Key Takeaways

- Strategic leadership changes, innovation, and product diversification position Winnebago for rapid margin and revenue growth, overcoming cyclical and operational headwinds.

- Early investment in premium segments and strong market positioning provide long-term growth drivers and the opportunity to capture share as competitors struggle.

- Demographic shifts, operational challenges, regulatory pressures, economic sensitivity, and geographic concentration threaten Winnebago's long-term revenue growth, profitability, and earnings stability.

Catalysts

About Winnebago Industries- Manufactures and sells recreation vehicles and marine products primarily for use in leisure travel and outdoor recreation activities.

- Analyst consensus expects operational improvements and margin recapture to only slowly materialize, but the company's aggressive leadership changes, comprehensive business transformation, and sharper production discipline could enable a much faster-than-expected rebound in working capital efficiency and net margin expansion by fiscal 2026.

- Analysts broadly agree that product innovation and affordability will help revenue growth, but the accelerated pace and quality of new launches across both RVs and marine (such as Thrive, Grand Design Lineage, and Barletta's refreshed offerings) are likely to rapidly expand Winnebago's customer base among younger and first-time buyers, which could drive sustained double-digit top-line growth and significant market share gains.

- Winnebago's outperformance in the marine segment-marked by Barletta and Chris-Craft delivering higher unit volumes and increasing share in a challenged market-demonstrates that strategic diversification is not only offsetting RV cyclicality but has the potential to drive company-wide revenue and EBITDA growth even before broader industry recovery.

- The normalization of remote work and on-the-road living is creating a much larger addressable market for premium RVs and adventure vans; Winnebago's early investments and brand strength in this space give it a long run advantage in capturing highly profitable, experience-driven demand, providing a durable growth engine for both revenue and margins.

- Industry consolidation and rationalization in the face of challenging macro conditions will leave Winnebago, with its disciplined inventory strategy and advantaged financial position, well-placed to capture outsized share as weaker competitors exit, supporting both higher long-term margins and a structural step-up in earnings power.

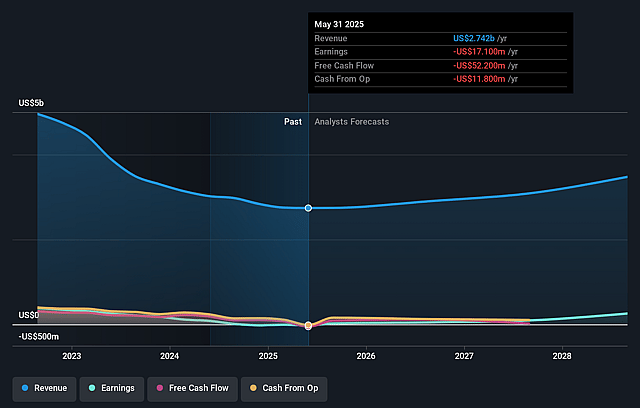

Winnebago Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Winnebago Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Winnebago Industries's revenue will grow by 8.2% annually over the next 3 years.

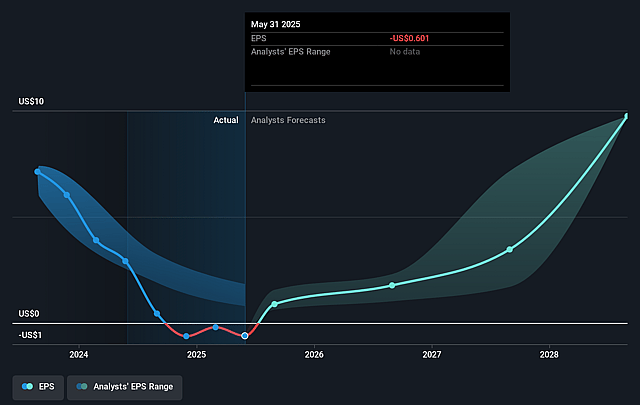

- The bullish analysts assume that profit margins will increase from -0.6% today to 7.4% in 3 years time.

- The bullish analysts expect earnings to reach $258.4 million (and earnings per share of $9.75) by about September 2028, up from $-17.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, up from -57.8x today. This future PE is lower than the current PE for the US Auto industry at 18.6x.

- Analysts expect the number of shares outstanding to decline by 3.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Winnebago Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- An aging U.S. population and shifting demographics toward urbanization are contributing to a shrinking base of new, younger RV consumers, which could drive a structural, secular decline in long-term demand for Winnebago's core products and negatively impact future revenue growth.

- Winnebago faces operational challenges in its core Motorhome business, including persistent margin declines driven by higher than historical discounting, field inventory issues, and slow response to changing consumer preferences, jeopardizing improvement in net margins and longer-term profitability.

- The rapid emergence of stricter environmental regulations and rising consumer demand for sustainable, low-emission vehicles puts pressure on Winnebago's legacy gasoline and diesel-powered lineup, likely requiring significant investment and increasing costs, which would depress net margins and dilute earnings if not addressed proactively.

- The company's cyclical business model tied to discretionary income makes it especially vulnerable to economic downturns and higher interest rates, as evidenced by near-term soft retail and wholesale RV demand, risking material contractions in revenue and earnings during periods of prolonged weak consumer sentiment.

- Heavy dependence on North American markets, with limited international diversification, exposes Winnebago to region-specific economic shocks and regulatory risks, creating increased volatility in earnings and limiting future revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Winnebago Industries is $61.91, which represents two standard deviations above the consensus price target of $38.08. This valuation is based on what can be assumed as the expectations of Winnebago Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.5 billion, earnings will come to $258.4 million, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 12.3%.

- Given the current share price of $35.24, the bullish analyst price target of $61.91 is 43.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Winnebago Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.