Last Update07 May 25Fair value Decreased 16%

Key Takeaways

- Shifting industry demand toward zero-emission and electric vehicles threatens Allison's traditional core business and risks a sustained decline in revenue, market share, and profitability.

- Insufficient investment in new driveline technologies and overreliance on returning capital to shareholders hinders innovation, jeopardizing future competitiveness and earnings.

- Expansion into international defense and commercial markets, innovative efficiency technologies, and disciplined capital allocation position Allison for sustainable growth and improved shareholder returns.

Catalysts

About Allison Transmission Holdings- Designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S.

- The accelerating global push toward rapid electrification of commercial vehicles combined with expanding government mandates for zero-emission fleets is set to sharply reduce demand for traditional automatic transmissions, cutting into Allison’s core topline growth opportunities and risking secular long-term revenue contraction.

- Intensifying technological disruption from direct-drive motors, fuel cell propulsion, and e-axle solutions threatens to leave Allison’s investment in conventional powertrains and gradual hybrid offerings technologically obsolete, which could lead to declining R&D relevance and ongoing deterioration in market share and pricing power, resulting in pressure on both revenue and gross margins.

- A slow pace of innovation in electric and hybrid transmission systems relative to more agile competitors risks eroding key OEM partnerships, heightening the probability of contract losses and an elongated decline in future sales, compressing EBITDA margins and ultimately lowering future earnings.

- Allison’s mature and undiversified product portfolio, still highly concentrated in North American transmission products, faces severe risk of margin erosion and growth stagnation as the industry transitions toward integrated, fuel-agnostic powertrain solutions and as competitors with strong electric offerings win an increasing share of the replacement cycle.

- As capital requirements for next-generation driveline technology, digitization, and software accelerate, Allison’s dependence on share repurchases and dividends for capital allocation diverts resources from urgently needed R&D investment; this exposes the company to a widening innovation gap and the likely long-term deterioration of net income as profitability is undermined by technological obsolescence and competition.

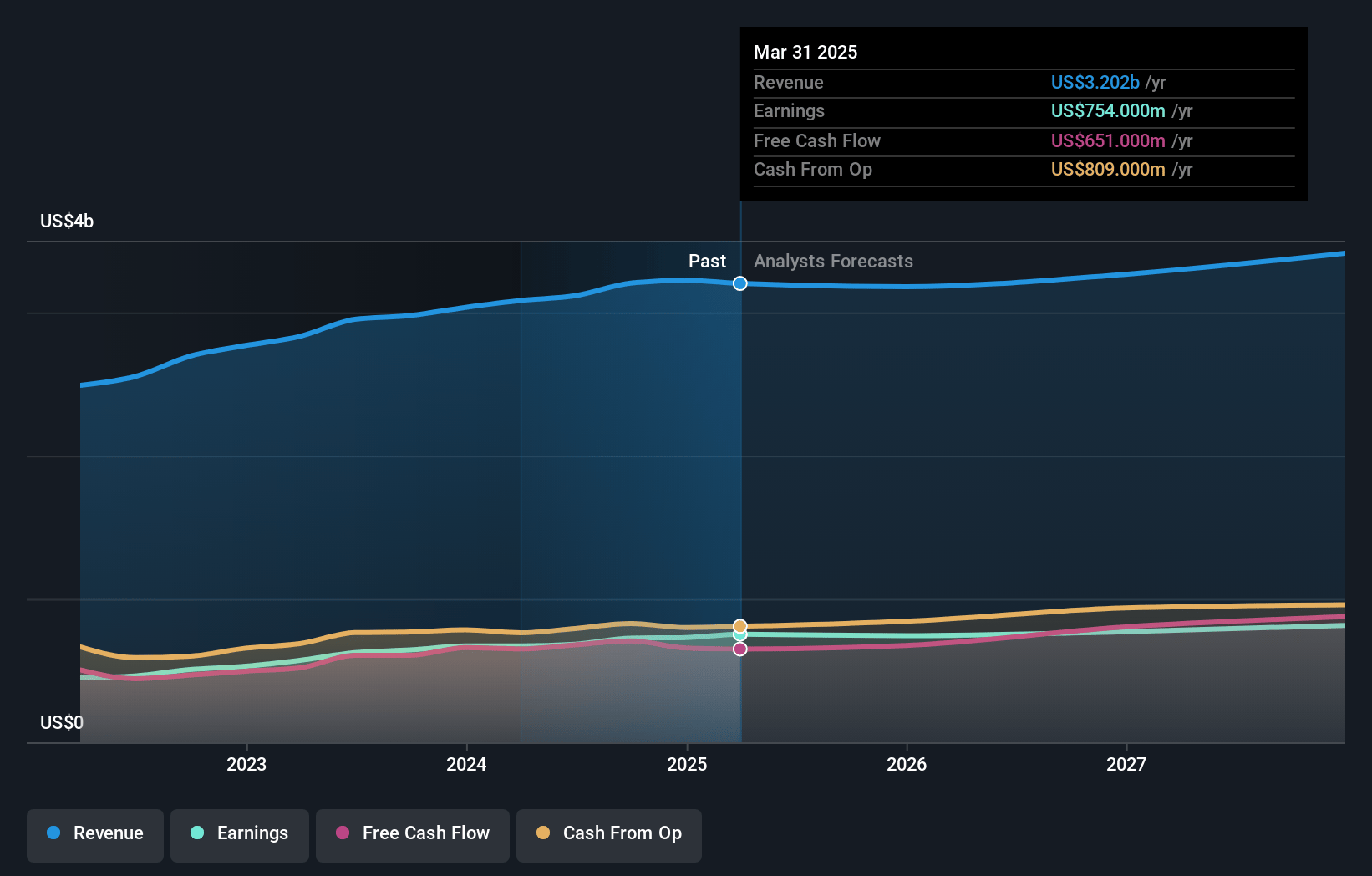

Allison Transmission Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Allison Transmission Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Allison Transmission Holdings's revenue will decrease by 0.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 23.5% today to 22.4% in 3 years time.

