Last Update 10 Dec 25

Fair value Decreased 0.24%AGCO: Aftermarket Precision Agriculture Will Drive Upside As Sector Inventories Normalize

Analysts have made a modest downward revision to their AGCO price target, trimming it by approximately $0.30 to about $119.60. They are balancing optimism around the company’s aftermarket precision agriculture strategy and improving agriculture inventories with a preference for other machinery names at this point in the cycle.

Analyst Commentary

Recent Street research reflects a cautiously balanced stance on AGCO, with modest price target adjustments and a consistent Equal Weight rating frame. Analysts see a company with solid strategic positioning in precision agriculture, but one that is still contending with mixed end-market and relative valuation dynamics versus other machinery names.

Bullish Takeaways

- Bullish analysts highlight AGCO's aftermarket precision agriculture strategy as a key long-term growth driver, supporting recurring revenue and higher-margin mix.

- Improving inventory levels across the machinery space, particularly in agriculture, are seen as reducing downside risk to volumes and supporting a more stable mid-cycle earnings outlook.

- Incremental price target increases signal confidence that expectations have reset to more achievable levels, creating room for upside if execution on technology and distribution remains solid.

- AGCO is viewed as a relative laggard within machinery. Some bullish analysts see this as an opportunity if sentiment normalizes and the market begins to reward underowned quality industrials.

Bearish Takeaways

- Bearish analysts maintain a preference for construction machinery names. They suggest that AGCO may underperform peers if capital rotates toward segments with clearer near term demand visibility.

- The continued Equal Weight stance implies limited conviction in multiple expansion, with AGCO seen as fairly valued on a mid-cycle basis rather than outright cheap.

- End-market uncertainty in global agriculture, including farmer spending and equipment replacement cycles, remains a constraint on more aggressive growth assumptions.

- Execution risk around scaling precision agriculture solutions and fully monetizing aftermarket initiatives could cap upside if adoption is slower than modeled.

What's in the News

- AGCO Power is opening new production facilities in Linnavuori, Finland, adding a machining hall for CVT components and cylinder heads for its latest CORE engine, backed by a EUR54 million investment under AGCO's broader EUR70 million commitment to the site (Key Developments).

- The Linnavuori expansion increases remanufacturing capacity for remanufactured engines, supporting AGCO's focus on the circular economy and higher margin aftermarket powertrain solutions (Key Developments).

- The Linnavuori plant, already Finland's largest transmission gear manufacturing site by volume, gains 5,600 square meters of new production space to supply engines for Fendt, Massey Ferguson, and Valtra tractor brands (Key Developments).

- AGCO completed a share repurchase program announced in December 2019, buying back about 2.72 million shares, or 3.62 percent of shares outstanding, for approximately $265 million by September 30, 2025 (Key Developments).

- A separate buyback authorization announced in July 2025 reported no shares repurchased through September 30, 2025, leaving that program effectively unused to date (Key Developments).

Valuation Changes

- Fair Value: trimmed slightly from $119.86 to $119.57, reflecting a modest downward revision in intrinsic value estimates.

- Discount Rate: risen marginally from 9.26% to 9.33%, indicating a small increase in the assumed risk profile or return requirement.

- Revenue Growth: nudged down slightly from 4.55% to 4.54%, signaling a very modest softening in long term top line expectations.

- Net Profit Margin: eased slightly from 7.29% to 7.26%, implying a minor reduction in forward profitability assumptions.

- Future P/E: increased modestly from 13.81x to 13.87x, suggesting a small uptick in the valuation multiple applied to future earnings.

Key Takeaways

- Investments in premium brands, precision agriculture, and digital solutions position AGCO for stronger growth, higher margins, and enhanced earnings quality.

- Structural improvements and aftermarket expansion support operational efficiency, stable earnings, and robust capital returns to shareholders.

- Prolonged weak demand, higher costs from tariffs, and elevated inventories threaten AGCO's profitability and undermine both market share gains and long-term margin targets.

