Key Takeaways

- Growing demand for electricity and solar adoption, along with international expansion, significantly increases Array’s market opportunities and potential for diversified, long-term revenue growth.

- Investments in domestic supply chain, product innovation, and operational agility strengthen margins, support higher-value contracts, and enhance earnings stability across regulatory environments.

- Margin and revenue growth are threatened by policy uncertainties, international expansion challenges, macroeconomic pressures, and heightened competition in an increasingly unpredictable global solar market.

Catalysts

About Array Technologies- Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

- The accelerating global demand for electricity—driven by industrial reshoring, electrification of transportation, and data center growth—is expected to require at least 50% more annual U.S. electricity production by 2035, with utility-scale solar emerging as the lowest-cost, quickest-to-deploy solution; this sustained demand growth directly expands Array’s addressable market and supports robust long-term revenue growth across both domestic and international segments.

- Governments and corporations worldwide are increasingly focused on energy security and grid resiliency, leading to greater adoption of domestic-content solar tracking solutions; Array’s proactive investments in a U.S.-centered supply chain and their ability to offer 100% domestic content trackers position the company to capture higher-margin government and utility-scale contracts, boosting future net margins and earnings stability.

- International expansion efforts, especially in regions like Europe and the Middle East where order momentum is high and competition for reliable tracking systems is increasing, open up significant new sources of revenue growth beyond the U.S. market and offer potential geographic diversification benefits to Array’s overall earnings profile over the next decade.

- Ongoing product innovation—including rapid market adoption of new offerings like OmniTrack and Skylink, as well as the integration of software platforms such as SmartTrack for weather adaptation and efficiency optimization—supports pricing power and margin expansion by delivering higher-value, differentiated solutions that attract premiums and drive recurring software and services revenue.

- Continued supply chain optimization, capital discipline, and operational agility—including the configuration of over 50 domestic suppliers and the diversification of international sourcing—enable Array to mitigate cost increases, maintain stable production through regulatory volatility, and increase operating leverage, ultimately supporting improved free cash flow conversion and long-term earnings growth.

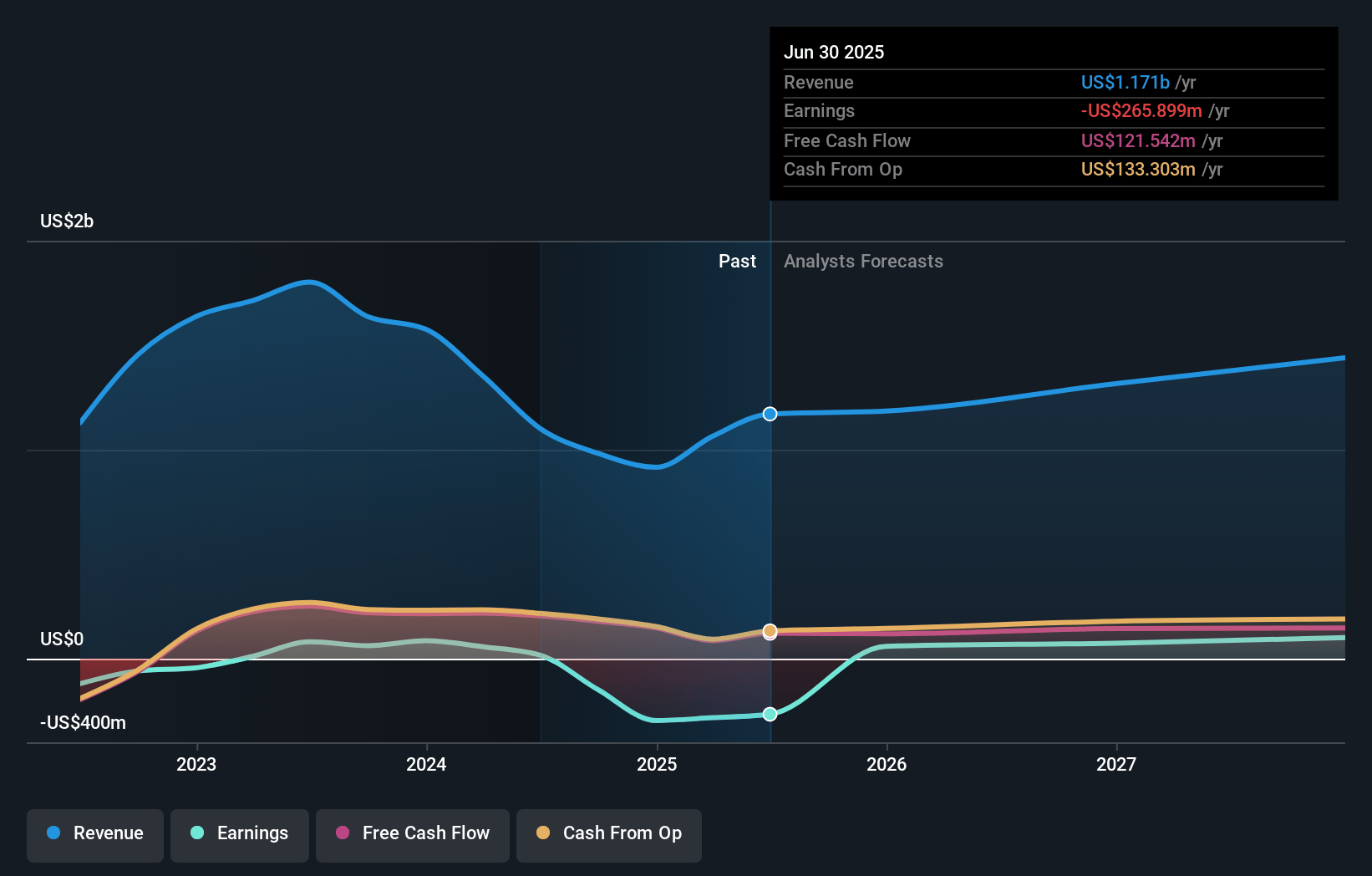

Array Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Array Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Array Technologies's revenue will grow by 18.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -26.5% today to 8.9% in 3 years time.

