Narratives are currently in beta

Key Takeaways

- Expansion of the leasing business and operational efficiencies are expected to enhance stable, higher-margin revenue streams and future profitability.

- Investment in innovation and adaptation to market dynamics could capture greater customer spending and stabilize revenue growth despite market cyclicality.

- North American railcar market growth constraints and leasing uncertainties may pressure Greenbrier's revenue, margins, and strategic success in a competitive landscape.

Catalysts

About Greenbrier Companies- Designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America.

- Greenbrier is expanding its leasing business, with plans to double recurring revenue from leasing activities within the next four years, which is expected to contribute to stable, higher-margin revenue streams that enhance future earnings.

- The company is focusing on operational efficiencies, such as in-sourcing and expanding lease fleet operations, likely to improve gross margins and net margins, supporting higher future profitability.

- Greenbrier's multiyear backlog valued at $3.4 billion provides significant revenue visibility, mitigating risks related to market cyclicality, and supporting sustained future revenue growth.

- The company is investing in innovation with new product developments like high-sided gondolas and new tank cars, aimed at capturing a larger share of customer spending, which could enhance future revenue growth.

- Greenbrier is capitalizing on altering market dynamics with its evolving manufacturing approach to meet steady demand in the railcar market, which could stabilize and potentially increase future revenue and earnings.

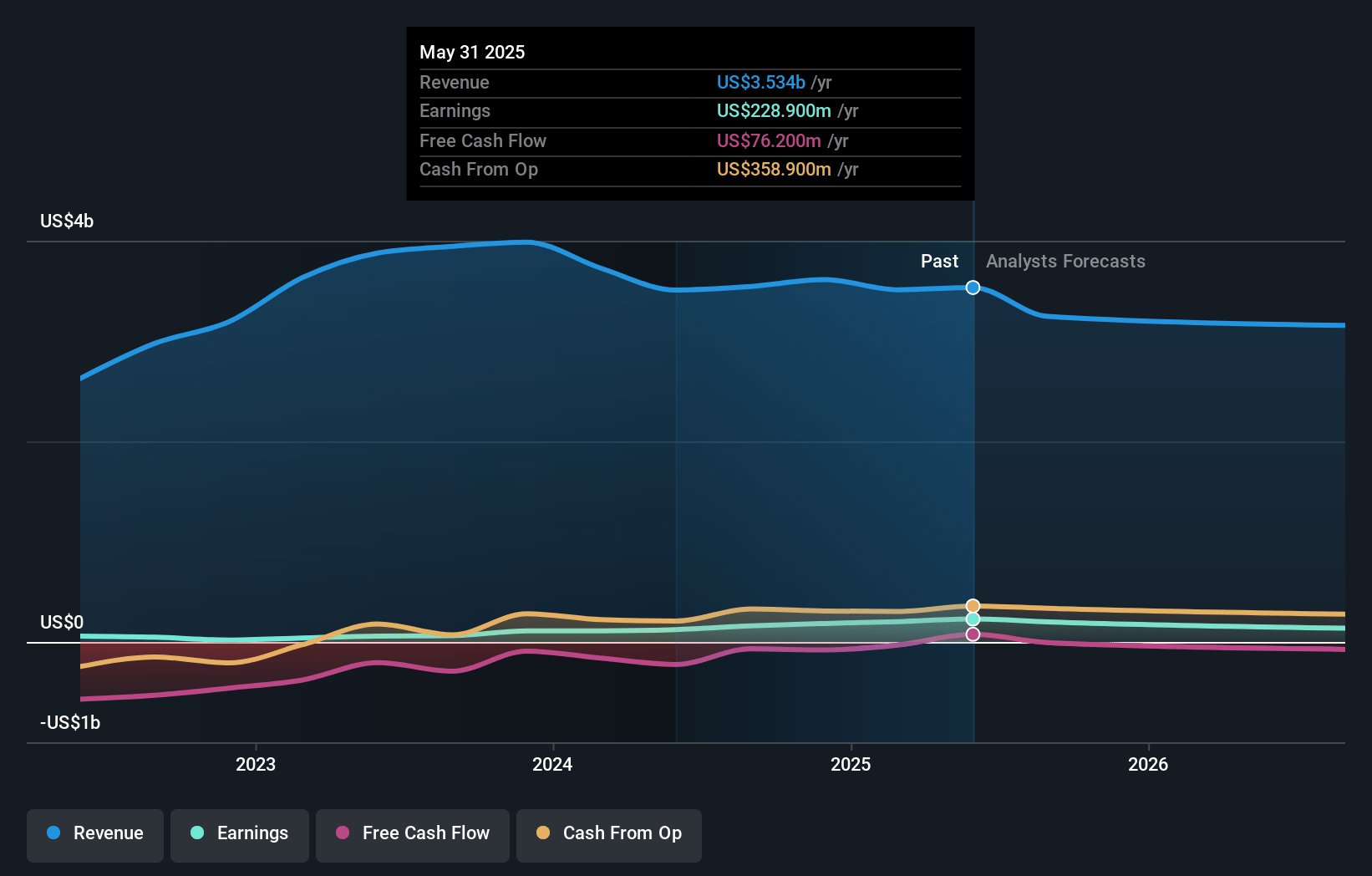

Greenbrier Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Greenbrier Companies's revenue will decrease by 0.7% annually over the next 3 years.

- Analysts are assuming Greenbrier Companies's profit margins will remain the same at 4.5% over the next 3 years.

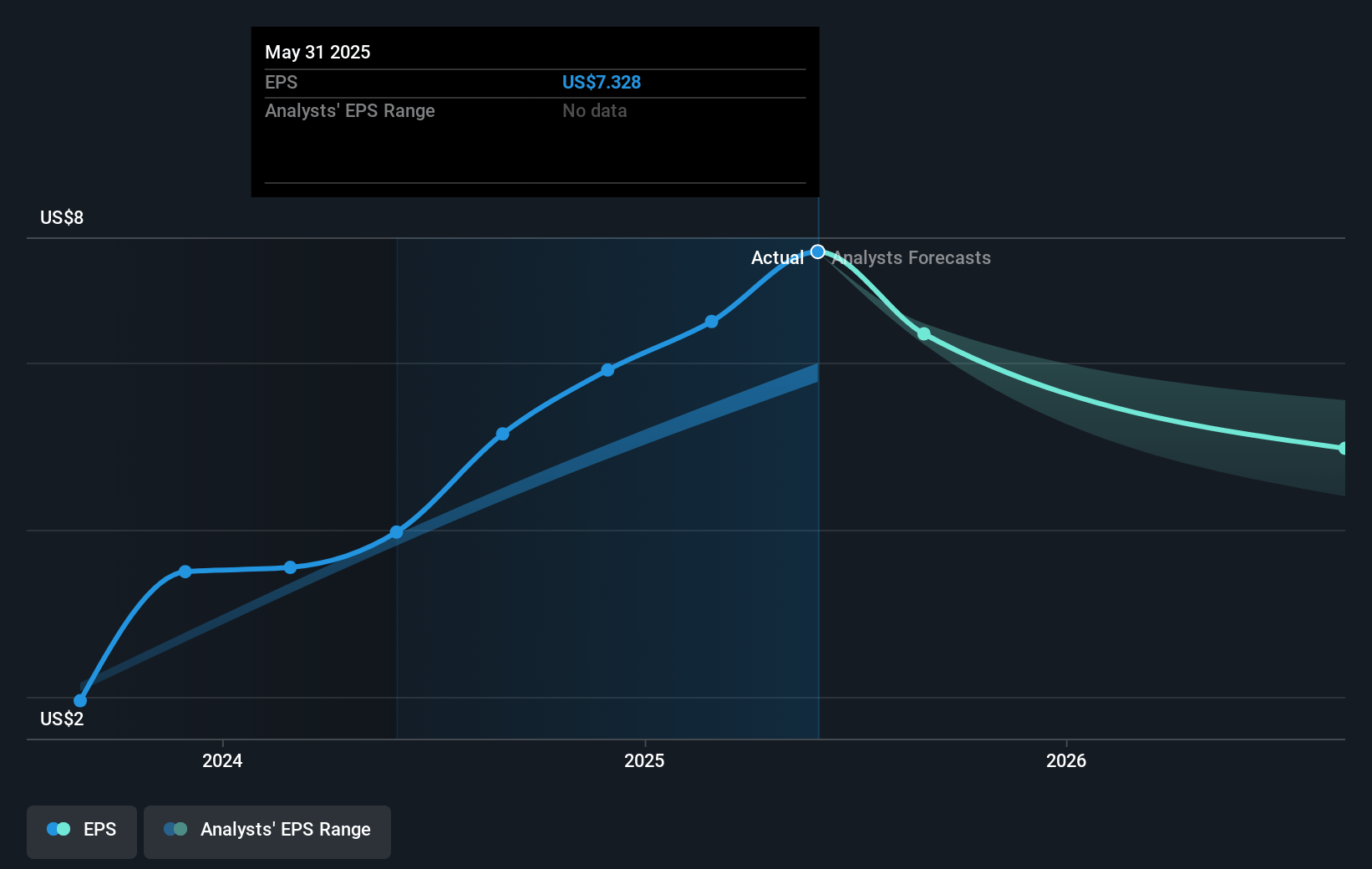

- Analysts expect earnings to reach $164.5 million (and earnings per share of $5.34) by about January 2028, up from $160.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, up from 11.8x today. This future PE is lower than the current PE for the US Machinery industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 0.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.48%, as per the Simply Wall St company report.

Greenbrier Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The North American railcar market may experience tepid growth, which could limit Greenbrier's ability to expand its revenue in this key region.

- Operating lessors have maintained a cautious approach, possibly impacting the demand for new leasing orders and leading to potential fluctuations in leasing revenue.

- The shift in product mix, such as increased demand in automotive versus slower growth in boxcars, may present challenges in managing production and margins effectively.

- Dependency on maintaining high fleet utilization and securing lease renewals to drive recurring revenue creates risk, potentially affecting margins and earnings if the market softens.

- Market cyclicality and competition in leasing and manufacturing could pressure net margins and operating margins if the strategic plans fail to meet targeted financial outcomes.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $62.5 for Greenbrier Companies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $164.5 million, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 7.5%.

- Given the current share price of $60.19, the analyst's price target of $62.5 is 3.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives