Last Update07 May 25Fair value Decreased 4.02%

Key Takeaways

- Expansion into emerging and infrastructure markets, combined with global OEM partnerships, strengthens growth, sales visibility, and revenue stability.

- Focus on advanced transmissions, service network investment, and pricing discipline drives margin expansion, efficiency leadership, and resilient high-margin aftermarket contributions.

- Allison Transmission faces significant long-term risks from electrification trends, reliance on legacy products, and exposure to shifting demand and regulatory pressures in commercial vehicle markets.

Catalysts

About Allison Transmission Holdings- Designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S.

- Allison’s selection by all OEMs for India’s Future Infantry Combat Vehicle modernization opens a multi-hundred-million-dollar revenue stream over the next two decades, demonstrating international expansion into fast-growing emerging markets and enhancing long-term sales visibility.

- The company’s FuelSense 2.0 and Neutral at Stop technologies are being standardized by major OEM partners like Daimler Truck North America, directly positioning Allison as a leader in energy efficiency and emissions reduction as global commercial vehicle customers increasingly adopt advanced automatic transmissions. This is likely to drive sustained revenue and market share gains.

- Allison’s investment in a global service network, especially in markets such as Japan and West Africa, supports increased aftermarket and OEM penetration as demand for heavy-duty vehicles grows globally alongside ongoing urbanization and e-commerce trends. This should provide more resilient and diversified revenue with high-margin aftermarket contributions.

- Management’s discipline in pricing and product mix is driving meaningful margin expansion, as evidenced by higher gross and EBITDA margins even amid spot demand softness, indicating operational leverage and the ability to further increase net margins over time as pricing power persists in a constrained labor and regulatory environment.

- Strategic exposure to infrastructure and municipal markets—segments less sensitive to short-term macroeconomic swings and benefiting from long-term infrastructure upgrades—offers Allison a stable source of earnings and cash flow, providing a reliable base for further growth, capital returns, and margin protection.

