Last Update 06 Dec 25

WGO: Shares Will Rise On Premium Demand Recovery Despite Muted RV Environment

Analysts have modestly raised their price target on Winnebago Industries, lifting it by several dollars into the low $40s per share, citing balanced views on still-muted RV demand, flatter 2026 wholesale expectations, and a fuller near term valuation, offset by conservative earnings guidance and selective optimism on the premium segment.

Analyst Commentary

Street research commentary on Winnebago highlights a mixed but generally balanced stance, with incremental price target increases tempered by ongoing concerns around demand normalization, inventory, and valuation after the recent share price rally.

Bullish Takeaways

- Bullish analysts see the recent price target moves into the mid to low $40s as supported by solid execution and better than expected quarterly results, even against a choppy consumer backdrop.

- Exposure to the premium RV segment is viewed as a structural positive, with potential to outperform lower tier offerings once retail demand stabilizes and higher income buyers reengage.

- Some view management's fiscal 2026 earnings guidance as prudently conservative, creating a setup for upside if demand or pricing proves more resilient than currently discounted.

- Recent industry checks at major RV shows, while muted, still suggest the brand remains competitively positioned for a recovery in higher value units once inventories normalize.

Bearish Takeaways

- Bearish analysts argue the stock's recent rally has compressed forward return potential, with valuation now described as fuller relative to macro uncertainty and still soft consumer confidence.

- Ongoing retail demand weakness and a mix shift toward more affordable, entry level products are seen as limiting near term growth and margin expansion.

- Industry wholesale activity is expected to remain relatively flat into 2026, constraining volume driven upside and reinforcing a more tempered growth trajectory.

- Elevated dealer inventories and muted tone from recent industry events increase the risk that any recovery in demand could be slower and more uneven than the current share price implies.

What's in the News

- Issued fiscal 2026 earnings guidance, targeting consolidated net revenues of $2.75 billion to $2.95 billion and reported EPS of $1.25 to $1.95, reinforcing management's cautious outlook on a gradual demand recovery (Corporate Guidance)

- Completed its August 2022 share repurchase authorization, buying back a total of 2,923,832 shares, or 9.93% of shares outstanding, for $170.09 million, with no additional shares repurchased between June 1 and August 30, 2025 (Buyback Tranche Update)

- Preparing a major product showcase at the Hershey RV Show in September 2025, debuting multiple new models and innovations across Winnebago, Grand Design, and Newmar, with over 120 premium RV models on display and an emphasis on high tech, higher end offerings (Product Related Announcements)

- Highlighting updated Winnebago motorized and towable lines, including refreshed View/Navion and Travato camper vans, new Thrive laminated towables, and redesigned Access and Micro Minnie travel trailers that target consumers seeking more features and modern design at premium price points (Product Related Announcements)

- Showcasing Grand Design's innovative 2026 lineup, including the Lineage motorhome series and Momentum toy haulers with advanced comfort, energy, and connectivity features, underscoring the company's push into higher value, tech forward RV segments (Product Related Announcements)

Valuation Changes

- Fair Value: Unchanged at approximately $44.17 per share, indicating no shift in the intrinsic value estimate.

- Discount Rate: Fallen slightly from 12.50% to about 12.45%, reflecting a marginally lower assumed risk profile.

- Revenue Growth: Effectively unchanged, holding near 5.41% annually and signaling stable long term top line expectations.

- Net Profit Margin: Essentially flat, remaining around 5.21% and suggesting no material revision to profitability assumptions.

- Future P/E: Edged down slightly from roughly 9.95x to 9.93x and implying a minimally lower valuation multiple on forward earnings.

Key Takeaways

- Strategic product innovations and lineup expansion across brands aim to enhance market share, revenue growth, and customer relationships in diverse segments.

- Tri-brand strategy in motorhomes and Barletta's channel expansion could mitigate risks and drive profit through market diversification and increased margins.

- Growing macroeconomic uncertainty, inflationary pressures, and increased competition could impact Winnebago's revenues, margins, and market share amidst soft retail conditions and cautious consumer demand.

Catalysts

About Winnebago Industries- Manufactures and sells recreation vehicles and marine products primarily for use in leisure travel and outdoor recreation activities.

