Narratives are currently in beta

Key Takeaways

- Expansion into San Francisco and growth in non-wholesale deposits could enhance revenue and strengthen net interest margins and earnings.

- Strategic shifts toward consumer loans and technological investments aim to improve loan yields, efficiency, and maintain strong returns on equity.

- High concentration of large deposits and reliance on rolling strategies expose Five Star Bancorp to liquidity, interest rate, and credit risks, affecting profitability.

Catalysts

About Five Star Bancorp- Operates as the bank holding company for Five Star Bank that provides a range of banking products and services to small and medium-sized businesses, professionals, and individuals in Northern California.

- Five Star Bancorp's successful expansion into the San Francisco market, including opening a full-service office and hiring additional personnel, is expected to enhance revenue through increased market presence and customer acquisition.

- The growth in non-wholesale deposits, supported by adding new core deposit accounts and relationships, could bolster the bank's net interest margins and earnings by providing a stable funding base at a lower cost.

- Increased consumer loan concentrations, due to purchased consumer loans, indicate a strategic shift that could increase loan yields and net margins, as consumer loans typically carry higher interest rates compared to commercial loans.

- The planned continuation of short-term wholesale deposit strategies positions the bank to benefit from potential interest rate cuts in 2025, which could improve net interest margins by reducing the cost of funding.

- Strategic investments in new technology and personnel are expected to drive future growth and operational efficiency, potentially enhancing net income and maintaining strong returns on equity.

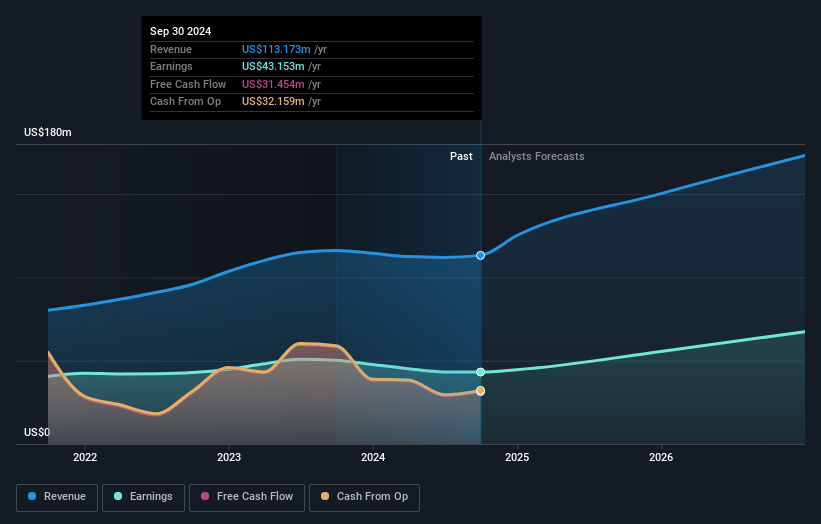

Five Star Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Five Star Bancorp's revenue will grow by 20.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 38.3% today to 39.3% in 3 years time.

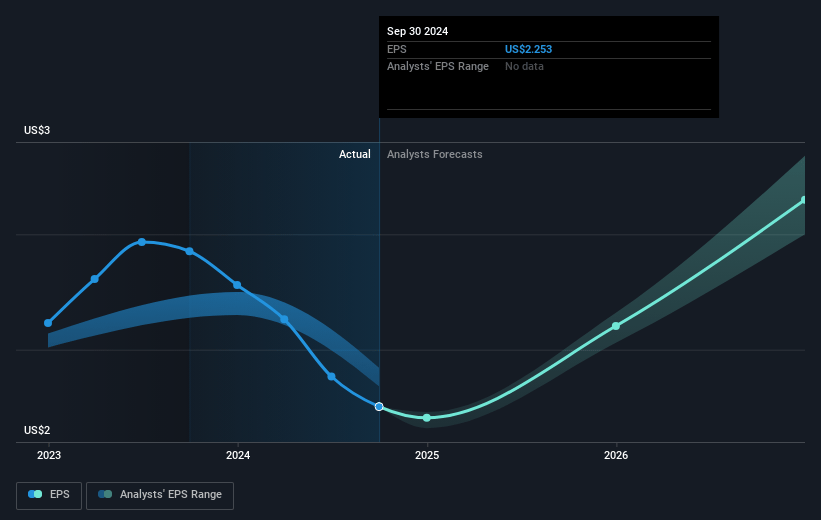

- Analysts expect earnings to reach $81.0 million (and earnings per share of $3.69) by about January 2028, up from $45.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.5x on those 2028 earnings, down from 14.3x today. This future PE is lower than the current PE for the US Banks industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Five Star Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The concentration of deposit accounts with balances greater than $5 million, which represent 61.13% of total deposits, suggests a potential risk if a significant number of these large accounts decide to withdraw or move their funds, impacting deposit stability and liquidity.

- The reliance on a rolling 3-month strategy for wholesale deposits exposes the company to interest rate risks and potential increases in funding costs, which could affect the net interest margin and profitability.

- The increase in substandard or doubtful loans, from $1.9 million to $2.6 million, may indicate rising credit risk and potential loan loss provisions, negatively impacting net earnings.

- The decrease in the commercial real estate concentration from 86.76% to 80.75% could imply a reduction in traditionally higher-yielding assets, potentially affecting overall loan yields and net interest income.

- The noted decline in noninterest-bearing deposits, from 27.46% to 25.93%, suggests a shift toward higher costing funding methods, which could put further pressure on the bank's cost of funds and net interest margin.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $37.33 for Five Star Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $205.8 million, earnings will come to $81.0 million, and it would be trading on a PE ratio of 11.5x, assuming you use a discount rate of 5.9%.

- Given the current share price of $30.72, the analyst's price target of $37.33 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives