Key Takeaways

- Ongoing economic pressures and industry headwinds are constraining RV demand and profitability, despite favorable demographic trends and shifts toward experiential spending.

- Execution risks from acquisitions, innovation challenges, and regulatory and competitive pressures threaten earnings recovery and long-term growth prospects.

- Prolonged demand weakness, operational challenges, tariff impacts, and competitive pressures threaten profitability, cash flow, and market share in a changing recreational vehicle landscape.

Catalysts

About Winnebago Industries- Manufactures and sells recreation vehicles and marine products primarily for use in leisure travel and outdoor recreation activities.

- While the trend of increased remote work and anywhere living continues to expand the market for RVs and supports future revenue potential, persistent macroeconomic headwinds, including higher borrowing costs and pressured consumer discretionary spending, are likely to constrain actual demand growth and keep unit sales below long-term potential, putting ongoing pressure on both revenue and net margins.

- Although an aging, affluent Baby Boomer and Gen X population suggests solid underlying long-term demand for outdoor lifestyle products, industry data shows RV retail sales have declined for multiple consecutive months, and with continued dealer destocking-especially in motorhomes-Winnebago faces a prolonged period of suboptimal capacity utilization and lower profitability.

- Despite ongoing investment in product innovation (such as more affordable models and expanded luxury lineups), integration risks from multiple acquisitions and the need to rapidly refresh underperforming business segments (notably Winnebago-branded Motorhomes) could dilute brand value and result in execution missteps, further depressing net earnings in the near to medium term.

- While industry advances like electrification and smart technology integration hold significant promise for catalyzing new replacement cycles and capturing younger demographic interest, Winnebago's ability to fully capitalize is limited by supply chain disruptions, higher input costs-exacerbated by tariffs-and the speed at which competitive, global entrants bring next-generation products to market, potentially compressing future margins.

- Although there is an ongoing shift toward experiential spending and rising market share in several segments, tightening credit conditions, mounting regulatory and environmental pressures on combustion vehicles, and underutilization of manufacturing assets from sustained inventory discipline could prolong earnings recoveries and increase the risk of stagnant top-line growth through at least fiscal 2026.

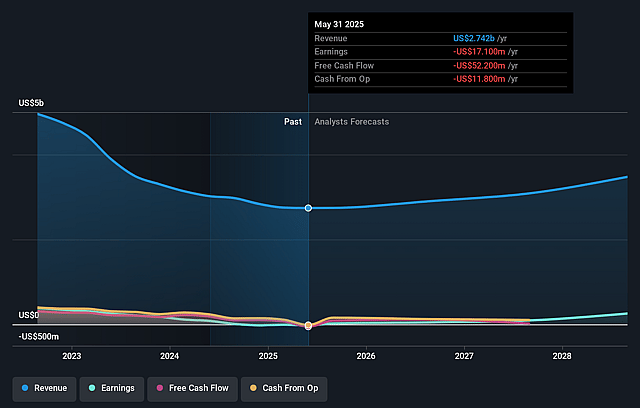

Winnebago Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Winnebago Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Winnebago Industries's revenue will grow by 4.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.6% today to 2.1% in 3 years time.

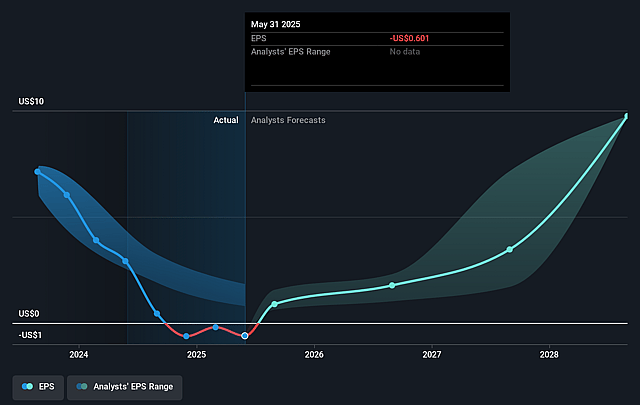

- The bearish analysts expect earnings to reach $64.5 million (and earnings per share of $2.34) by about July 2028, up from $-17.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, up from -52.1x today. This future PE is greater than the current PE for the US Auto industry at 14.9x.

- Analysts expect the number of shares outstanding to decline by 3.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Winnebago Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained weakness in consumer demand for RVs and boats, evident from three consecutive months of North America RV retail sales declining by over eight percent, could indicate a secular decline in the addressable market, which would negatively impact long-term revenues and earnings.

- The Winnebago-branded Motorhome business continues to struggle with operational inefficiencies, excess inventory, and a need for deep discounting to move units, leading to lower margins and working capital challenges, which, if unresolved, could suppress net margins and cash flow over the long run.

- New and ongoing tariff pressures, with an unresolved projected cost impact of fifty to seventy-five cents per share on diluted earnings in fiscal 2026, combined with difficulty in fully offsetting these costs via price increases amid a weak consumer environment, pose risks to long-term profitability and earnings per share.

- Heavy reliance on discretionary spending means macroeconomic uncertainty, higher borrowing costs, and potential tightening of consumer credit could further depress demand for big-ticket items like RVs, leaving Winnebago vulnerable to revenue volatility, excess inventory, and suppressed operating earnings through economic cycles.

- Competitive discounting across the industry, elevated field inventories from peers, and risks that Winnebago may be slow to adapt its legacy Winnebago-branded Motorhome lineup to affordability or innovation trends could lead to market share attrition, margin compression, and stagnation of revenue growth, particularly as emerging competitors focus aggressively on electric, affordable, or modular RV offerings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Winnebago Industries is $30.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Winnebago Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.1 billion, earnings will come to $64.5 million, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 11.6%.

- Given the current share price of $31.8, the bearish analyst price target of $30.0 is 6.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Winnebago Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.