Last Update08 Oct 25Fair value Increased 3.64%

Analysts have increased their price target for Rocket Lab from $46.40 to $48.09, citing stronger infrastructure progress and heightened confidence in the company’s future launch capabilities.

Analyst Commentary

Recent research notes from bullish analysts have highlighted both progress and remaining uncertainties for Rocket Lab as it continues its trajectory within the aerospace sector.

Bullish Takeaways

- Bullish analysts are encouraged by Rocket Lab’s significant advancements in launch site infrastructure, which supports the company’s readiness for upcoming launches.

- Growing confidence in Rocket Lab’s next-generation Neutron rocket is strengthening the overall buy thesis, with tangible progress seen at the new launch pad.

- The continued momentum observed within the broader aerospace and defense sector is seen as a positive indicator for Rocket Lab’s potential revenue growth and future market share expansion.

- Upward adjustments in price targets reflect heightened optimism around valuation, execution, and the company’s ability to leverage recent infrastructure investments for long-term growth.

Bearish Takeaways

- Bearish analysts remain watchful regarding execution risks tied to Rocket Lab's initial Neutron launches, as real-world performance of new hardware will be a decisive factor for valuation.

- Market sentiment could be impacted by any delays or unforeseen technical hurdles during early launch attempts, affecting near-term growth expectations.

- The sector’s overall momentum may introduce competition pressures, requiring consistent operational success to meet the raised expectations embedded in revised price targets.

What's in the News

- Rocket Lab announced a launch window opening October 14 for "Owl New World," its seventh mission for Synspective to deploy a next-generation SAR satellite as part of a 21-mission agreement. This marks its 15th launch this year and 73rd overall (Key Developments).

- The company secured a second multi-launch contract with Synspective, bringing the total order to 21 dedicated Electron missions. This is the largest single-customer order in Rocket Lab's history (Key Developments).

- Rocket Lab delivered two Explorer-class spacecraft for NASA's ESCAPADE Mars mission, completing the design, build, integration, and testing in just three and a half years. The launch is scheduled for this fall on Blue Origin’s New Glenn rocket (Key Developments).

- The company officially opened Launch Complex 3 in Virginia for its reusable Neutron rocket, significantly expanding U.S. launch capacity and setting a new benchmark for construction speed and operational capability (Key Developments).

- Rocket Lab completed a $396.6 million follow-on equity offering and filed for an additional $750 million at-the-market equity program, strengthening its balance sheet for upcoming projects (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from $46.40 to $48.09, reflecting increased optimism around Rocket Lab's valuation.

- Discount Rate has moved up marginally from 7.61% to 7.67%, indicating a minor recalibration in risk assessment.

- Revenue Growth projections have edged higher from 37.47% to 37.53%, signaling incremental confidence in future top-line expansion.

- Net Profit Margin has decreased minimally from 8.66% to 8.64%, showing marginally lower expected profitability.

- Future P/E ratio has risen from 216.7x to 223.4x, suggesting slightly higher valuation expectations relative to projected earnings.

Key Takeaways

- Expanded vertical integration and end-to-end space solutions position Rocket Lab for major defense contracts and future margin growth.

- High launch cadence, satellite manufacturing, and reusable rocket development enable multi-year revenue growth, backlog expansion, and broader market access.

- High R&D costs, contract dependence, competition, and regulatory risks threaten profitability, while M&A and integration complexity may distract from core execution and margin improvement.

Catalysts

About Rocket Lab- A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

- Rocket Lab's move toward end-to-end space solutions-including the acquisition of Geost and expanding vertically integrated payload, satellite, and launch service capabilities-uniquely positions the company to capture larger, national security and defense contracts like the Golden Dome and SDA constellations, supporting significant top-line growth and enhanced gross margins in future quarters.

- Escalating demand for real-time data, earth observation, and global connectivity is driving increasing recurring revenue opportunities through satellite constellation launches and manufacturing-Rocket Lab's high Electron launch cadence and in-house satellite production (including potential for future proprietary constellations) are enabling the company to capitalize on these industry tailwinds, supporting multi-year revenue growth and backlog expansion.

- Successful development and operational ramp of the medium-lift reusable Neutron rocket will allow Rocket Lab to target larger, higher-value payloads (including those currently reliant on Falcon 9), increasing addressable market, boosting revenue, and driving margin expansion through production scale and vehicle reusability.

- Demonstrated pricing power and international expansion-highlighted by increased Electron average selling prices, strong international agency demand, and multi-launch agreements-reflect Rocket Lab's differentiated reliability and execute status in a consolidating launch market, likely supporting higher net margins and revenue predictability.

- Current elevated investment in R&D, infrastructure, and acquisitions is masking near-term earnings and cash flow, but the company's strong cash position, clear line of sight to significant government/commercial contract wins, and shifting focus from R&D to production post-Neutron debut are poised to deliver operating leverage and profitability as secular industry demand continues to accelerate.

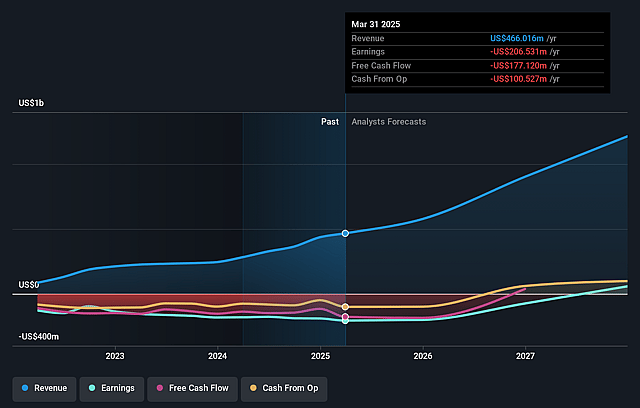

Rocket Lab Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rocket Lab's revenue will grow by 37.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -45.9% today to 8.7% in 3 years time.

- Analysts expect earnings to reach $113.4 million (and earnings per share of $0.21) by about September 2028, up from $-231.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 216.7x on those 2028 earnings, up from -90.8x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to decline by 4.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

Rocket Lab Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained elevated R&D and capital expenditures for Neutron development and scaling, with management projecting ongoing negative free cash flow and cash consumption into 2027 or beyond-this could materially pressure earnings and increase dilution risk if capital markets tighten or if expected revenue growth is delayed.

- Management highlighted project "lumpiness" and dependency on large contract wins (e.g., SDA Tranche 3, Golden Dome), exposing Rocket Lab to program delays, revenue recognition volatility, and heightened execution risk that could lead to irregular revenue, backlog fluctuations, and lower-than-expected operating leverage.

- While demand signals for Neutron are strong, actual customer commitment is lagging until a successful test flight, and management noted that increased competition (including established and well-capitalized peers like SpaceX and potential industry consolidation) could lead to margin compression, limited pricing power, and risk to long-term revenue targets if Neutron faces technical or schedule setbacks.

- The strategy of rapid vertical integration and aggressive M&A expands capabilities and addressable market, but also introduces operational complexities, integration risks, and possible distractions from core execution. Acquisition-driven growth requires sustained access to capital and successful integration to avoid impacting net margins and profitability.

- Exposure to variable trends in commercial and government launch budgets, and the risk of regulatory or geopolitical headwinds (such as export controls or launch bottlenecks at federal sites), could reduce launch frequency, delay government contract awards, and limit access to key international markets. These long-term trends could negatively impact revenue growth and market share if not mitigated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $46.4 for Rocket Lab based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $113.4 million, and it would be trading on a PE ratio of 216.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $43.53, the analyst price target of $46.4 is 6.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.