Last Update 24 Sep 25

Fair value Decreased 5.88%A decline in forecasted revenue growth and a higher future P/E ratio have contributed to analysts lowering Quanex Building Products’ consensus price target from $29.75 to $28.00.

What's in the News

- Class action lawsuit filed alleging Quanex misled investors about significant underinvestment and degraded conditions in Tyman Mexico facility, resulting in unexpected costs and delayed Tyman integration benefits; stock dropped 22% over two trading days following disclosure.

- Company repurchased 100,000 shares for $2.05 million, completing a total buyback of 2,075,407 shares (4.93%) for $41.45 million under the 2021 program.

- Updated fiscal 2025 earnings guidance estimates net sales of approximately $1.82 billion.

- Added to the Russell 2000 Dynamic Index.

Valuation Changes

Summary of Valuation Changes for Quanex Building Products

- The Consensus Analyst Price Target has fallen from $29.75 to $28.00.

- The Future P/E for Quanex Building Products has significantly risen from 7.13x to 9.48x.

- The Consensus Revenue Growth forecasts for Quanex Building Products has significantly fallen from 1.4% per annum to 1.0% per annum.

Key Takeaways

- Strategic integration, facility upgrades, and product innovation are set to enhance profitability, operating margins, and long-term earnings as temporary headwinds subside.

- Strength in energy-efficient solutions, growing demand, and disciplined capital deployment underpin revenue growth and expanded market share in North America and Europe.

- Dependence on acquisitions amid weak demand, operational setbacks, tariff uncertainties, and customer consolidation threaten sustainable growth, pricing power, and profitability.

Catalysts

About Quanex Building Products- Provides components for the fenestration industry in the United States, Europe, Canada, Asia, and internationally.

- The combination with Tyman has created significant cost synergy opportunities, now estimated at $45 million (up from $30 million initially), with further medium-term synergy potential expected from operational footprint optimization, go-to-market strategies, and new product development; these should drive margin expansion and higher long-term earnings.

- Quanex is positioned to benefit from pent-up demand as interest rates decline and consumer confidence recovers, given the long-term need for energy-efficient building products and an aging North American housing stock, supporting future revenue growth.

- Investment in facility upgrades, notably at the Monterrey, Mexico plant, is expected to resolve operational inefficiencies and restore segment profitability by early fiscal 2026, improving EBITDA and net margins once temporary headwinds subside.

- Share buybacks, supported by robust cash flow generation and a disciplined capital allocation policy, are likely to drive EPS growth as ongoing free cash flow is currently being allocated to debt repayment and opportunistic share repurchases.

- The company's strategy to expand high-performance, energy-efficient product lines and leverage market share gains in both North America and Europe positions it to benefit from increasing regulatory and consumer focus on sustainable and energy-saving building solutions, driving future sales and margin improvement.

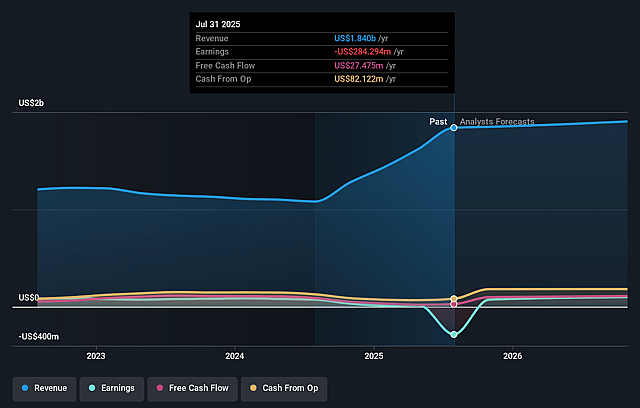

Quanex Building Products Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Quanex Building Products's revenue will grow by 1.4% annually over the next 3 years.

- Analysts are not forecasting that Quanex Building Products will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Quanex Building Products's profit margin will increase from -15.5% to the average US Building industry of 12.3% in 3 years.

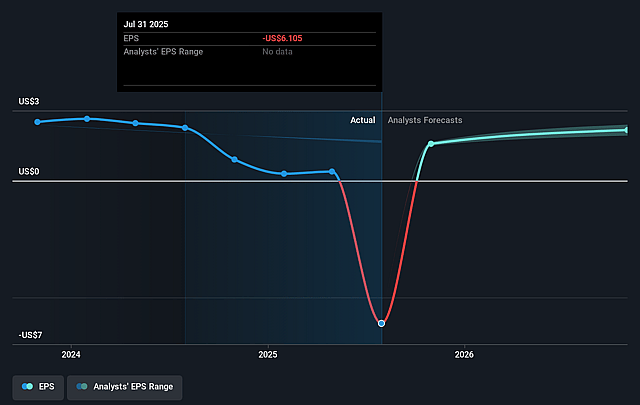

- If Quanex Building Products's profit margin were to converge on the industry average, you could expect earnings to reach $236.5 million (and earnings per share of $5.77) by about September 2028, up from $-284.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.1x on those 2028 earnings, up from -2.5x today. This future PE is lower than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 2.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.4%, as per the Simply Wall St company report.

Quanex Building Products Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged softness in new construction and R&R (repair and remodeling) markets in both North America and Europe, coupled with weak consumer confidence and delayed activity due to ongoing high interest rates, pose a risk of continued depressed volumes, potentially suppressing revenue and earnings growth.

- Operational challenges at the Monterrey, Mexico facility-including tooling and equipment issues leading to inefficiencies, increased costs (such as expedited freight), and negative segment EBITDA-highlight execution risk in acquired asset integration; delayed resolution could further pressure segment net margins and overall profitability into early fiscal 2026.

- The company's recent strong revenue and EBITDA growth is heavily reliant on the Tyman acquisition, with organic growth across legacy product lines remaining negligible or negative; this dependence on acquisition-driven growth, especially during weak demand periods, increases risk to sustainable earnings improvement if integration or synergy capture is delayed or falls short.

- Ongoing and increasing tariff uncertainties and pressures, as well as foreign exchange volatility in international markets, have been noted as material contributors to costs and pricing decisions, representing risks to both top-line stability and net margin maintenance if trade landscapes shift or tariffs rise.

- Industry consolidation among large customers (window/door manufacturers and OEMs) may erode supplier bargaining power, creating pricing pressure that could offset Quanex's market share wins and operational gains, thereby constraining future revenue and net margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.75 for Quanex Building Products based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $236.5 million, and it would be trading on a PE ratio of 7.1x, assuming you use a discount rate of 11.4%.

- Given the current share price of $15.29, the analyst price target of $29.75 is 48.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.