Narratives are currently in beta

Key Takeaways

- Organizational redesign enhances operating efficiencies and margins by merging Manufacturing and Maintenance Services into one segment.

- Increased North American rail traffic boosts railcar demand, supporting revenue growth through deliveries and service contracts.

- Greenbrier's dependence on cyclical demand and fleet utilization challenges could strain earnings and margins, while investments may impact liquidity and cash flow.

Catalysts

About Greenbrier Companies- Designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America.

- Greenbrier's organizational redesign, which combines Manufacturing and Maintenance Services into one segment, is expected to streamline operations and improve manufacturing productivity, potentially leading to higher operating efficiencies and better net margins.

- As rail traffic in North America is projected to increase, railcar demand is anticipated to rise, supporting potential revenue growth from increased railcar deliveries and service contracts.

- The expansion into lease originations in Europe aims to stabilize production activity and is expected to enhance long-term revenue streams from leasing activities, contributing to recurring revenue growth.

- Ongoing railcar restoration activities, such as rebodying and requalifications, provide predictable revenue streams that are not included in backlog, which can improve utilization of current capacity and positively impact net margins.

- Greenbrier's commitment to capital allocation through stock buybacks and dividends signals confidence in future profitability and could lead to increased earnings per share by reducing outstanding share count.

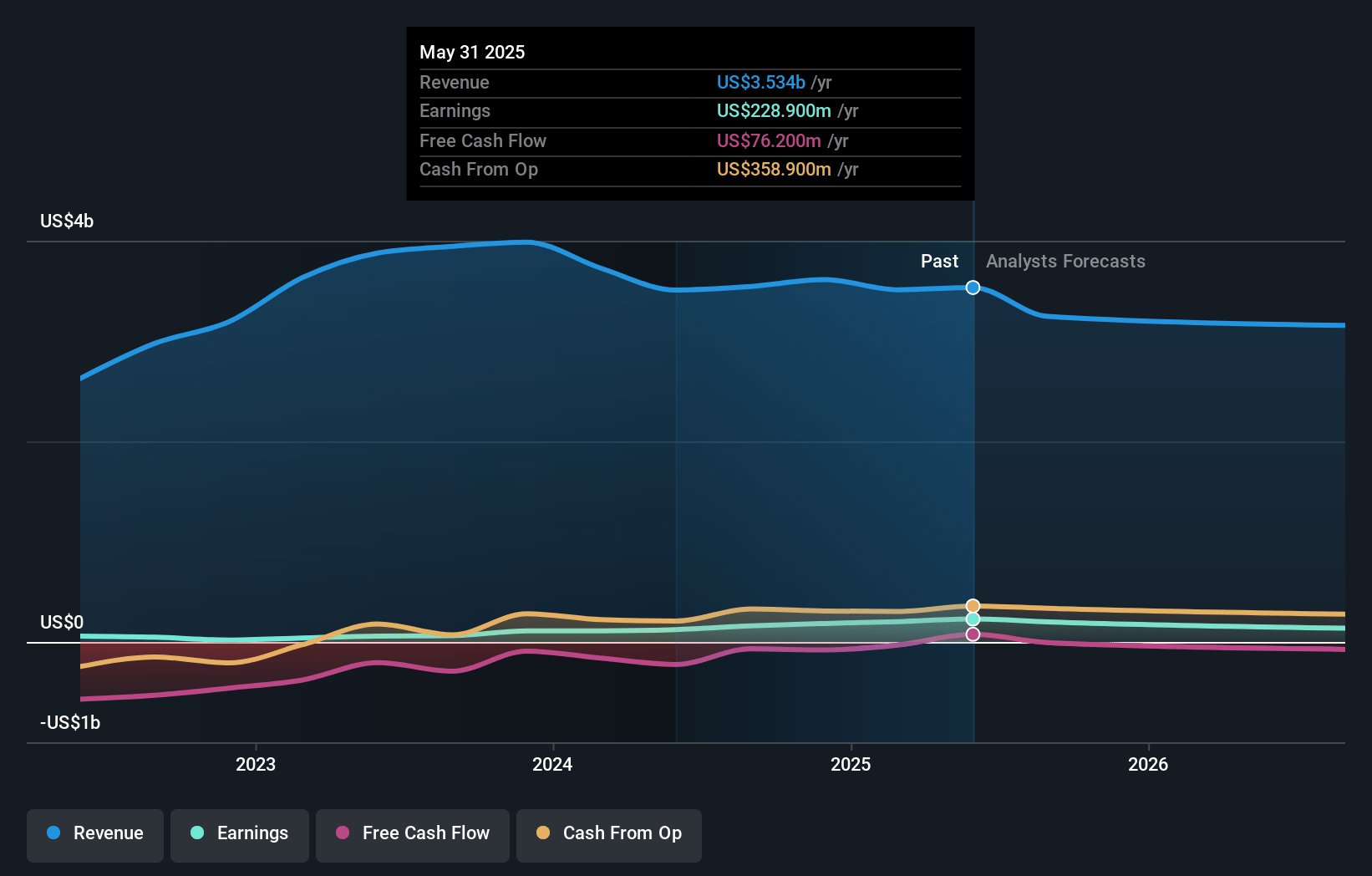

Greenbrier Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Greenbrier Companies's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.1% today to 5.6% in 3 years time.

