Key Takeaways

- Direct distribution via the G5 Store drives margin expansion and revenue growth, with future platform potential from third-party developer participation.

- Strategic focus on user acquisition efficiency and new game launches boosts profitability and reduces dependence on older titles.

- Heavy dependence on a few hit games, rising user acquisition costs, currency risks, and slow release cycles threaten growth, profitability, and adaptability in a shifting market.

Catalysts

About G5 Entertainment- Develops and publishes free-to-play games for smartphones, tablets, and personal computers in Sweden.

- Rapid growth and scaling of the G5 Store-now at 23% of net revenue and still expanding at nearly 40% YoY-allows G5 to bypass high third-party platform fees, directly increasing gross margins and creating a durable profitability catalyst as more users shift to direct distribution channels. This supports both top-line growth and ongoing margin expansion.

- Upcoming ability for third-party developers to distribute their games on G5 Store could turn the store into a broader platform, adding incremental revenue streams and accelerating the store's scale benefits, which will positively impact overall revenue growth and earnings leverage in future quarters.

- Improved in-house user acquisition efficiency (expanding UA channels, optimizing spend towards high-value users, and tailoring game mechanics for better monetization) allows for stable or rising revenues with fewer, but more profitable, customers-supporting a sustainable increase in net margins as average gross revenue per paying user hits new records.

- Launch of new proprietary titles such as Twilight Land-combined with a disciplined, iterative approach to development and live-ops-positions G5 to capture more value from the expanding global mobile/tablet gaming market, contributing to future revenue acceleration and reducing reliance on legacy titles.

- G5's strong cash position (SEK 247m, debt-free) and robust cash flows provide investment flexibility to capitalize on future industry growth drivers, including possible M&A, platform partnerships, or expanded content offerings, supporting long-term revenue growth and the durability of net earnings.

G5 Entertainment Future Earnings and Revenue Growth

Assumptions

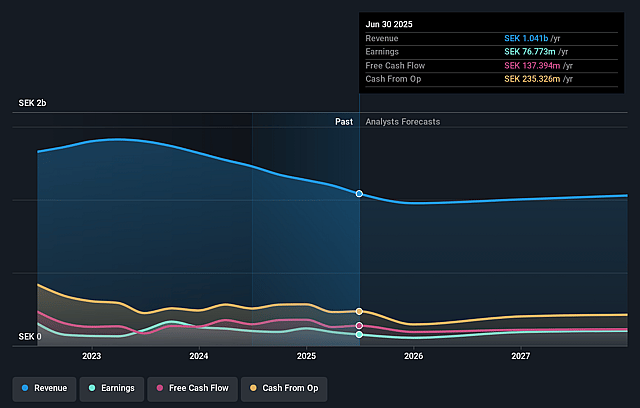

How have these above catalysts been quantified?- Analysts are assuming G5 Entertainment's revenue will decrease by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 11.1% in 3 years time.

- Analysts expect earnings to reach SEK 108.7 million (and earnings per share of SEK 12.65) by about September 2028, up from SEK 76.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.7x on those 2028 earnings, up from 9.0x today. This future PE is lower than the current PE for the GB Entertainment industry at 22.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.87%, as per the Simply Wall St company report.

G5 Entertainment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a concentrated group of top-performing titles (e.g., Sherlock, Jewels family) exposes G5 to the risk of revenue stagnation or decline if consumer interest wanes or the hidden object/puzzle genre loses favor, potentially impacting long-term revenue growth and earnings stability.

- Declining organic user acquisition and increased dependence on paid user acquisition may drive up user acquisition costs over time, especially as competition intensifies and privacy regulations (such as GDPR and Apple's ATT) limit targeting, potentially compressing net margins and reducing return on marketing investments.

- The gradual, rather than explosive, growth expected from the G5 Store's third-party distribution strategy could limit top-line acceleration, and if integration or market fit is slower than expected, G5 may not achieve anticipated revenue or margin uplifts in the near to mid-term.

- Currency volatility and the need to revalue substantial USD-denominated assets and revenues into SEK introduce ongoing risks for earnings and EBIT margin, as evidenced by marked negative FX impacts this quarter; continued SEK strengthening could further erode reported profits.

- Slow pace of global game launches (targeting only 1–2 new global releases per year) and lengthy, iterative development cycles increase the risk that G5's game portfolio may not keep pace with changing consumer preferences or innovation cycles, potentially restraining long-term revenue growth and competitive positioning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK187.5 for G5 Entertainment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK240.0, and the most bearish reporting a price target of just SEK135.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK982.6 million, earnings will come to SEK108.7 million, and it would be trading on a PE ratio of 14.7x, assuming you use a discount rate of 6.9%.

- Given the current share price of SEK88.7, the analyst price target of SEK187.5 is 52.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on G5 Entertainment?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.