Key Takeaways

- Strategic pivot towards asset-light, high-margin businesses and portfolio realignment enhances profitability, earnings stability, and reduces exposure to economic cycles.

- Digitalization, sustainability trends, and structural M&A provide robust growth drivers, elevating recurring revenue, pricing power, and enabling flexible reinvestment for long-term value creation.

- Exposure to cyclical sectors, currency headwinds, and regulatory pressures may constrain Ratos's earnings growth despite operational improvements and targeted acquisitions.

Catalysts

About Ratos- A private equity firm specializing in buyouts, turnarounds, add on acquisitions, and middle market transactions.

- Analysts broadly agree the Knightec and Semcon merger will generate substantial cost synergies and efficiency, but this likely substantially underestimates upside from the long-term digitalization trend across industries, which should create outsized recurring revenue and margin expansion as demand for digital consultancy accelerates and utilization rates remain high.

- The consensus expects restructuring of Plantasjen to improve profitability, but this overlooks the transformational shift towards a far more capital-light, resilient business model that can drive sustained EBITA margin outperformance, especially as Plantasjen leverages its leadership in the attractive Nordics market and rising consumer preference for sustainability-focused retailers.

- Ratos's strategic focus on high-margin, asset-light businesses positions the group to structurally increase net margins and earnings stability, further supported by ongoing portfolio realignment that reduces cyclicality and elevates group-wide profitability in all market cycles.

- Robust organic growth in critical infrastructure and industrial services, amplified by bolt-on M&A in resilient, future-proof sectors, provides a platform for compounded revenue growth and risk diversification, with enhanced pricing power as supply-demand imbalances in infrastructure and ESG-focused markets persist.

- Ratos's strong balance sheet, high cash conversion, and potential monetization of its substantial Sentia stake provide significant financial flexibility, enabling accelerated reinvestment into high-growth, ESG-aligned assets or opportunistic share buybacks, which should drive outsized EPS growth and further support valuation re-rating.

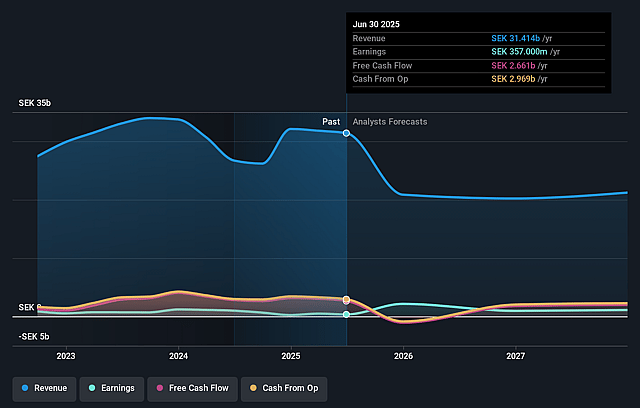

Ratos Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ratos compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ratos's revenue will decrease by 14.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.1% today to 6.6% in 3 years time.

- The bullish analysts expect earnings to reach SEK 1.3 billion (and earnings per share of SEK 3.95) by about August 2028, up from SEK 357.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, down from 32.4x today. This future PE is lower than the current PE for the GB Capital Markets industry at 26.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.98%, as per the Simply Wall St company report.

Ratos Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ratos is still exposed to cyclical sectors such as industrials and infrastructure, with management explicitly noting that certain business areas like Industrial Services and Product Solutions have seen weaker results or flat organic growth in part due to subdued end markets and working day effects, which could result in ongoing revenue volatility and pressure on net margins during economic downturns.

- Persistent macroeconomic uncertainties in Europe, including slow biotech markets and weaker consumer demand linked to unpredictable weather, have led to declines in sales and EBITA in key portfolio companies such as Plantasjen and TFS, suggesting that sluggish growth across core regions may constrain the group's ability to sustainably grow earnings over the long term.

- Currency impacts, specifically the strengthening of the Swedish krona against the Norwegian krone, have already had a material negative impact on both sales and profit margins this quarter, and ongoing currency volatility could further erode group-level earnings, especially given Ratos's pan-Nordic exposure and concentration in affected currencies.

- Despite operational improvements and divestments aimed at lowering financial leverage, the adjusted net debt to EBITDA ratio has increased to 1.7 from 1.2 year-over-year post-disposals, which, combined with rising interest rates, could make future financing more expensive and weigh on net income if profitability is not consistently improved through operational measures.

- The company's focus on bolt-on M&A to drive growth in its stable segments comes amid an increasingly competitive private equity environment and greater regulatory scrutiny on ESG, which could lead to higher acquisition multiples, limited investment universe, and increased compliance costs, ultimately reducing achievable returns and pressures on return on equity over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ratos is SEK41.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ratos's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK19.6 billion, earnings will come to SEK1.3 billion, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of SEK35.32, the bullish analyst price target of SEK41.0 is 13.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.