Key Takeaways

- Policy uncertainty, rising costs, and potential subsidy rollbacks threaten demand visibility and could weaken Array’s long-term revenue growth and project pipeline.

- Intensifying competition and difficulty passing increased costs to customers are expected to further reduce Array’s margins, pricing power, and market share.

- Sustained solar demand, innovative products, operational strength, geographic expansion, and financial discipline position Array Technologies for stable growth and improved long-term profitability.

Catalysts

About Array Technologies- Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

- Persistent uncertainty around global and domestic policy, including volatile tariff conditions, ongoing legislative negotiations over energy tax credits, and potential changes to the Inflation Reduction Act, threaten long-term demand visibility and could lead to a slowdown in utility-scale solar installations. This is likely to negatively affect Array’s project pipeline and revenue growth beyond 2025.

- Rising global interest rates and tighter credit markets continue to push up the cost of capital for large-scale solar projects, which may result in delayed investment decisions, fewer new project starts, and increased cancellations in key international markets such as Brazil, thereby constraining Array’s future revenue and order book.

- Heightened input cost volatility driven by ongoing geopolitical instability, currency fluctuations in international markets, and protectionist trade actions has already compressed and is expected to further compress Array’s gross margins and operating margins over the next several years, especially as the company faces difficulties fully passing increased costs onto customers.

- The solar tracker industry is experiencing increasing competition from both established and low-cost emerging players, as well as rapid advances in alternative mounting and tracking technologies, which could erode Array’s market share, reduce pricing power, and further squeeze average selling prices and overall profitability.

- Any rollback or reduction of renewable energy subsidies, especially in key markets like the U.S. and Brazil, would significantly reduce the total addressable market for utility-scale solar and undermine the long-term policy and demand stability on which Array’s growth expectations—and current valuation—are premised, likely resulting in lower-than-forecasted revenue and earnings.

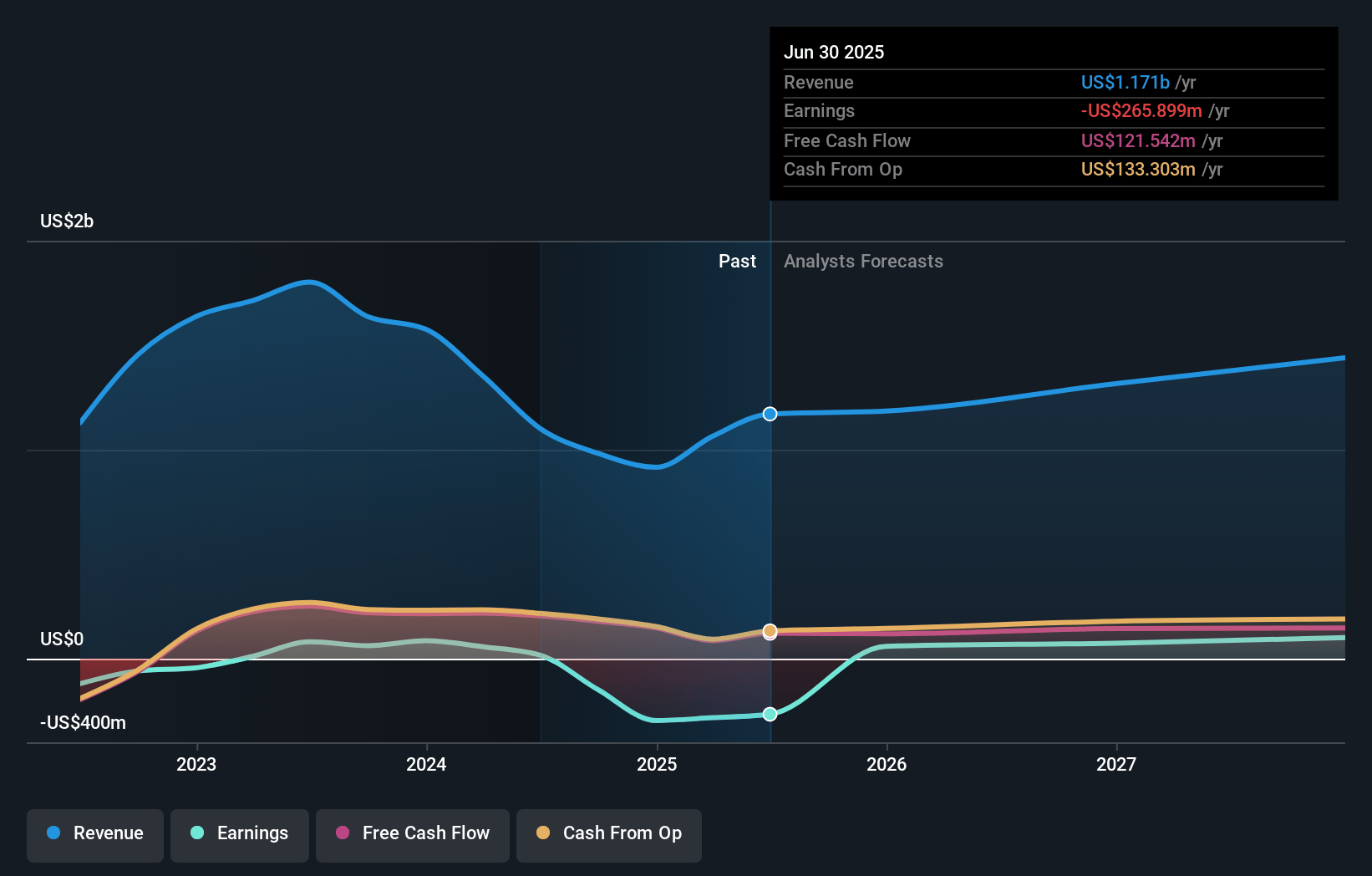

Array Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Array Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Array Technologies's revenue will grow by 2.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -26.5% today to 8.9% in 3 years time.