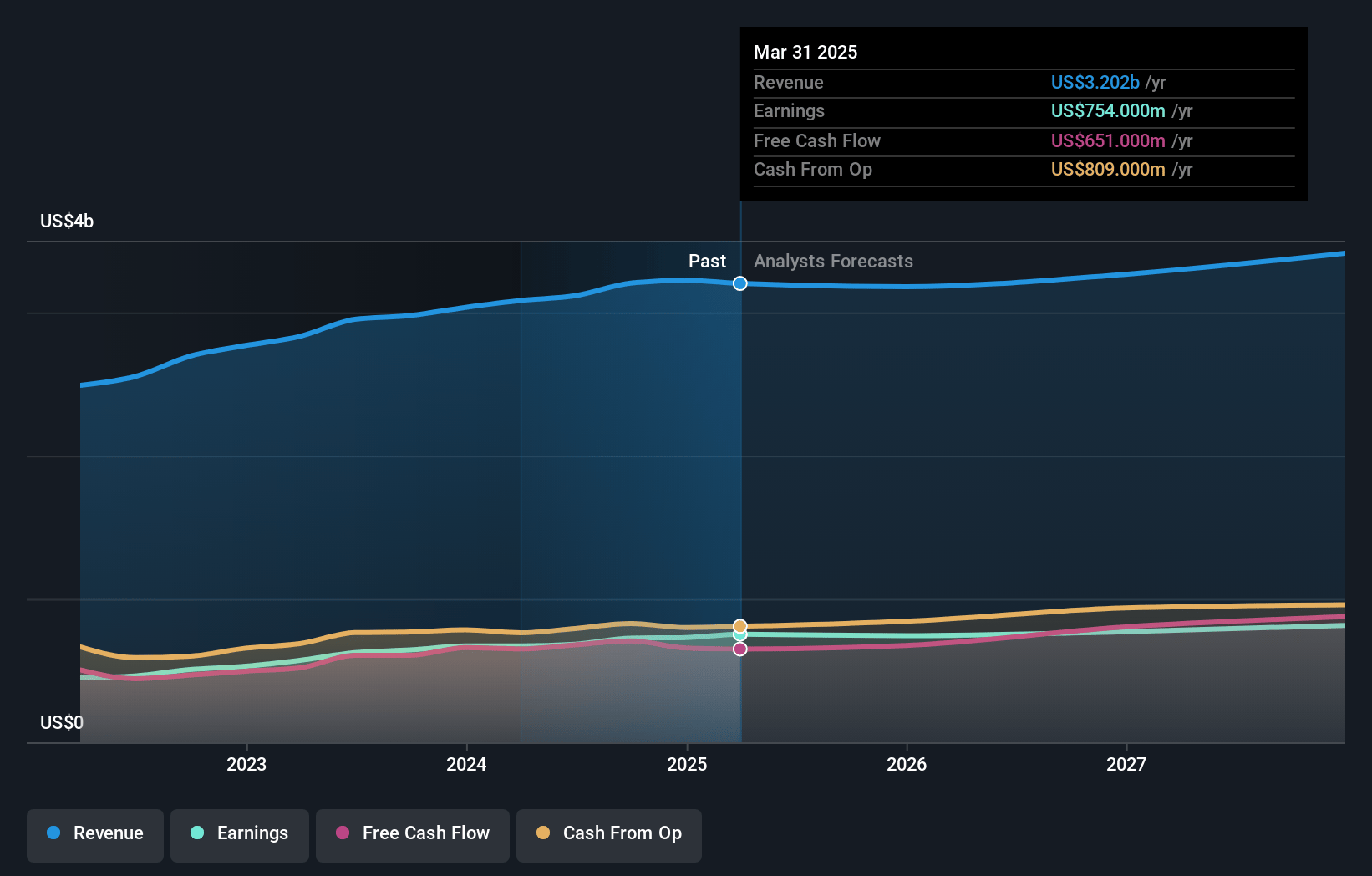

Allison Transmission Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Allison Transmission Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Allison Transmission Holdings's revenue will grow by 4.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 23.5% today to 26.3% in 3 years time.