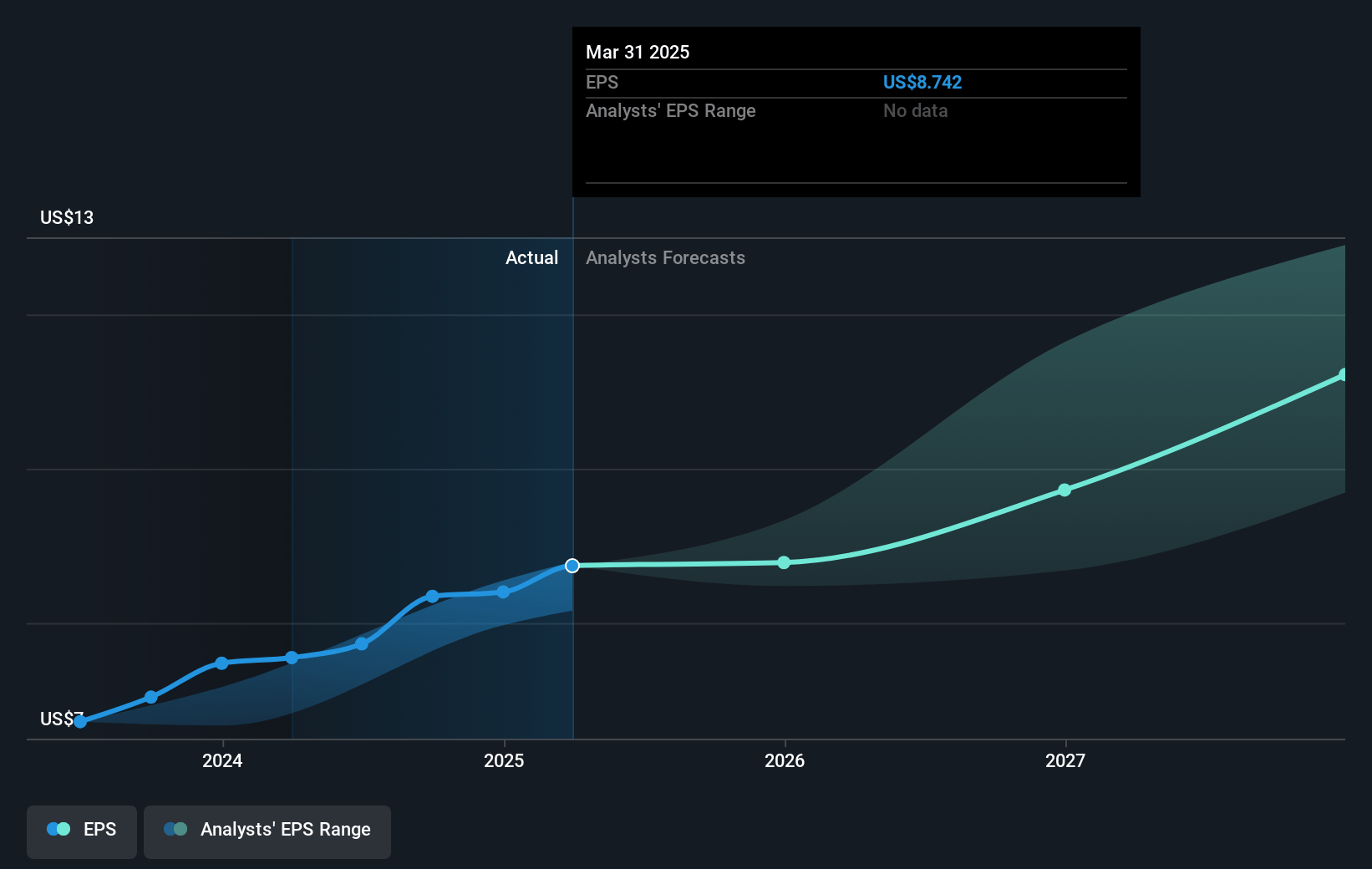

- The bearish analysts expect earnings to reach $718.6 million (and earnings per share of $9.69) by about May 2028, down from $754.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.7x on those 2028 earnings, down from 10.9x today. This future PE is lower than the current PE for the US Machinery industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 3.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.85%, as per the Simply Wall St company report.

Allison Transmission Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Allison’s selection as the transmission supplier for India’s Future Infantry Combat Vehicle program, representing several hundred million dollars in potential revenue over two decades, highlights a growing international defense market presence that could support long-term revenue growth.

- Strategic expansion into emerging and international markets, including global service network growth in Japan and West Africa, positions Allison to capture new geographic revenue streams and diversify its business, positively impacting revenue and earnings stability.

- Continued adoption and standardization of Allison’s advanced fuel efficiency technologies, such as FuelSense 2.0 with Daimler Truck North America, shows Allison’s capability to benefit from tightening emissions and efficiency regulations, supporting sustained or rising net margins and market share.

- The company’s ability to consistently increase prices, as demonstrated by price increases driving margin improvements and expectations for mid-single digit price growth for the rest of the year, may lead to improved gross profit and resilient operating margins, even during periods of subdued volume.

- Strong free cash flow generation and disciplined capital allocation, including increased dividends and a $1 billion share repurchase authorization, indicate management’s commitment to enhancing shareholder value and signal confidence in the company’s long-term earnings power and financial strength.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Allison Transmission Holdings is $74.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Allison Transmission Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $126.0, and the most bearish reporting a price target of just $74.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.2 billion, earnings will come to $718.6 million, and it would be trading on a PE ratio of 9.7x, assuming you use a discount rate of 7.8%.

- Given the current share price of $97.23, the bearish analyst price target of $74.0 is 31.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.