Key Takeaways

- Strategic focus on sustainable infrastructure and high-growth sectors, supported by acquisitions and operational efficiency, is driving profitability and margin expansion.

- Stable demand for core services and portfolio streamlining are delivering recurring revenue, improved earnings quality, and sustainable long-term growth.

- Currency volatility, weak core markets, restructuring risks, external dependencies, and rising leverage all threaten margins, earnings stability, and the company's long-term shareholder value.

Catalysts

About Ratos- A private equity firm specializing in buyouts, turnarounds, add on acquisitions, and middle market transactions.

- Accelerated shift towards sustainable and energy-efficient solutions, especially in construction and energy services, is increasing demand and expanding project backlogs for Ratos' critical infrastructure holdings (supports future revenue growth).

- Massive long-term investments required to upgrade and maintain aging European infrastructure are driving stable demand for Ratos' services in construction, maintenance, and industrial segments (favors stable, recurring cash flows and revenue).

- Ongoing portfolio streamlining toward more profitable sectors and deliberate exit from lower-performing or volatile businesses are improving earnings quality and supporting higher net margins.

- Active bolt-on acquisition strategy within stable, high-growth platforms is generating operational synergies and scale benefits, underpinning EBITDA margin expansion and longer-term topline growth.

- Implementation of operational excellence and cost efficiency programs across the group is boosting profitability, enhancing return on capital employed (ROCE), and supporting sustainable EPS growth.

Ratos Future Earnings and Revenue Growth

Assumptions

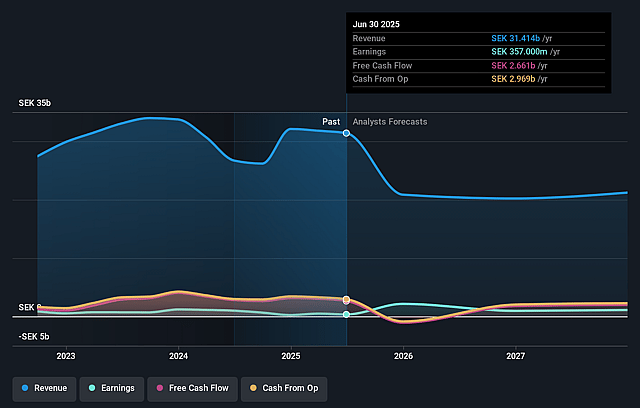

How have these above catalysts been quantified?- Analysts are assuming Ratos's revenue will decrease by 17.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.1% today to 6.0% in 3 years time.

- Analysts expect earnings to reach SEK 1.1 billion (and earnings per share of SEK 3.39) by about September 2028, up from SEK 357.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK1.3 billion in earnings, and the most bearish expecting SEK958 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, down from 31.7x today. This future PE is lower than the current PE for the GB Capital Markets industry at 24.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.99%, as per the Simply Wall St company report.

Ratos Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Exposure to currency volatility, particularly the strengthening of the Swedish Krona against the Norwegian Krone, has negatively impacted margins and sales; persistent FX headwinds could continue to erode earnings and dampen revenue growth.

- Continued soft market conditions in core segments like Industrial Services and subdued performance in slowing end-markets such as biotech signal possible stagnation or even decline in underlying organic growth, which could weigh on consolidated revenue and long-term earnings momentum.

- Execution risk from ongoing restructuring, divestments (e.g., airteam, potential future Consumer exits), and reliance on bolt-on acquisitions to drive growth may lead to lower-than-expected synergies or integration challenges, risking lower net margins and future profitability.

- Dependence on external factors such as unpredictable weather (noted in Plantasjen performance) and calendar effects can significantly impact sales and margins for key portfolio businesses, creating earnings volatility and limiting the reliability of margin expansion targets.

- A rise in gearing (leverage up from 1.2 to 1.7) despite claims of a strong balance sheet, combined with the uncertainty around future deployment of proceeds from divested assets, introduces financial risk; if capital is not invested or returned accretively (e.g., unprofitable M&A, delayed buybacks), shareholder value and EPS growth could suffer.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK41.0 for Ratos based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK17.9 billion, earnings will come to SEK1.1 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of SEK34.58, the analyst price target of SEK41.0 is 15.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.