Key Takeaways

- Rocket Lab's vertical integration and unique end-to-end offerings position it to secure premium pricing, superior margins, and major defense and constellation contracts ahead of peers.

- The company is set to capture significant market share with reusable launches and international expansion, transforming backlogs into stable, high-margin recurring revenue streams.

- High cash burn, regulatory risk, government contract dependence, competitive pressures, and execution risks threaten Rocket Lab's path to profitability and sustainable revenue growth.

Catalysts

About Rocket Lab- A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

- Analyst consensus sees Neutron as a medium-class rocket capitalizing on constellation launches, but this fundamentally understates the scale of pent-up demand for Falcon 9 alternatives-in reality, Neutron is positioned to capture an outsized market share as the only operational US-based reusable competitor, potentially driving a rapid, nonlinear acceleration in backlog and revenue as soon as it achieves orbit and demonstrating operating leverage much sooner than expected.

- Analysts broadly agree that vertical integration and expansion in Space Systems will lead to margin improvements; however, by fully controlling payloads, critical components, bus manufacturing, and launch, Rocket Lab is uniquely positioned as the only Western supplier able to deliver fixed-price, end-to-end solutions for defense and constellation customers-unlocking premium pricing, higher recurring revenues, and structurally superior gross and net margins ahead of industry peers.

- The looming multi-hundred-billion-dollar Golden Dome Defense Initiative and Mars communication programs represent generational secular mega-trends; Rocket Lab is currently the only agile, vertically integrated player with rapid execution capability and a real track record, making it a frontrunner for contract wins that could multiply revenue and secure extremely long-duration cash flows absent from analyst models.

- The company's international expansion, exemplified by direct ESA contracts and aggressive moves into the European national security sector, opens up new, underappreciated total addressable markets and revenue streams; combined with unique in-house technology from recent acquisitions, Rocket Lab is positioned to force-multiply both market share and contract value versus competitors tied to slower or less integrated supply chains.

- With reusable vehicle cadence, rapid infrastructure buildout, and automated composite manufacturing coming online, Rocket Lab stands to achieve launch rates-particularly for government, hypersonic, and constellation contracts-orders of magnitude higher than current expectations, turning what are perceived as "lumpy" backlogs into a pipeline of predictable, high-margin, and cash-generative business.

Rocket Lab Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Rocket Lab compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

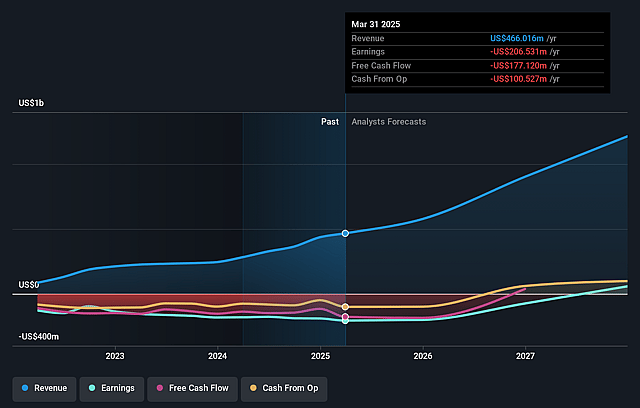

- The bullish analysts are assuming Rocket Lab's revenue will grow by 42.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -45.9% today to 9.1% in 3 years time.

- The bullish analysts expect earnings to reach $132.9 million (and earnings per share of $0.23) by about September 2028, up from $-231.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 239.2x on those 2028 earnings, up from -98.1x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to decline by 4.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.64%, as per the Simply Wall St company report.

Rocket Lab Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rocket Lab's continued high cash consumption and negative free cash flow, especially driven by Neutron development and scaling, make its path to sustainable profitability and positive cash generation uncertain, which could put pressure on future earnings and the company's ability to fund growth internally.

- Secular trends of rising regulation and scrutiny on space launches, such as the need for more environmental approvals and potential carbon emission limits, could increase Rocket Lab's compliance costs and delay missions, negatively impacting revenue growth and launch margins over the long term.

- The company remains highly dependent on large, lumpy government contracts for both its Space Systems and Launch Services segments, making its backlog and future revenues vulnerable to delays, non-renewals, or political budget changes that can lead to significant volatility in earnings.

- Intensifying competition in the commercial launch sector, with increasing entrants and established giants like SpaceX, may drive down launch prices, dampen revenue per launch, and compress net margins as Rocket Lab attempts to remain competitive, particularly if launch supply grows faster than demand.

- Delays or underperformance in scaling reusable Neutron production and reliable launches could result in missed market opportunities, slow contract awards, and greater R&D and capital expenditures than planned, directly threatening long-term revenue growth and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Rocket Lab is $60.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Rocket Lab's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $132.9 million, and it would be trading on a PE ratio of 239.2x, assuming you use a discount rate of 7.6%.

- Given the current share price of $47.03, the bullish analyst price target of $60.0 is 21.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.