Narratives are currently in beta

Key Takeaways

- Strong defense program wins and European expansion position Moog for significant growth in the defense sector.

- Operational efficiency initiatives and focus on sustainability may enhance margins and attract ESG-focused investors, supporting long-term revenue growth.

- Extreme weather, geopolitical tensions, and currency fluctuations present significant risks to Moog's production, revenue, and profit margins.

Catalysts

About Moog- Designs, manufactures, and integrates precision motion and fluid controls and controls systems for original equipment manufacturers and end users in the aerospace, defense, and industrial markets in the United States, Germany, and internationally.

- Moog's significant program wins in the Space and Defense segment, including the $100 million production order for Lockheed's PAC-3 program and initial bookings on collaborative combat aircraft platforms, indicate strong future revenue growth from defense demand.

- The expansion of the manufacturing space in their Böblingen site in Germany alongside strong European defense needs suggests potential to meet increasing demand and drive revenue growth in the Defense sector.

- The ramp-up in production for large Commercial Aircraft like the Boeing 787 and Airbus A350, supported by Boeing's investment in its Charleston facility, is expected to boost Moog's OE sales, contributing to revenue growth.

- Operational initiatives, including the 80/20 deployment and facility consolidation, are expected to enhance margins through simplification and efficiency, positively impacting net margins and earnings.

- Sustained emphasis on sustainability and innovation in areas like the JetZero collaboration may attract more investors focused on ESG, potentially supporting long-term revenue growth and margin improvement through new business opportunities.

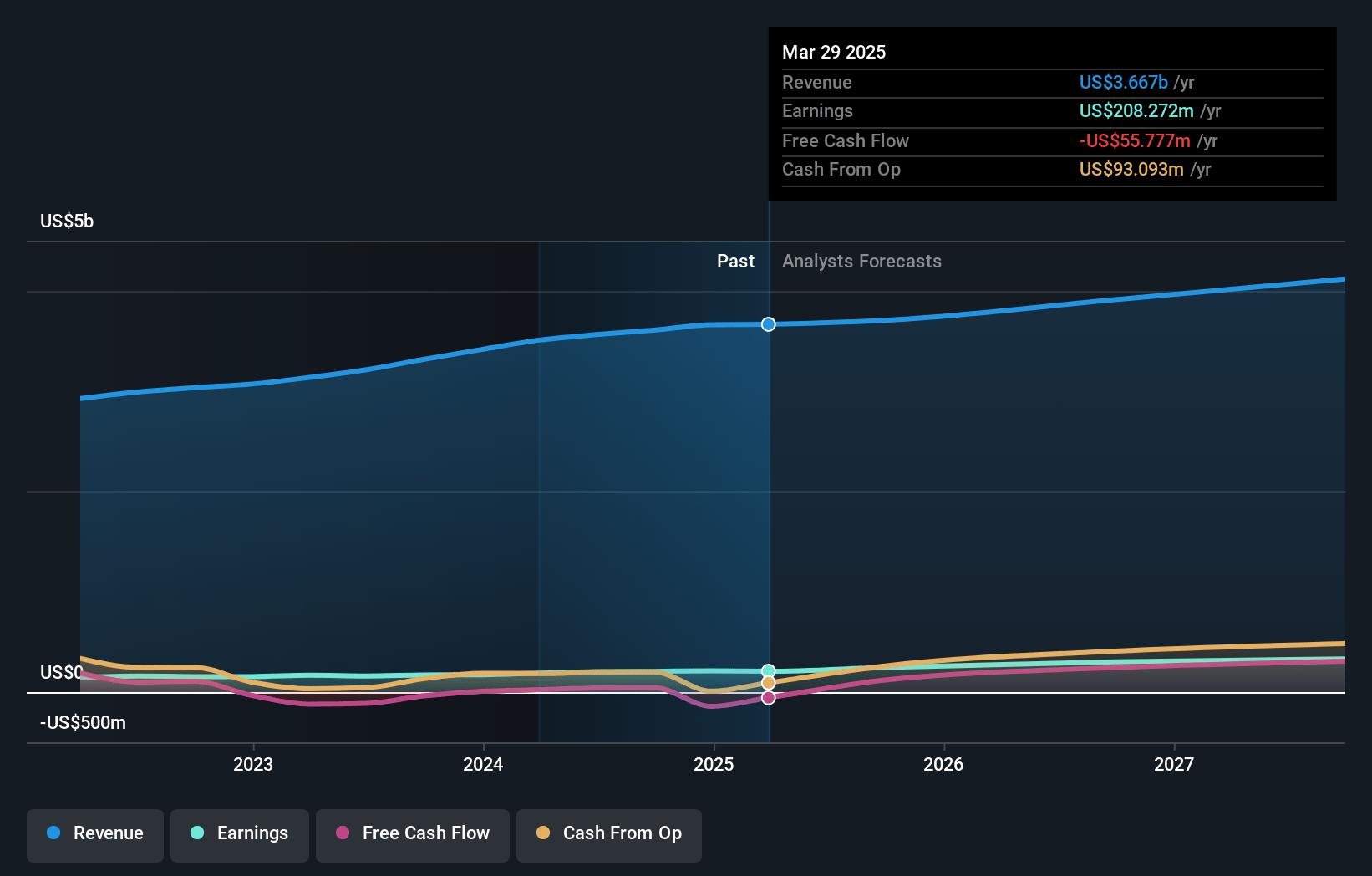

Moog Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Moog's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.8% today to 9.2% in 3 years time.

