Key Takeaways

- Accelerating digital and DTC expansion, combined with rising global demand for outdoor brands, positions KMD favorably for increased market share and operating leverage.

- Strong sustainability credentials and improved wholesale momentum are set to enhance brand loyalty, support premium pricing, and boost long-term margin stability.

- Heavy reliance on the Australasian market, rising competition, operational complexity, and climate risks threaten profitability, revenue growth, and long-term market share.

Catalysts

About KMD Brands- Designs, markets, wholesales, and retails apparel, footwear, and equipment for surfing and the outdoors under the Kathmandu, Rip Curl, and Oboz brands in New Zealand, Australia, North America, Europe, Southeast Asia, and Brazil.

- Analysts broadly agree that investments in digital and eCommerce are likely to drive online growth, but the current market may be underestimating the network effects as online penetration accelerates across all three brands, unlocking faster-than-expected global customer acquisition and delivering substantial operating leverage on digital margins.

- Analyst consensus expects international store rollouts to fuel growth, yet the significant competitor retrenchment in North America and Europe gives KMD Brands an unprecedented opportunity to take market share through DTC expansion, which can rapidly increase both revenue and profit margins as the company solidifies its position in key markets.

- The global surge in outdoor recreation and active travel continues to outpace general retail growth, positioning KMD's technical and lifestyle brands to benefit from a structural uplift in demand, potentially supporting revenue acceleration and pricing power well above market expectations.

- KMD Brands' industry-leading sustainability credentials and supply chain transparency, highlighted by initiatives like the carbon capture activewear range and B Corp certification, are likely to command premium pricing and foster greater brand loyalty, enhancing long-term net margins and reducing sales cyclicality.

- Recent improvements in wholesale order books and signs that inventory destocking cycles have bottomed may drive a swift rebound in high-margin wholesale channel sales, offering a powerful tailwind to overall group revenues and earnings as macro and industry headwinds abate.

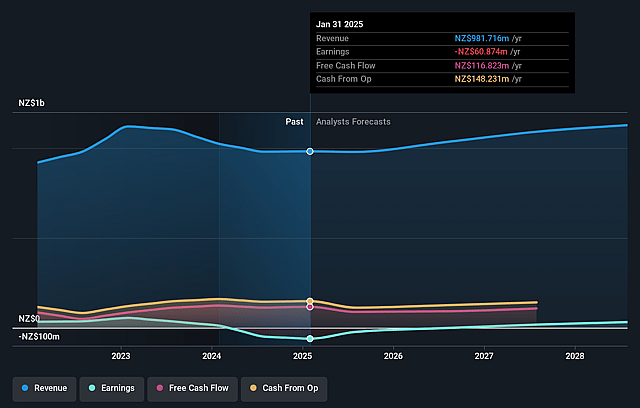

KMD Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on KMD Brands compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming KMD Brands's revenue will grow by 4.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -6.2% today to 2.9% in 3 years time.

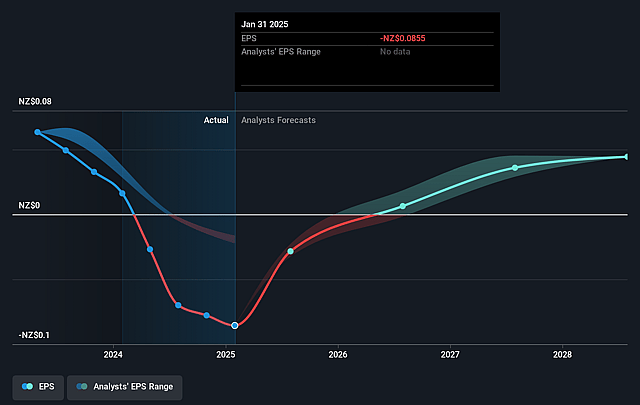

- The bullish analysts expect earnings to reach NZ$32.8 million (and earnings per share of NZ$0.05) by about September 2028, up from NZ$-60.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, up from -3.0x today. This future PE is lower than the current PE for the AU Specialty Retail industry at 15.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.95%, as per the Simply Wall St company report.

KMD Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent pressure on gross margins, especially for Kathmandu, due to heightened promotional activity and heavy competition in Australasian malls, may lead to weaker profitability and compressed net margins over the longer term.

- The company remains highly exposed to macroeconomic risks in Australasia, with over 80% of sales from Australia and limited successful international revenue diversification, leaving future group revenue growth vulnerable to regional downturns or slower consumer spending.

- Increased operational complexity and costs from managing multiple brands and ongoing investment in store refurbishments, advertising, product innovation, and digital upgrades may not be matched by top-line sales growth, threatening future earnings.

- The rapid rise of digital-first and low-cost competitors, as well as shifts in consumer preferences toward experiences over goods and more price-driven purchases online, could erode KMD Brands' market share and put downward pressure on group revenues.

- Climate change and more frequent extreme weather events have already led to lost trading days and could cause further unpredictable supply chain disruptions and cost increases, with additional risks that sustainability compliance may drive up costs and negatively impact net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for KMD Brands is NZ$0.45, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of KMD Brands's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NZ$0.45, and the most bearish reporting a price target of just NZ$0.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NZ$1.1 billion, earnings will come to NZ$32.8 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 11.9%.

- Given the current share price of NZ$0.26, the bullish analyst price target of NZ$0.45 is 43.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.