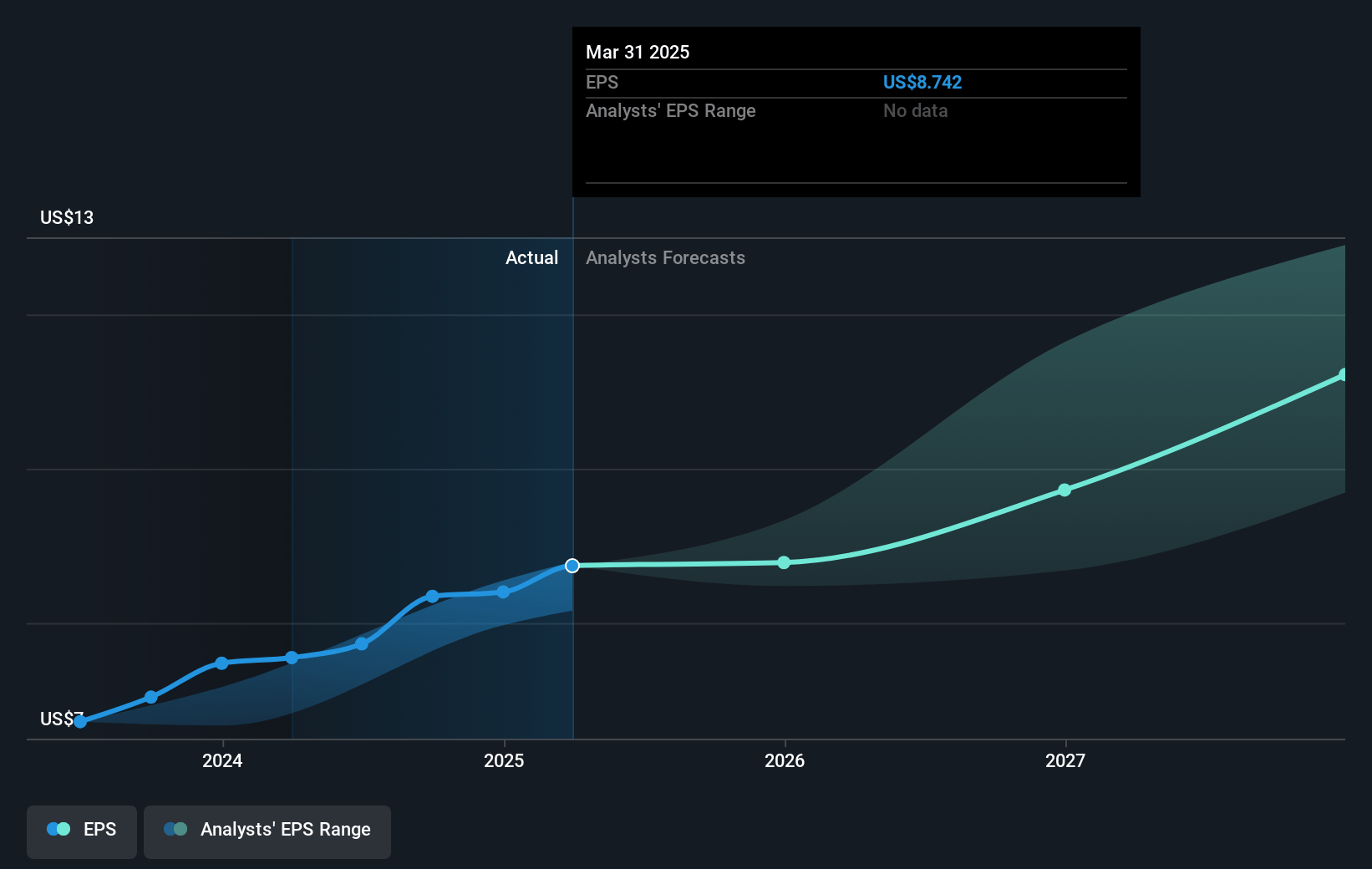

- The bullish analysts expect earnings to reach $973.4 million (and earnings per share of $12.17) by about May 2028, up from $754.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, up from 10.9x today. This future PE is lower than the current PE for the US Machinery industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 3.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.84%, as per the Simply Wall St company report.

Allison Transmission Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global shift towards electrification and zero-emission mandates in commercial vehicles threatens demand for traditional automatic transmissions, and the text does not highlight significant progress by Allison Transmission in electric or hybrid transmission technology, creating a risk of long-term revenue and market share decline as fleets modernize.

- Increasing adoption of autonomous and digitally integrated fleets, along with the rising regulatory and investor emphasis on sustainability, could favor new, tech-driven drivetrain solutions over Allison’s historically diesel-focused product portfolio, putting pressure on future contracts and potentially raising Allison’s cost of capital and impacting margins.

- Heavy reliance on price increases to offset softening demand in end markets, such as medium-duty trucks and the parts business, suggests an underlying risk: if demand weakens further or price increases are no longer tenable, revenue and net income growth could stall or reverse.

- The company’s high fixed manufacturing costs and legacy infrastructure create significant downside risk to margins and net earnings, especially if unit volumes decline due to market shifts, intensifying competition, or regulatory disruptions noted but not fully addressed in the call.

- Allison’s concentrated customer base, particularly reliance on large OEMs and municipal buyers within a market facing technological disruption and potential regulatory uncertainty, exposes it to volume declines and renegotiation of contract terms, which could lead to revenue volatility and margin compression in future years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Allison Transmission Holdings is $126.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Allison Transmission Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $126.0, and the most bearish reporting a price target of just $74.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $973.4 million, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 7.8%.

- Given the current share price of $97.12, the bullish analyst price target of $126.0 is 22.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.