Catalysts

About Rocket Lab

Rocket Lab designs, manufactures and operates launch vehicles and space systems for government and commercial customers.

What are the underlying business or industry changes driving this perspective?

- Escalating capital intensity for Neutron, with cumulative spending already moving well above the original 250 million to 300 million budget range, risks structurally higher depreciation and R&D run rates. This could cap future operating leverage and delay sustainable earnings.

- Reliance on rapid growth in government space and defense programs, including SDA transport layers and hypersonic test initiatives, exposes revenue to budget debates, shutdowns and award timing. This could drive lumpier backlog conversion and slower top line growth than current expectations.

- Vertical integration and aggressive M&A, from component suppliers to payload and sensor businesses, increase fixed costs and integration complexity. This raises the risk that acquired revenue underperforms and compresses consolidated gross margins and free cash flow.

- Ambitious launch cadence targets for Electron and future Neutron missions depend on scaling highly specialized manufacturing and test infrastructure. Execution missteps or supply bottlenecks could constrain capacity, reduce launch availability and limit revenue growth while overhead remains elevated.

- Growing competition across small launch, satellite manufacturing and payload markets, including larger primes with deep capital bases, may force sharper pricing and contract terms. This could pressure average selling prices, net margins and long term return on invested capital.

Assumptions

This narrative explores a more pessimistic perspective on Rocket Lab compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

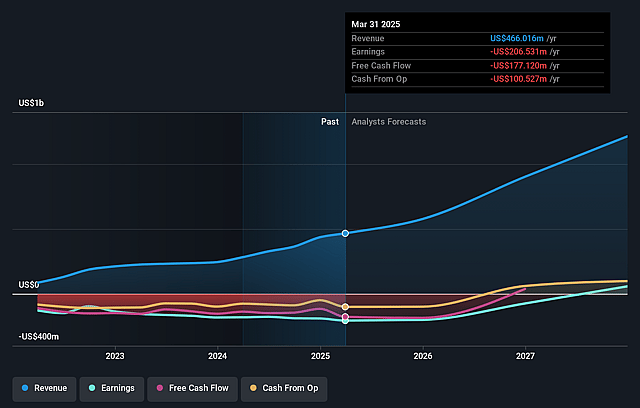

- The bearish analysts are assuming Rocket Lab's revenue will grow by 33.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -35.6% today to 1.2% in 3 years time.

- The bearish analysts expect earnings to reach $16.4 million (and earnings per share of $0.03) by about December 2028, up from $-197.6 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $120.4 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 2329.9x on those 2028 earnings, up from -166.2x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 38.7x.

- The bearish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.55%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Electron is demonstrating accelerating demand with 17 launches signed in a single quarter, a record annual launch cadence and a factory designed for significantly higher throughput, which could support sustained top line growth and operating leverage, improving revenue and earnings.

- Space Systems has scaled from small beginnings to contribute the majority of revenue with high margin satellite manufacturing, diversified government and commercial programs and a growing pipeline of large SDA and national security contracts, which may provide long duration, secular growth in space infrastructure spending that strengthens revenue visibility and margins.

- Long term government and defense trends, including hypersonic test programs like Golden Dome, SDA transport layers and increasing international agency reliance on Electron, position Rocket Lab as a key strategic supplier, which could drive structurally higher backlog, pricing power and gross margins.

- Vertical integration across launch, spacecraft buses, sensors and future laser communications, combined with disciplined M&A and a strong liquidity position above 1 billion dollars, may allow Rocket Lab to capture more of the value chain and outperform peers on cost and schedule, supporting higher net margins and cash flow over time.

- Neutron and the Archimedes engine are being developed with an emphasis on reliability, reusability and thorough ground testing, and if successful they could open a higher capacity, higher ASP launch market and enable larger satellite constellations, materially increasing long term revenue, gross margin and earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Rocket Lab is $47.0, which represents up to two standard deviations below the consensus price target of $65.67. This valuation is based on what can be assumed as the expectations of Rocket Lab's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $83.0, and the most bearish reporting a price target of just $47.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $16.4 million, and it would be trading on a PE ratio of 2329.9x, assuming you use a discount rate of 7.5%.

- Given the current share price of $61.49, the analyst price target of $47.0 is 30.8% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Rocket Lab?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.