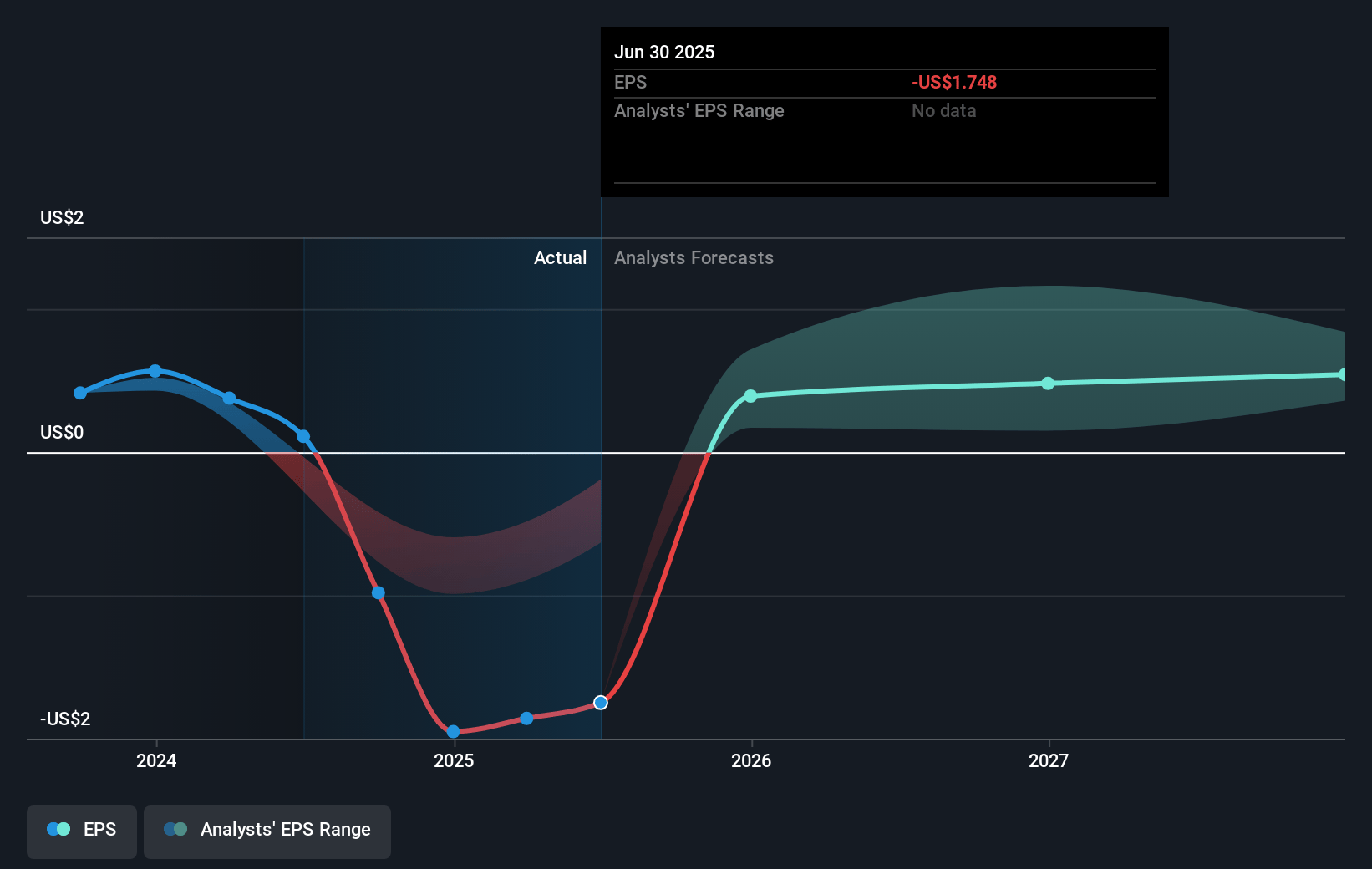

- The bearish analysts expect earnings to reach $101.1 million (and earnings per share of $0.49) by about July 2028, up from $-282.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, up from -4.0x today. This future PE is lower than the current PE for the US Electrical industry at 27.3x.

- Analysts expect the number of shares outstanding to grow by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.75%, as per the Simply Wall St company report.

Array Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global long-term secular trend of increasing electricity demand, driven by manufacturing reshoring, transportation electrification, and data center growth, continues to favor utility-scale solar, which supports sustained revenue growth and demand for Array Technologies' solutions.

- Product innovation and a robust new product pipeline—including the rapid adoption of OmniTrack, the wireless Skylink platform, and differentiated software offerings like SmartTrack—have enabled Array to win market share, expand average selling prices, and enhance long-term net margins.

- Strong operational execution, resilient order book growth to $2 billion, and high customer engagement along with the ability to pass through tariffs in over 75% of contracts, position Array to maintain revenue stability and weather short-term policy or pricing headwinds.

- Geographic expansion and supply chain optionality, including a domestic supplier network covering over 93% of bill of material content for U.S. projects and active growth in Europe and the Middle East, diversify risk and open new long-term revenue streams.

- Financial discipline, visible near-term project schedules, a solid liquidity position with $348 million cash and $510 million total liquidity, as well as reaffirmed full-year guidance and expected growth in adjusted net income and EBITDA, support the ability to drive sustained earnings expansion over multiple years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Array Technologies is $5.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Array Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $5.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $101.1 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 9.7%.

- Given the current share price of $7.42, the bearish analyst price target of $5.5 is 34.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.