Key Takeaways

- Rapid expansion of the G5 Store, enhanced game engagement, and strategic user acquisition are expected to significantly boost profitability and drive sustainable revenue growth.

- Strong financial health and content strategy position G5 to benefit from global digital trends, ensuring stability, higher user value, and greater shareholder returns.

- Over-reliance on a narrow game portfolio, rising acquisition costs, and stricter data regulations threaten both user monetization and long-term revenue stability.

Catalysts

About G5 Entertainment- Develops and publishes free-to-play games for smartphones, tablets, and personal computers in Sweden.

- Analysts broadly agree that the G5 Store's rapid growth will drive gross margin expansion, but given current 40 percent year-over-year growth and the imminent addition of third-party titles, the Store could surpass half of total revenue within a few years, potentially boosting group gross margin by several hundred basis points and transforming profitability.

- While analyst consensus views improvements in Sherlock and Twilight Land as positive for engagement and monetization, the ongoing optimization of user acquisition combined with G5's proprietary analytics and tighter integration between game mechanics and acquisition channels could unlock a new era of high-value, long-retention users, fueling sustained top-line outperformance and significant ARPU gains.

- G5 is uniquely positioned to capitalize on the rapidly expanding global smartphone user base and increasing digital payments adoption, enabling explosive user growth and microtransaction volume, particularly in untapped emerging markets, which can drive both accelerating revenue and improved cash flows.

- The company's evergreen portfolio strategy, regular content updates, and long game lifecycles cater to aging populations that are increasingly drawn to casual and puzzle games, supporting industry-leading retention, reducing churn, and growing lifetime user value, resulting in more predictable, recurring revenues and greater earnings stability.

- With a pristine balance sheet, strong cash flow generation, and aggressive share buybacks in motion, G5 Entertainment has the capital strength to execute value-accretive M&A or invest heavily in new tech and content, paving the way for outsized EPS growth and further enhancing shareholder returns.

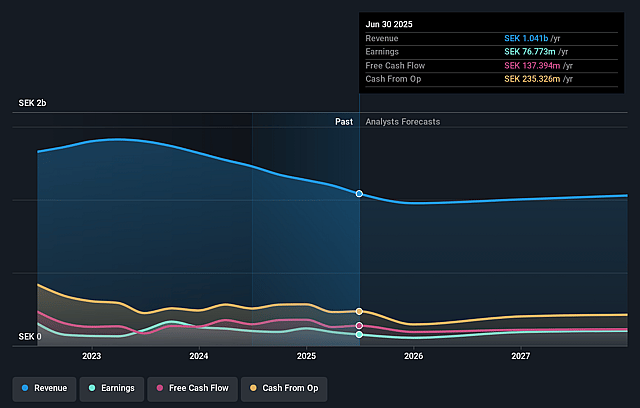

G5 Entertainment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on G5 Entertainment compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming G5 Entertainment's revenue will decrease by 0.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.4% today to 10.5% in 3 years time.

- The bullish analysts expect earnings to reach SEK 111.3 million (and earnings per share of SEK 14.33) by about September 2028, up from SEK 76.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, up from 9.2x today. This future PE is lower than the current PE for the GB Entertainment industry at 19.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

G5 Entertainment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Exposure to stricter data privacy regulations and changes in digital advertising policies, such as Apple's App Tracking Transparency, may significantly hamper the effectiveness of user acquisition campaigns and reduce user monetization, likely constraining both top line revenue growth and net margins.

- The persistent decline in annual revenue-in this case, an 11 percent year-over-year drop in revenue measured in US dollars-signals a risk that the company is struggling to offset market saturation and rising user acquisition costs, which puts long-term revenue and earnings trajectories under pressure.

- Heavy dependence on a limited portfolio centered around hidden object and casual puzzle games, without evidence of breakout new titles or diversified genre expansion, increases the risk that shifting player preferences and market fragmentation will erode G5 Entertainment's market share and suppress future revenue growth.

- The company's increasing reliance on a shrinking but higher-paying user base, combined with a user acquisition system that delivers fewer total users but at higher cost, exposes G5 Entertainment to the risk of sudden revenue volatility if top-spending players churn, while rising acquisition costs threaten net earnings.

- Deliberately slow expansion of the game pipeline-averaging only one to two global releases per year and highly gradual rollouts of new third-party content on the G5 Store-may limit the company's ability to capitalize on industry trends like generative AI and free-to-play innovation, potentially undermining gross margin improvements and restricting earnings growth as larger players accelerate their cadence and take share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for G5 Entertainment is SEK240.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of G5 Entertainment's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK240.0, and the most bearish reporting a price target of just SEK135.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK1.1 billion, earnings will come to SEK111.3 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 6.9%.

- Given the current share price of SEK90.5, the bullish analyst price target of SEK240.0 is 62.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.