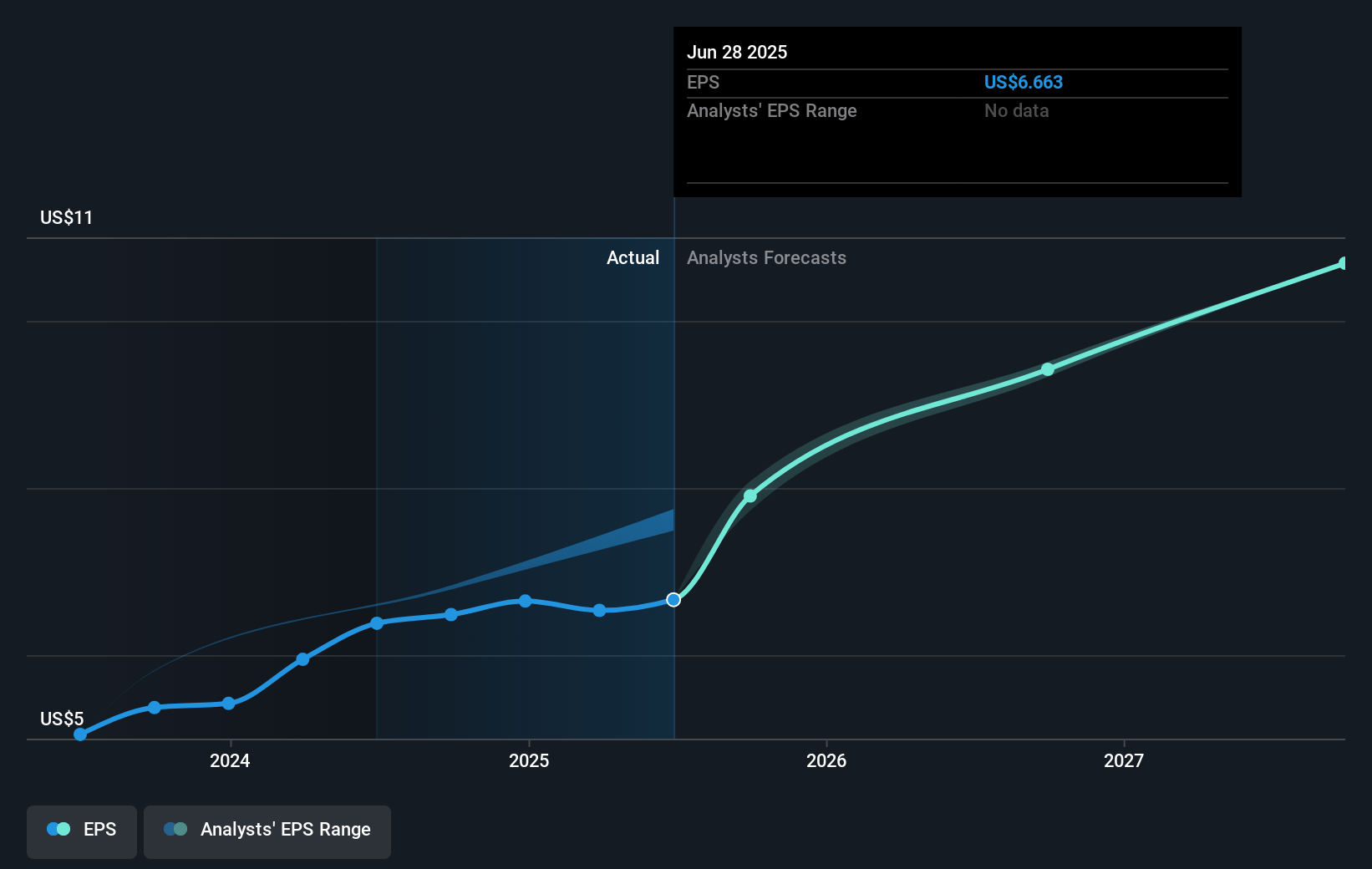

- Analysts expect earnings to reach $379.9 million (and earnings per share of $10.39) by about January 2028, up from $212.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.7x on those 2028 earnings, down from 26.9x today. This future PE is lower than the current PE for the US Aerospace & Defense industry at 34.0x.

- Analysts expect the number of shares outstanding to grow by 4.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.55%, as per the Simply Wall St company report.

Moog Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There are potential risks associated with extreme weather events, as seen with the severe damage to the Tewkesbury Commercial Aircraft facility, which could impact production and overall revenue if such events recur.

- The geopolitical environment remains challenging, with ongoing tensions that could potentially affect international defense orders and consequently impact Moog's defense revenue.

- Exchange rate fluctuations have influenced the Industrial segment's revenue projections, highlighting a potential risk to earnings if adverse currency movements persist.

- The decision to consolidate and simplify operations, while generally a positive move, means any executional missteps, such as the proposed closure of the UK slip ring manufacturing site, could disrupt operations and negatively impact net margins.

- Uncertainty surrounding new tariffs by the administration could increase costs for Moog, affecting profit margins if they cannot be fully passed on to customers.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $233.0 for Moog based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.2 billion, earnings will come to $379.9 million, and it would be trading on a PE ratio of 26.7x, assuming you use a discount rate of 6.5%.

- Given the current share price of $181.22, the analyst's price target of $233.0 is 22.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives