Key Takeaways

- Portfolio repositioning and capital discipline offer growth promise, but exposure to cyclical sectors and regulatory costs threaten earnings stability and profitability.

- Digitalization and infrastructure investments drive future potential, while demographic shifts and technological disruption risk undermining long-term growth and margins.

- Margin pressures, low organic growth, external risk exposures, and reduced diversification threaten long-term revenue stability and earnings resilience for Ratos.

Catalysts

About Ratos- A private equity firm specializing in buyouts, turnarounds, add on acquisitions, and middle market transactions.

- Although Ratos is strategically repositioning its portfolio towards majority-owned, cash-generative Nordic companies that should, over time, produce more predictable earnings and improved net margins, the company is still affected by a concentration in mature and cyclical industries, which makes revenue and earnings particularly vulnerable to economic slowdowns and sector-specific downturns.

- While increased infrastructure investment across Europe, particularly in sustainability and modernization, supports stronger organic growth and future revenue potential in Ratos's infrastructure-related portfolio, ongoing aging demographics and sluggish economic growth in Scandinavia and broader Europe may limit the overall demand and cut into long-term growth opportunities for its underlying businesses.

- Even though enhanced capital allocation discipline-demonstrated by timely divestitures (Sentia, airteam) and retained financial flexibility-should support improved returns on equity, heightened regulatory scrutiny and accelerating compliance costs in Europe risk raising operational expenses and reducing future profitability, particularly as ESG standards become more demanding for investment holding companies.

- In spite of accelerating digitalization trends that present long-term tailwinds for engineering and technology-enabled segments like Knightec and their integration synergies, there is a risk that traditional business models within other parts of Ratos's portfolio could be outpaced by technological advancements, resulting in margin pressures and potential obsolescence if not continuously addressed at the operational level.

- While the broad industry trend of consolidation in Nordic alternative investments could allow Ratos to benefit from bolt-on acquisitions at attractive valuations-potentially boosting long-term top-line and bottom-line growth-a persistent contraction in the listed investment company premium and the growing dominance of passive vehicles are likely to keep the share trading at a discount to net asset value, hindering share price appreciation and capital raising over the long run.

Ratos Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ratos compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

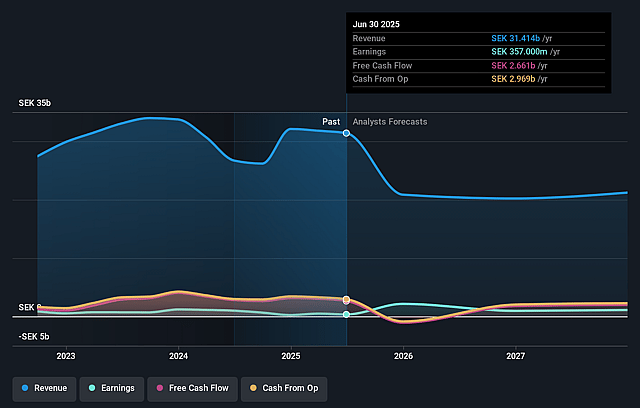

- The bearish analysts are assuming Ratos's revenue will decrease by 15.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.1% today to 5.1% in 3 years time.

- The bearish analysts expect earnings to reach SEK 976.5 million (and earnings per share of SEK 2.98) by about August 2028, up from SEK 357.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, down from 32.4x today. This future PE is lower than the current PE for the GB Capital Markets industry at 26.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.98%, as per the Simply Wall St company report.

Ratos Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued challenges in key portfolio segments, including slow biotech markets in Industrial Services and margin dilution from currency effects in Aibel, raise concerns about the revenue growth and earnings stability of Ratos's core businesses over the long term.

- The company's organic growth remains modest at only 1.3 percent, and much of the structural improvement in profits is the result of significant store closures and divestments rather than underlying demand expansion, which may limit sustainable top-line growth and eventually hurt net revenues.

- Exposure to weather conditions and macroeconomic uncertainty, as seen with Plantasjen's performance being dragged down by unexpected cold weather in Norway, demonstrates vulnerability to uncontrollable external factors, increasing the risk of future fluctuations in earnings and margins.

- There is persistent foreign exchange risk due to Ratos's geographic diversification, illustrated by the negative impact of a strengthening SEK against the Norwegian Krone, directly reducing consolidated group revenues and operating margins.

- The strategy of divesting consumer segments and streamlining towards infrastructure and industry could lead to increased portfolio concentration and reduce diversification, which may heighten sensitivity to sector-specific downturns and negatively affect long-term earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ratos is SEK38.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ratos's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK19.2 billion, earnings will come to SEK976.5 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 8.0%.

- Given the current share price of SEK35.32, the bearish analyst price target of SEK38.0 is 7.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.