Key Takeaways

- Execution on cost synergies and operational efficiency is strong, but unproven revenue synergies and regulatory costs may limit long-term margin and topline growth.

- Expansion efforts face risks from macroeconomic headwinds, volatile input costs, and competitive pressures that could constrain gains from secular industry trends.

- Reliance on acquisitions, exposure to rising costs, and weak core market demand threaten long-term margin sustainability and financial flexibility amid ongoing industry and macroeconomic challenges.

Catalysts

About Quanex Building Products- Provides components for the fenestration industry in the United States, Europe, Canada, Asia, and internationally.

- Although Quanex has demonstrated strong execution on cost synergies from the Tyman acquisition and is progressing toward higher-than-expected synergy targets, the company's ability to achieve meaningful revenue synergies from go-to-market and geographic expansion plans remains unproven, and any delays or underperformance here could limit longer-term topline growth.

- While Quanex is poised to benefit from global trends such as rising demand for energy-efficient building upgrades and increased replacement activity in aging housing stock, persistent higher interest rates and broader housing affordability issues may suppress volumes in key end markets, undermining revenue growth despite secular tailwinds.

- The company's operational efficiency initiatives, including supply chain localization and automation, support improved margin profile, but exposure to volatile raw material costs and the ongoing need to absorb higher regulatory compliance costs related to environmental standards could offset these efficiency gains, pressuring net margins over time.

- Market share gains in Europe and strategic supply chain moves in North America underpin opportunities for expansion, but declining consumer confidence amid macro uncertainty, as well as competitive pricing pressures, particularly in the commoditized fenestration segment, present ongoing risks to both revenue and margin targets.

- Despite management's confidence in mitigating tariff impacts and leveraging domestic manufacturing as a competitive advantage, there remains material exposure to cyclical housing market downturns and demographic headwinds, especially with over 20 percent of cost of goods sold at risk of cost volatility, which could constrain earnings growth in the event of persistent end-market weakness.

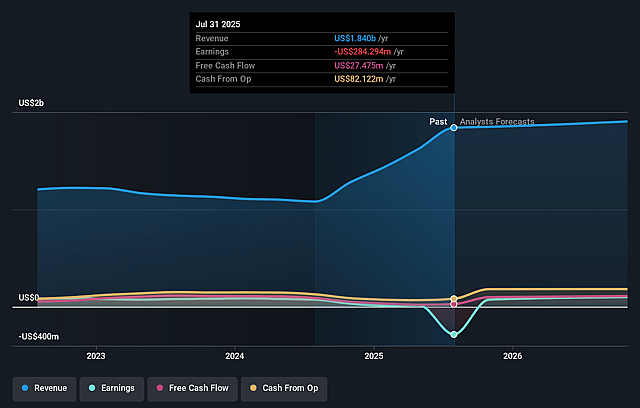

Quanex Building Products Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Quanex Building Products compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Quanex Building Products's revenue will grow by 11.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.0% today to 11.8% in 3 years time.

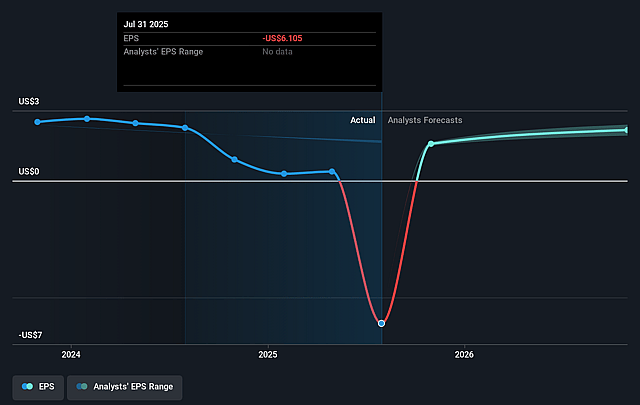

- The bearish analysts expect earnings to reach $262.3 million (and earnings per share of $5.61) by about September 2028, up from $17.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.1x on those 2028 earnings, down from 53.8x today. This future PE is lower than the current PE for the US Building industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 2.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.6%, as per the Simply Wall St company report.

Quanex Building Products Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent declines in North American volumes, driven by low consumer confidence, higher interest rates, and tariff uncertainty, signal ongoing weakness in Quanex's core end markets and could translate into downward pressure on revenue and earnings if these secular headwinds do not abate.

- The company's heavy reliance on acquisition-driven growth, as evidenced by the lift from the Tyman acquisition masking underlying organic sales declines, raises concerns about long-term sustainability of revenue and net margin improvements if organic demand does not recover.

- Exposure to volatile input costs and tariffs, with approximately 22 percent of cost of goods sold affected by tariff risk, creates unpredictability in gross margins and could erode profitability if Quanex is unable to consistently pass on rising costs through pricing mechanisms.

- Ongoing pricing pressure, particularly in European markets where the company reported price drops despite volume gains, suggests limited pricing power in a competitive, commoditized industry, which could compress net margins and restrict earnings growth over time.

- Elevated leverage following the Tyman acquisition, with a net debt to adjusted EBITDA ratio above 3 times, introduces long-term balance sheet risk and could constrain financial flexibility, especially if secular trends lead to sustained declines in operating cash flow or EBITDA.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Quanex Building Products is $28.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Quanex Building Products's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $38.0, and the most bearish reporting a price target of just $28.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.2 billion, earnings will come to $262.3 million, and it would be trading on a PE ratio of 6.1x, assuming you use a discount rate of 10.6%.

- Given the current share price of $20.09, the bearish analyst price target of $28.0 is 28.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.