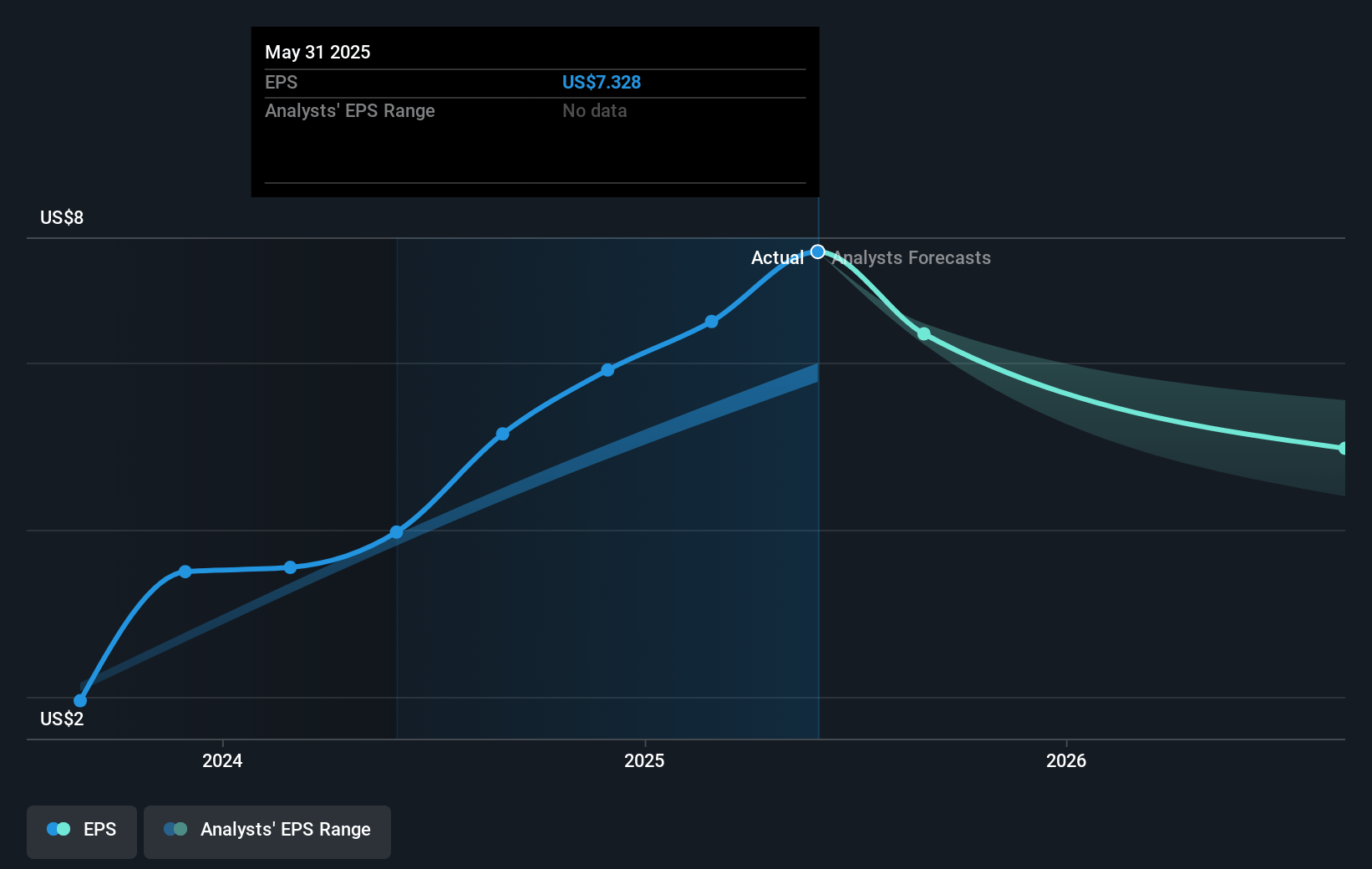

- Analysts expect earnings to reach $207.9 million (and earnings per share of $6.25) by about January 2028, up from $184.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, up from 11.4x today. This future PE is lower than the current PE for the US Machinery industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 2.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.71%, as per the Simply Wall St company report.

Greenbrier Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Greenbrier's dependence on the cyclical railcar industry, which sees demand fluctuations based on macroeconomic conditions, could potentially impact revenue stability and growth.

- The company faces potential challenges with North American railcar fleet utilization predicted to slightly decrease during 2025, possibly leading to a drop in demand and revenues.

- Currency exchange rate fluctuations and foreign earnings impact, as noted in the financial summary, could create unforeseen volatility in net earnings and margins.

- A reliance on product mix and specialized car types to maintain gross margins could become a concern if there is a shift towards less profitable commodity car types, impacting net margin.

- Greenbrier's active capital expenditure and investment plans, while strategic, could strain liquidity if syndication activities face delays or if there are shifts in order timing, potentially affecting net income and free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $68.5 for Greenbrier Companies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $207.9 million, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 8.7%.

- Given the current share price of $67.02, the analyst's price target of $68.5 is 2.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives