Last Update30 Aug 25Fair value Increased 2.20%

Rocket Lab’s price target was raised to $46.40 as analysts express increased confidence in Neutron rocket milestones, robust sector momentum, and operational advantages, moderated by ongoing unprofitability and limited visibility into profitability.

Analyst Commentary

- Bullish analysts cite increased confidence in Rocket Lab’s Neutron rocket progress, with launch pad infrastructure fully in place and readiness for initial launches.

- Upward adjustments reflect robust momentum across the aerospace and defense sector, contributing to raised estimates and optimism for the company.

- Proprietary supplier and industry surveys indicate ongoing tightness in the aerospace & defense aftermarket and sustained strength in Space & Defense, supporting elevated valuations.

- Management’s track record of successful launches, a diversified portfolio of three rocket types, and operational moats from dual launchpads are seen as strong competitive advantages.

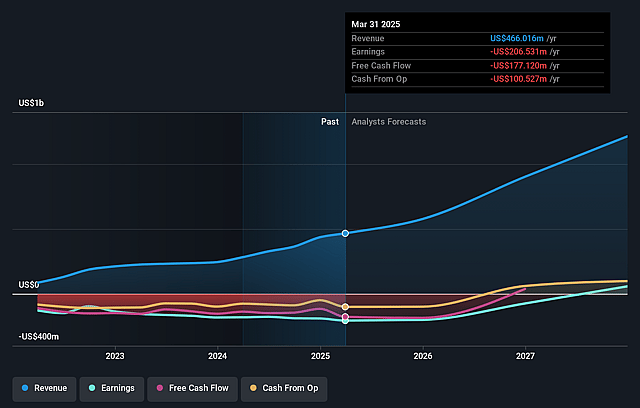

- Bearish analysts note that despite sector leadership, Rocket Lab remains unprofitable with no current positive cash flow as it invests in Neutron development, and there is limited visibility into the financial trajectory toward sustainable profitability.

What's in the News

- Rocket Lab is expanding U.S. semiconductor manufacturing capacity, acquiring Geost, and receiving $23.9 million from the Department of Commerce to strengthen domestic supply for space-grade components, with plans to double wafer output and add over 2,000 U.S. jobs.

- The company continues its rapid launch cadence with 100% mission success, surpassing 70 Electron missions, setting new turnaround records, and landing multi-launch contracts with customers including iQPS, HawkEye 360, BlackSky, and the European Space Agency.

- Rocket Lab secured a dedicated Electron launch contract with ESA to deploy the first LEO-PNT navigation satellites, reinforcing its international profile.

- RKLB transitioned from the Russell 2000 indices to inclusion in the Russell 1000, Midcap, and related Growth and Dynamic indices.

- Amendments to the company’s Articles of Association and Certificate of Incorporation were approved at the AGM, and revenue guidance for Q3 2025 was set between $145 million and $155 million.

Valuation Changes

Summary of Valuation Changes for Rocket Lab

- The Consensus Analyst Price Target has risen slightly from $45.40 to $46.40.

- The Future P/E for Rocket Lab remained effectively unchanged, moving only marginally from 212.02x to 215.21x.

- The Discount Rate for Rocket Lab remained effectively unchanged, moving only marginally from 7.60% to 7.61%.

Key Takeaways

- Expanded vertical integration and end-to-end space solutions position Rocket Lab for major defense contracts and future margin growth.

- High launch cadence, satellite manufacturing, and reusable rocket development enable multi-year revenue growth, backlog expansion, and broader market access.

- High R&D costs, contract dependence, competition, and regulatory risks threaten profitability, while M&A and integration complexity may distract from core execution and margin improvement.

Catalysts

About Rocket Lab- A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

- Rocket Lab's move toward end-to-end space solutions-including the acquisition of Geost and expanding vertically integrated payload, satellite, and launch service capabilities-uniquely positions the company to capture larger, national security and defense contracts like the Golden Dome and SDA constellations, supporting significant top-line growth and enhanced gross margins in future quarters.

- Escalating demand for real-time data, earth observation, and global connectivity is driving increasing recurring revenue opportunities through satellite constellation launches and manufacturing-Rocket Lab's high Electron launch cadence and in-house satellite production (including potential for future proprietary constellations) are enabling the company to capitalize on these industry tailwinds, supporting multi-year revenue growth and backlog expansion.

- Successful development and operational ramp of the medium-lift reusable Neutron rocket will allow Rocket Lab to target larger, higher-value payloads (including those currently reliant on Falcon 9), increasing addressable market, boosting revenue, and driving margin expansion through production scale and vehicle reusability.

- Demonstrated pricing power and international expansion-highlighted by increased Electron average selling prices, strong international agency demand, and multi-launch agreements-reflect Rocket Lab's differentiated reliability and execute status in a consolidating launch market, likely supporting higher net margins and revenue predictability.

- Current elevated investment in R&D, infrastructure, and acquisitions is masking near-term earnings and cash flow, but the company's strong cash position, clear line of sight to significant government/commercial contract wins, and shifting focus from R&D to production post-Neutron debut are poised to deliver operating leverage and profitability as secular industry demand continues to accelerate.

Rocket Lab Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rocket Lab's revenue will grow by 37.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -45.9% today to 8.7% in 3 years time.

- Analysts expect earnings to reach $113.4 million (and earnings per share of $0.21) by about September 2028, up from $-231.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 216.7x on those 2028 earnings, up from -90.8x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to decline by 4.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

Rocket Lab Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained elevated R&D and capital expenditures for Neutron development and scaling, with management projecting ongoing negative free cash flow and cash consumption into 2027 or beyond-this could materially pressure earnings and increase dilution risk if capital markets tighten or if expected revenue growth is delayed.

- Management highlighted project "lumpiness" and dependency on large contract wins (e.g., SDA Tranche 3, Golden Dome), exposing Rocket Lab to program delays, revenue recognition volatility, and heightened execution risk that could lead to irregular revenue, backlog fluctuations, and lower-than-expected operating leverage.

- While demand signals for Neutron are strong, actual customer commitment is lagging until a successful test flight, and management noted that increased competition (including established and well-capitalized peers like SpaceX and potential industry consolidation) could lead to margin compression, limited pricing power, and risk to long-term revenue targets if Neutron faces technical or schedule setbacks.

- The strategy of rapid vertical integration and aggressive M&A expands capabilities and addressable market, but also introduces operational complexities, integration risks, and possible distractions from core execution. Acquisition-driven growth requires sustained access to capital and successful integration to avoid impacting net margins and profitability.

- Exposure to variable trends in commercial and government launch budgets, and the risk of regulatory or geopolitical headwinds (such as export controls or launch bottlenecks at federal sites), could reduce launch frequency, delay government contract awards, and limit access to key international markets. These long-term trends could negatively impact revenue growth and market share if not mitigated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $46.4 for Rocket Lab based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $113.4 million, and it would be trading on a PE ratio of 216.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $43.53, the analyst price target of $46.4 is 6.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.