Last Update07 May 25Fair value Decreased 15%

Key Takeaways

- Tariffs on Chinese imports are set to raise costs, compress margins, and negatively affect earnings despite mitigation efforts.

- Uncertainty in the wind market and canceled agreements threaten revenue and earnings, especially if demand softens or projects are completed.

- Anticipated energy demand and decarbonization could boost GE Vernova's revenue, supported by a strong backlog, strategic investments, and a solid balance sheet.

Catalysts

About GE Vernova- An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

- The implementation of tariffs, particularly on Chinese imports, is expected to raise costs for GE Vernova by $300 million to $400 million in 2025. This could compress profit margins and negatively impact overall earnings despite efforts to mitigate this impact through pricing and supply chain adjustments.

- The uncertainty in the wind market, especially in the wind segment, where U.S. policy uncertainty and permitting delays have led to a notable decrease in orders by 43%, suggests revenue headwinds and possible underperformance relative to expectations.

- The termination of an 18-megawatt offshore wind supply agreement might lead to decreased future revenue from this segment as existing projects complete and no new agreements are in the pipeline, posing risks to the segment’s earnings and revenue contributions.

- Incremental costs associated with ongoing investments in the installed onshore wind fleet and the associated services could hinder the improvement of net margins, especially if the expected improvement does not materialize as planned in 2026.

- The rapid expansion of capacity to meet strong demand, while beneficial long-term, could lead to short-term cost escalations that outpace revenue growth, particularly if the anticipated demand tapering or economic recessionary indicators become more pronounced, impacting future revenue and earnings scalability.

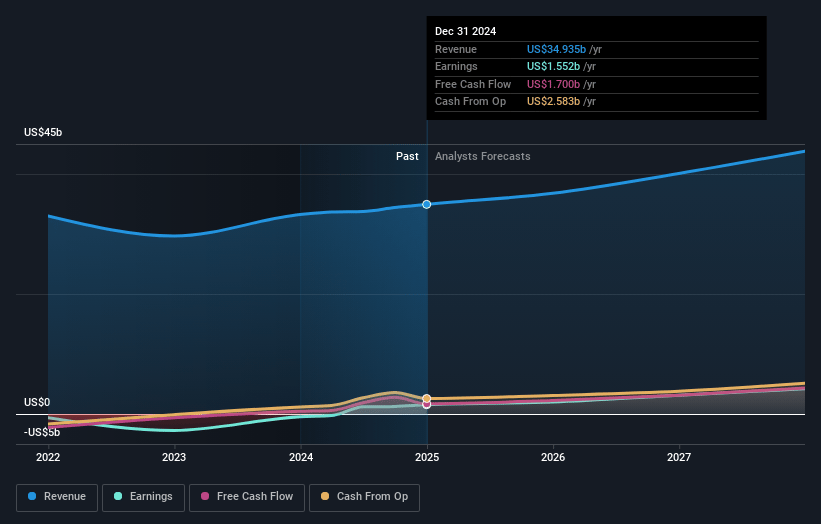

GE Vernova Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on GE Vernova compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming GE Vernova's revenue will grow by 4.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.4% today to 7.2% in 3 years time.