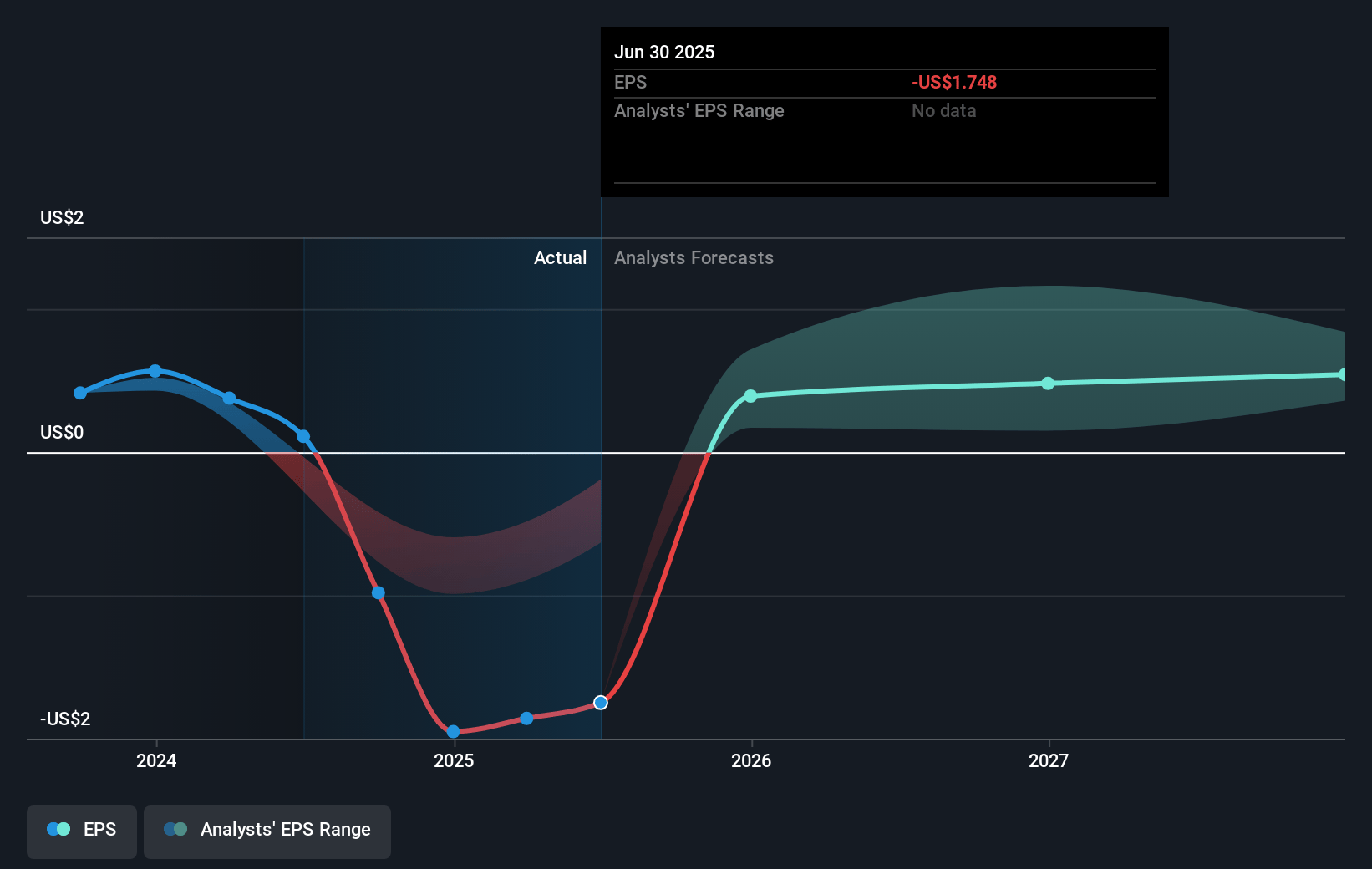

- The bullish analysts expect earnings to reach $156.8 million (and earnings per share of $1.03) by about July 2028, up from $-282.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, up from -3.8x today. This future PE is lower than the current PE for the US Electrical industry at 28.7x.

- Analysts expect the number of shares outstanding to grow by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.92%, as per the Simply Wall St company report.

Array Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Uncertainty and volatility around tariffs, trade policy, and the evolving Inflation Reduction Act create significant risk of project delays and complicate forward pricing and PPA agreements, leading to unpredictable order patterns and potential revenue slowdowns in future quarters.

- The company’s results this quarter benefited from legacy project deliveries and volume catch-up, but guidance and management commentary suggest future margin compression driven by a mix shift toward lower-margin international projects, declines in adjusted selling prices, and roll-off of one-time tax benefits, all of which could pressure gross margins and net income in the medium to long term.

- Persistent global macroeconomic challenges—including higher interest rates, tighter credit conditions, and supply chain disruptions—may make it more difficult for customers to finance or commit to large-scale solar projects, resulting in revenue growth headwinds as project pipelines stall or shrink.

- Despite efforts to expand internationally, Array remains exposed to delays or downturns in key regions, as evidenced by the slowdown in Brazil from currency devaluation, new tariffs, and regulatory instability, as well as the company’s heavy dependence on North American sales, risking revenue concentration and cyclicality as global solar markets become less predictable.

- Increasing competition from both established and emerging domestic and international solar tracker providers could pressure Array’s market share, drive down average selling prices over time, and squeeze gross margins, particularly as customers negotiate more aggressively and technological advances potentially shift preference to alternative solutions, directly impacting long-term profitability and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Array Technologies is $13.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Array Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $156.8 million, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 9.9%.

- Given the current share price of $7.06, the bullish analyst price target of $13.0 is 45.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.