Catalysts

About AGCO- Manufactures and distributes agricultural equipment and replacement parts worldwide.

- The global push for higher agricultural productivity due to population growth and rising food demand continues to drive AGCO's investments in premium brands (like Fendt) and expansion into underserved regions, positioning the company to outgrow industry demand and materially lift long-term revenue growth.

- Accelerating adoption of precision agriculture and digital solutions is expected to significantly increase demand for AGCO's retrofit technologies (e.g., Precision Planting and PTx), supporting the shift toward higher-margin software-driven revenue, which should enhance future margins and earnings quality.

- Recent structural improvements-including reduced fixed costs, lower dealer inventories, and dealer-focused initiatives like FarmerCore-are expected to deliver improved operational leverage and working capital efficiency, setting a foundation for higher free cash flow and increased net margins as demand recovers.

- AGCO's global parts and aftermarket expansion leverages both e-commerce and service innovation, capitalizing on the aging installed base and growing focus on recurring, high-margin revenues; this strategy is likely to drive more stable and resilient long-term earnings and margin expansion across cycles.

- With the resolution of the TAFE partnership, AGCO has greater capital allocation flexibility, enabling a $1 billion share buyback program; this buyback, combined with expected mid-cycle margin improvement targets, should accelerate EPS growth and return capital to shareholders.

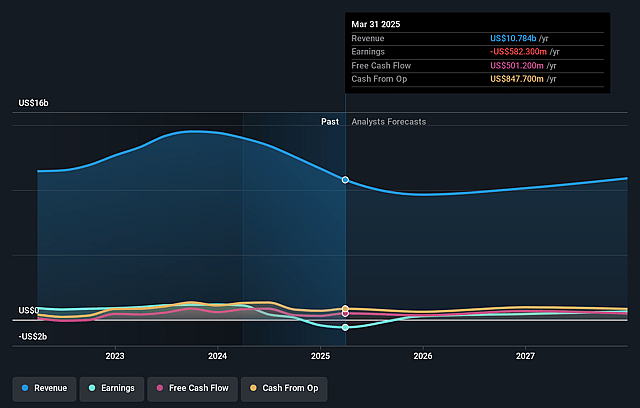

AGCO Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AGCO's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.0% today to 6.6% in 3 years time.

- Analysts expect earnings to reach $800.1 million (and earnings per share of $11.01) by about September 2028, up from $99.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 80.6x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.91%, as per the Simply Wall St company report.

AGCO Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weak demand in North America and Western Europe, driven by cautious farmer sentiment, persistently high input costs, lower export demand, and ongoing policy uncertainty, risks suppressing AGCO's revenues and operating margins in its core markets over the long term.

- Tariffs and global trade conflicts-especially newly announced EU tariffs and continuing U.S. policy uncertainty-could further compress AGCO's margins by increasing costs and forcing delayed or diluted pricing actions, directly impacting net earnings and profitability.

- Elevated dealer inventories in North America and ongoing underproduction (down over 50% in Q3 and Q4) suggest a risk of continued negative operating margins in that region, which may weigh on consolidated company earnings if the inventory overhang and demand weakness persist longer than expected.

- AGCO's market share gains, particularly for premium brands like Fendt, could be undermined by increased costs relative to competitive products if tariffs lead to higher relative prices or if production footprint changes are not implemented in time, creating risk to both future revenue growth and margin expansion plans.

- Structural industry headwinds such as four consecutive years of industry decline in Europe, growing factory under-absorption costs during downturns, and potential for further cost inefficiencies from supply chain or production mismatches threaten AGCO's ability to achieve mid-cycle margin targets and sustainable cash flow growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $123.769 for AGCO based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $97.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.1 billion, earnings will come to $800.1 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 8.9%.

- Given the current share price of $107.61, the analyst price target of $123.77 is 13.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AGCO?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.