Key Takeaways

- Margin pressure from promotional activity, operational costs, and sustainability investments may constrain profit growth and limit benefits from digital and direct-to-consumer momentum.

- Exposure to climate risks and slow recovery in wholesale channels challenge revenue consistency and top-line growth despite international expansion and brand innovation efforts.

- Heightened competition, sluggish wholesale demand, rising costs, and climate risks threaten KMD Brands' profitability, margin stability, and long-term revenue growth.

Catalysts

About KMD Brands- Designs, markets, wholesales, and retails apparel, footwear, and equipment for surfing and the outdoors under the Kathmandu, Rip Curl, and Oboz brands in New Zealand, Australia, North America, Europe, Southeast Asia, and Brazil.

- While the company is seeing positive momentum in direct-to-consumer and online channels across all brands, persistent pressure on gross margins-especially in the Kathmandu brand due to heavy promotional activity in very competitive Australasian mall environments-poses a significant risk to future earnings and limits the ability to fully capitalize on e-commerce growth.

- Although operational improvements and investments in product innovation and sustainability position KMD Brands well for evolving consumer preferences, the ongoing vulnerability to climate-driven disruptions and unpredictable extreme weather could undermine revenue consistency, particularly for seasonally sensitive outdoor categories.

- The company has made progress diversifying revenue streams with international expansion, especially in North America and Europe, but the slow and uncertain recovery of wholesale sales-amid prolonged caution from wholesale partners and potential trade disruptions-raises concerns about top-line growth and operational leverage moving forward.

- While KMD Brands' focus on omnichannel integration and digital transformation supports customer engagement and conversion rates, deeper cost-efficiency gains are needed as operating expenses remain elevated due to brand investment and store network refreshes, pressuring net margins if sales momentum slows.

- Despite embracing sustainability and holding B Corp certification across all brands, the risk of rising compliance and production costs associated with increased global demand for environmentally responsible sourcing could erode future margin expansion, particularly if fast fashion entrants drive further price competition in outdoor and activewear markets.

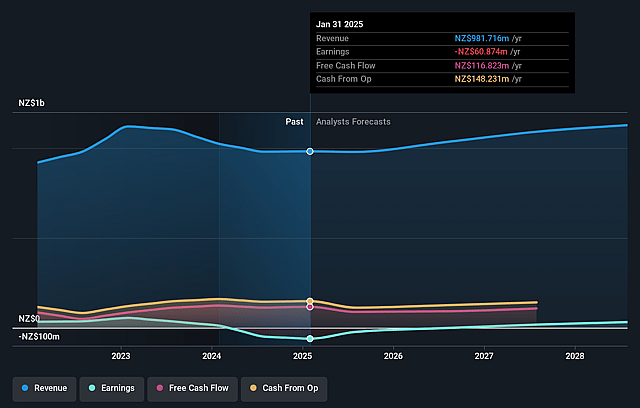

KMD Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on KMD Brands compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming KMD Brands's revenue will grow by 4.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -6.2% today to 2.9% in 3 years time.

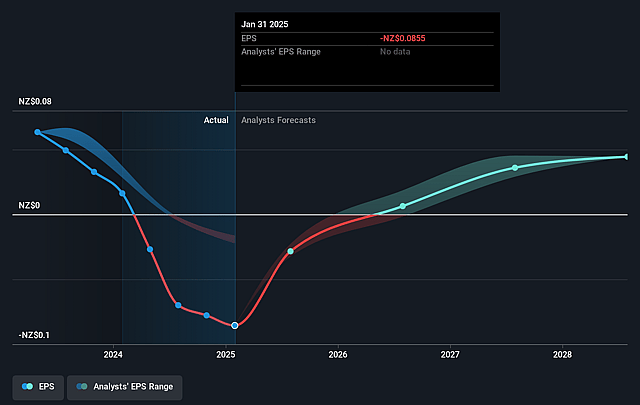

- The bearish analysts expect earnings to reach NZ$32.5 million (and earnings per share of NZ$0.05) by about September 2028, up from NZ$-60.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, up from -2.9x today. This future PE is lower than the current PE for the AU Specialty Retail industry at 15.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.95%, as per the Simply Wall St company report.

KMD Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing promotional intensity and heightened retail competition, particularly for Kathmandu in Australia and New Zealand malls, continue to put downward pressure on gross margins, which may limit future earnings growth and overall profitability.

- The global wholesale channel remains subdued, with buyers cautious amid uncertain macroeconomic and geopolitical conditions, which risks weaker top-line revenue growth and increased earnings volatility across core international markets.

- Elevated operating expenses driven by targeted brand investments and store upgrades persist even as overall sales growth is only modest, adding pressure to net margins and the company's ability to generate consistent free cash flow.

- Climate-related disruptions, such as cyclones and unpredictable seasonal weather shifts, present increasing risks for store operations and inventory management, potentially resulting in revenue loss, further volatility, and stranded assets.

- Intensifying competition in the outdoor and activewear sector-including from fast fashion entrants, discount e-commerce channels, and specialty vertical brands-may erode KMD Brands' market share and restrict the company's ability to grow revenue and sustain gross margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for KMD Brands is NZ$0.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of KMD Brands's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NZ$0.45, and the most bearish reporting a price target of just NZ$0.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be NZ$1.1 billion, earnings will come to NZ$32.5 million, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 11.9%.

- Given the current share price of NZ$0.25, the bearish analyst price target of NZ$0.3 is 16.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.