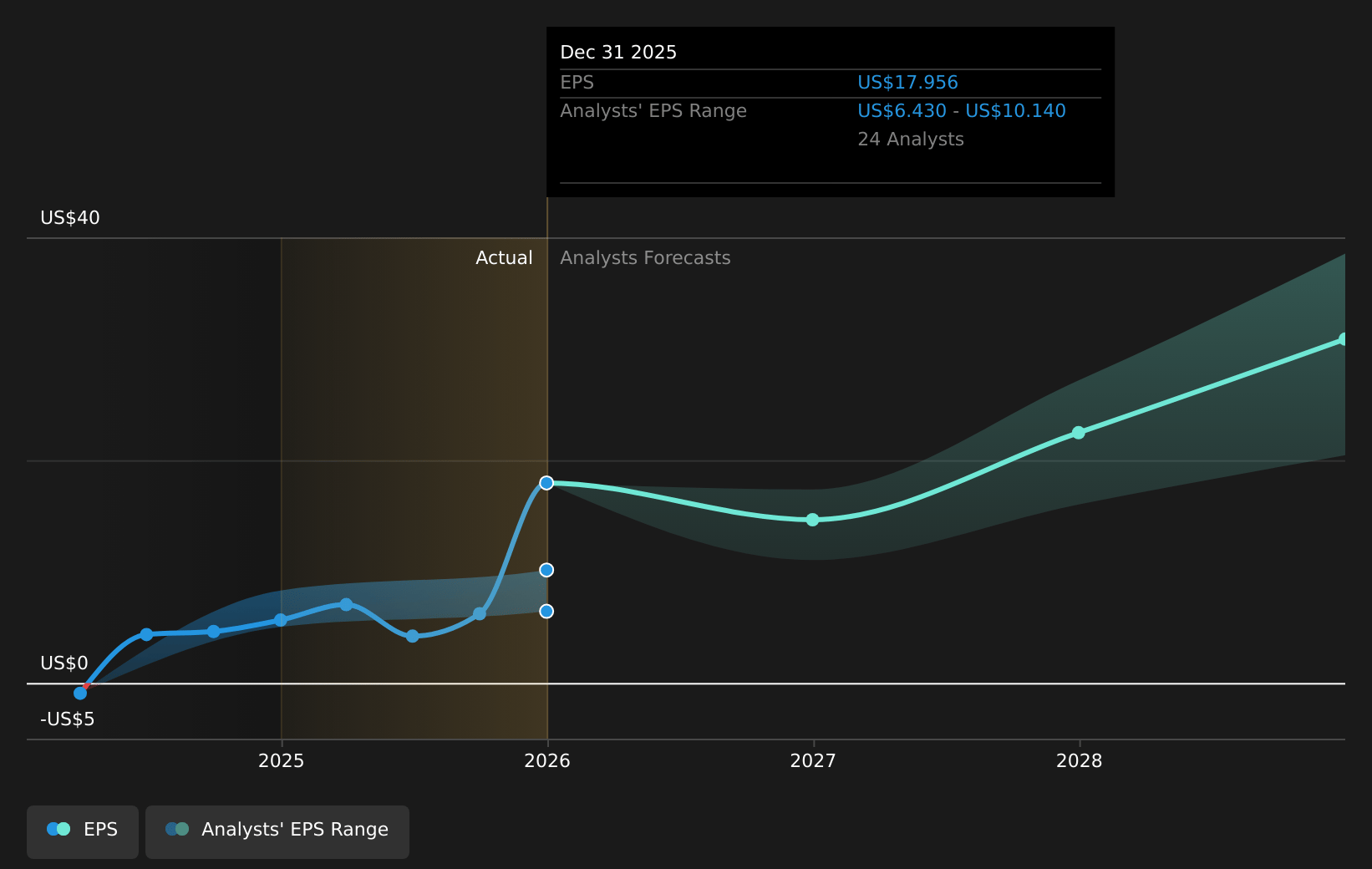

- The bearish analysts expect earnings to reach $2.9 billion (and earnings per share of $10.9) by about May 2028, up from $1.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 32.9x on those 2028 earnings, down from 57.4x today. This future PE is greater than the current PE for the US Electrical industry at 21.9x.

- Analysts expect the number of shares outstanding to decline by 0.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.56%, as per the Simply Wall St company report.

GE Vernova Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The anticipated global super cycle in energy needs and decarbonization, driven by emerging markets and manufacturing growth, could lead to increased demand for GE Vernova's services and equipment, potentially boosting revenue and generating stronger cash flow.

- With over 60% of GE Vernova's backlog comprising services with strong margins, the company enjoys significant revenue visibility, which can ensure stable and predictable earnings growth over the next few years.

- The substantial investments planned in U.S. manufacturing and R&D amounting to $9 billion through 2028 indicate a commitment to expanding capacity and improving operations, which may enhance net margins and bolster future earnings.

- The robust order growth observed in the Power and Electrification segments, with significant increases in equipment orders and sequential backlog growth, suggests that GE Vernova is well-positioned to capture growing demand, leading to continued revenue expansion.

- The company's strong balance sheet, with an $8 billion cash reserve and positive free cash flow, allows for strategic investments and shareholder returns, such as share buybacks and dividends, which could positively impact investor sentiment and support share price stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for GE Vernova is $286.69, which represents two standard deviations below the consensus price target of $397.75. This valuation is based on what can be assumed as the expectations of GE Vernova's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $500.0, and the most bearish reporting a price target of just $279.12.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $40.5 billion, earnings will come to $2.9 billion, and it would be trading on a PE ratio of 32.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $406.81, the bearish analyst price target of $286.69 is 41.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.