- The successful launch and ramp-up of the Grand Design Motorhome Lineage lineup, including new models like the Series M Class C, Series F Super C Coach, and Series VT Class B, is expected to boost future revenues and market share in the motorized RV segment.

- The strategic transformation of Winnebago Towables under new leadership, with a focus on innovative pricing and product strategies, aims to increase market share and drive revenue growth in the competitive towables market.

- The development of new product offerings such as the Newmar Summit Aire and the expansion of Newmar's model year 2026 lineup are expected to strengthen dealer relationships, broaden the customer base, and enhance revenue growth.

- A tri-brand strategy in the motorhome sector (Winnebago, Grand Design, and Newmar) to cater to distinct market segments may mitigate risk and unlock potential for greater margin expansion and revenue diversification.

- Barletta's strategic channel expansion and innovative new model introductions are positioned to leverage its growing U.S. pontoon market share, which should positively impact revenue and profitability.

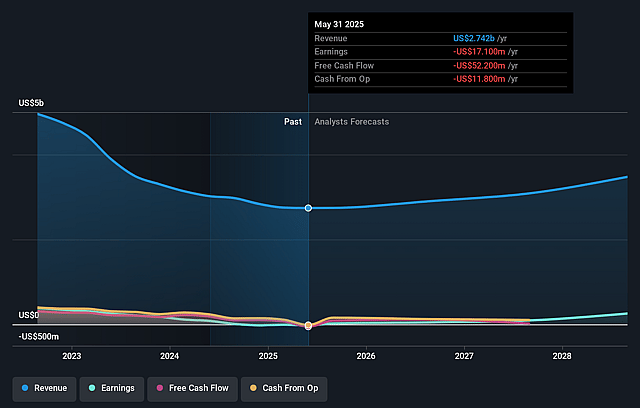

Winnebago Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Winnebago Industries's revenue will grow by 7.2% annually over the next 3 years.

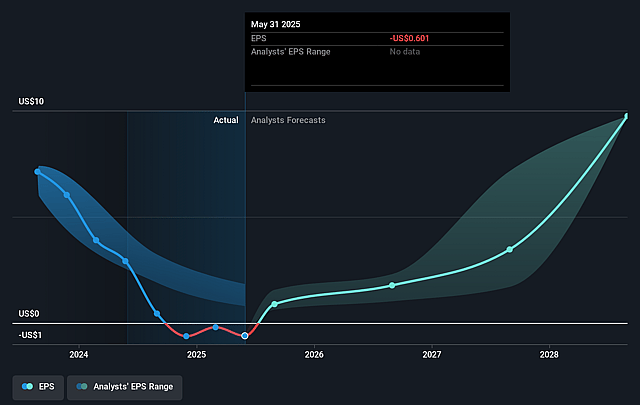

- Analysts assume that profit margins will increase from -0.6% today to 6.4% in 3 years time.

- Analysts expect earnings to reach $217.6 million (and earnings per share of $8.17) by about September 2028, up from $-17.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.2x on those 2028 earnings, up from -57.8x today. This future PE is lower than the current PE for the US Auto industry at 18.6x.

- Analysts expect the number of shares outstanding to decline by 3.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Winnebago Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing macroeconomic uncertainty and soft retail conditions present a challenging sales environment for Winnebago, potentially impacting future revenues and earnings.

- Expected tariffs and inflationary pressures may affect product costs and consumer purchasing power, potentially leading to reduced revenue and compressed net margins.

- Dealers are maintaining leaner inventory levels due to higher carrying costs and cautious consumer demand, which could limit revenue growth if market conditions do not improve.

- A decrease in adjusted EPS guidance reflects lowered consumer confidence and sentiment, suggesting potential impacts on profitability and earnings.

- Increased competition and elevated discounting, particularly in the motorhome segment, could pressure Winnebago’s market share and margins if pricing and inventory strategies are not effectively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.083 for Winnebago Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $217.6 million, and it would be trading on a PE ratio of 6.2x, assuming you use a discount rate of 12.3%.

- Given the current share price of $35.24, the analyst price target of $38.08 is 7.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Winnebago Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.