Last Update04 Aug 25Fair value Increased 11%

AGCO's consensus price target has been raised to $121.46, driven by anticipated sector tailwinds from renewed bonus depreciation, the expected boost from monetary easing, machinery outperformance, and strengthened governance and capital return policies following the TAFE agreement.

Analyst Commentary

- Passage of the One Big Beautiful Bill reinstates 100% bonus depreciation and delays several Liberation Day tariffs, providing sector tailwinds.

- Anticipation of Fidela Reserve rate cuts expected to boost machinery sector performance ahead of monetary easing.

- AGCO's machinery group has recently outperformed the broader market, helping support higher valuations.

- The finalized agreement with TAFE enables AGCO to resume significant share repurchases, with $300M in buybacks estimated to deliver a 17c/share EPS benefit.

- The TAFE agreement enhances governance clarity by restricting TAFE’s ownership, removing its board representation, and ending legal disputes and commercial ties.

What's in the News

- AGCO raised full-year 2025 earnings guidance, now expecting net sales of ~$9.8 billion and EPS between $4.75 and $5.00.

- Infosys expanded its strategic partnership with AGCO to enhance IT infrastructure and HR operations using automation, generative AI, and standardized processes.

- AGCO announced a $1 billion share repurchase program authorized by the Board of Directors.

- AGCO and TAFE resolved all outstanding disputes via multiple agreements: TAFE granted exclusive rights to the Massey Ferguson brand in India, ongoing legal proceedings and commercial agreements terminated, and TAFE to buy back AGCO’s stake in TAFE for $260 million.

- AGCO was dropped from the Russell 1000 Defensive Index and the Russell 1000 Value-Defensive Index.

Valuation Changes

Summary of Valuation Changes for AGCO

- The Consensus Analyst Price Target has risen from $111.19 to $121.46.

- The Consensus Revenue Growth forecasts for AGCO has significantly risen from 2.0% per annum to 5.8% per annum.

- The Net Profit Margin for AGCO has risen from 6.26% to 6.63%.

Key Takeaways

- Investments in premium brands, precision agriculture, and digital solutions position AGCO for stronger growth, higher margins, and enhanced earnings quality.

- Structural improvements and aftermarket expansion support operational efficiency, stable earnings, and robust capital returns to shareholders.

- Prolonged weak demand, higher costs from tariffs, and elevated inventories threaten AGCO's profitability and undermine both market share gains and long-term margin targets.

Catalysts

About AGCO- Manufactures and distributes agricultural equipment and replacement parts worldwide.

- The global push for higher agricultural productivity due to population growth and rising food demand continues to drive AGCO's investments in premium brands (like Fendt) and expansion into underserved regions, positioning the company to outgrow industry demand and materially lift long-term revenue growth.

- Accelerating adoption of precision agriculture and digital solutions is expected to significantly increase demand for AGCO's retrofit technologies (e.g., Precision Planting and PTx), supporting the shift toward higher-margin software-driven revenue, which should enhance future margins and earnings quality.

- Recent structural improvements-including reduced fixed costs, lower dealer inventories, and dealer-focused initiatives like FarmerCore-are expected to deliver improved operational leverage and working capital efficiency, setting a foundation for higher free cash flow and increased net margins as demand recovers.

- AGCO's global parts and aftermarket expansion leverages both e-commerce and service innovation, capitalizing on the aging installed base and growing focus on recurring, high-margin revenues; this strategy is likely to drive more stable and resilient long-term earnings and margin expansion across cycles.

- With the resolution of the TAFE partnership, AGCO has greater capital allocation flexibility, enabling a $1 billion share buyback program; this buyback, combined with expected mid-cycle margin improvement targets, should accelerate EPS growth and return capital to shareholders.

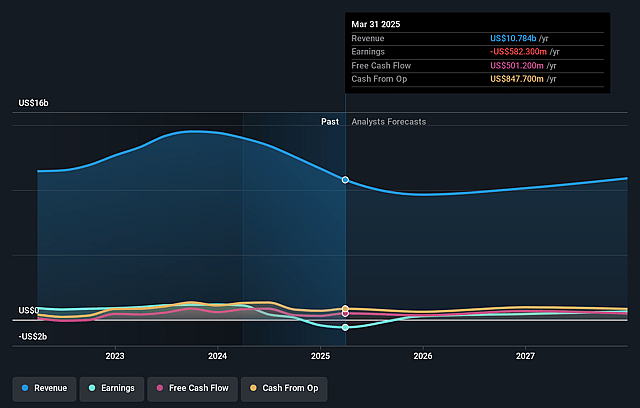

AGCO Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AGCO's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.0% today to 6.6% in 3 years time.

- Analysts expect earnings to reach $800.1 million (and earnings per share of $11.01) by about August 2028, up from $99.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 84.2x today. This future PE is lower than the current PE for the US Machinery industry at 24.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.85%, as per the Simply Wall St company report.

AGCO Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weak demand in North America and Western Europe, driven by cautious farmer sentiment, persistently high input costs, lower export demand, and ongoing policy uncertainty, risks suppressing AGCO's revenues and operating margins in its core markets over the long term.

- Tariffs and global trade conflicts-especially newly announced EU tariffs and continuing U.S. policy uncertainty-could further compress AGCO's margins by increasing costs and forcing delayed or diluted pricing actions, directly impacting net earnings and profitability.

- Elevated dealer inventories in North America and ongoing underproduction (down over 50% in Q3 and Q4) suggest a risk of continued negative operating margins in that region, which may weigh on consolidated company earnings if the inventory overhang and demand weakness persist longer than expected.

- AGCO's market share gains, particularly for premium brands like Fendt, could be undermined by increased costs relative to competitive products if tariffs lead to higher relative prices or if production footprint changes are not implemented in time, creating risk to both future revenue growth and margin expansion plans.

- Structural industry headwinds such as four consecutive years of industry decline in Europe, growing factory under-absorption costs during downturns, and potential for further cost inefficiencies from supply chain or production mismatches threaten AGCO's ability to achieve mid-cycle margin targets and sustainable cash flow growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $123.923 for AGCO based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $97.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.1 billion, earnings will come to $800.1 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 8.9%.

- Given the current share price of $112.41, the analyst price target of $123.92 is 9.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.