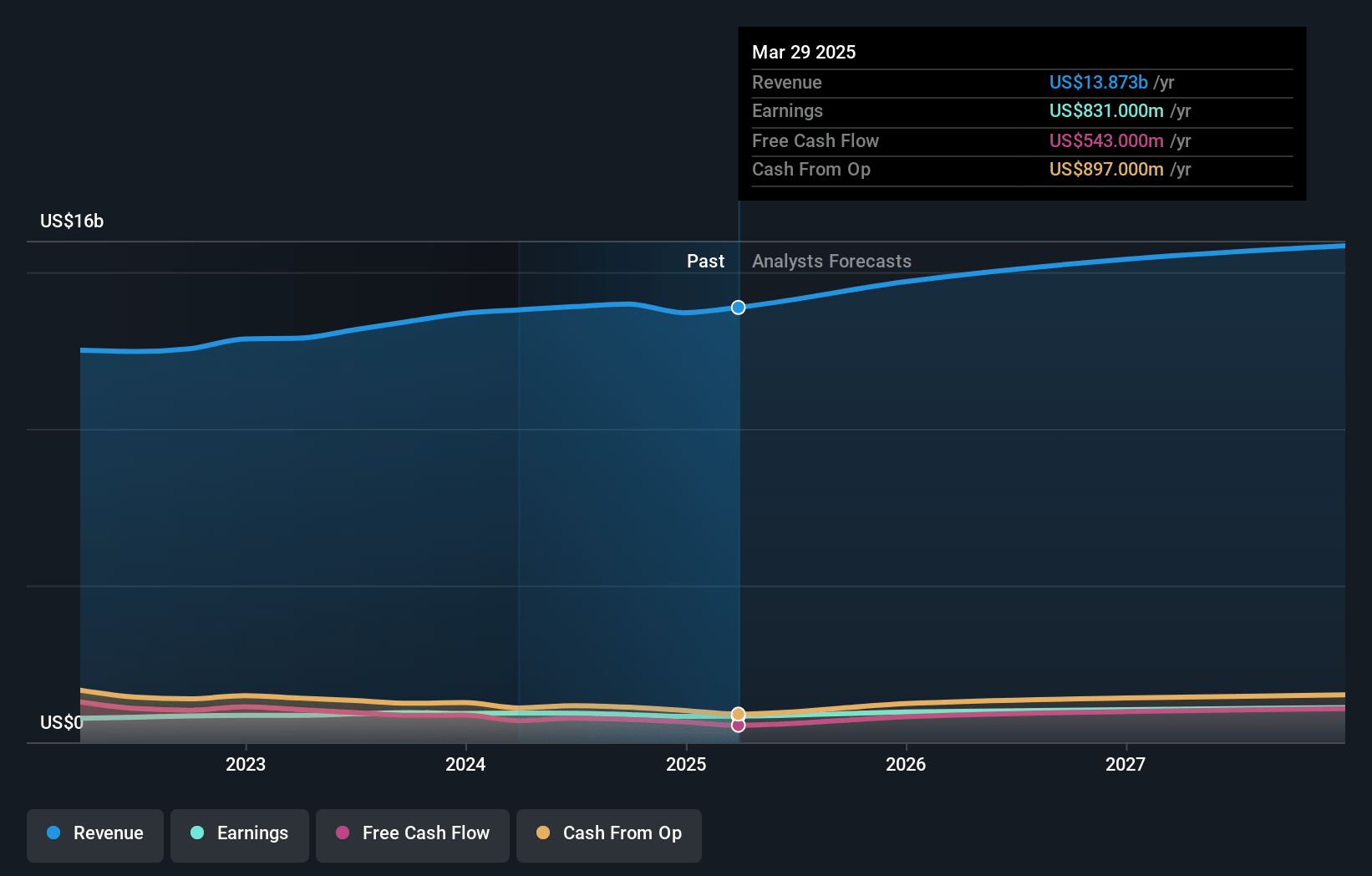

How have these above catalysts been quantified?- Analysts are assuming Textron's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.3% today to 7.3% in 3 years time.

- Analysts expect earnings to reach $1.2 billion (and earnings per share of $6.92) by about December 2027, up from $883.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $1.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.3x on those 2027 earnings, up from 16.8x today. This future PE is lower than the current PE for the US Aerospace & Defense industry at 34.2x.

- Analysts expect the number of shares outstanding to decline by 2.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

Textron Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The strike at the Aviation division led to a temporary halt in production and delivery, which negatively impacted revenue and segment profit in 2024. The disruption may continue to affect financial results as the company works to ramp up production to pre-strike levels. This could impact future earnings if similar disruptions occur.

- Lower revenues and operating profit in the Industrial segment, driven by continued weakness in specialized vehicles, reflect market softness that could depress future revenues and net margins if the trend persists.

- Textron Systems experienced a drop in revenues and profits due to lower volumes, indicating potential risks in sustaining profitable growth. Continued stagnation in this segment could impact overall earnings if demand does not increase.

- The retirement of key executives, including the CFO, introduces leadership transition risks that might affect strategic execution, potentially impacting financial stability and investor confidence, which could influence net margins and earnings.

- The company has adjusted its full-year outlook to account for the strike, lowering expected earnings per share and cash flow for 2024. This indicates volatility and potential for lower-than-expected earnings, impacting overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $99.1 for Textron based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $118.0, and the most bearish reporting a price target of just $79.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $16.0 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 6.5%.

- Given the current share price of $80.07, the analyst's price target of $99.1 is 19.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives