Key Takeaways

- Strategic fleet expansion and high-value contracts position Höegh Autoliners for strong market share gains and resilient margins despite industry volatility.

- Investments in energy-efficient vessels and capacity align the company for premium pricing, outperforming expectations in sustainability and long-term profitability.

- A diversified portfolio, long-term contracts, strong balance sheet, operational investments, and deep OEM integration position Höegh Autoliners for resilience and stable profitability.

Catalysts

About Höegh Autoliners- Provides ocean transportation services within the roll-on roll-off (RoRo) cargoes on deep sea and short sea markets worldwide.

- Analyst consensus sees the company's strong backlog of long-term contracts as capping upside to revenues, but in reality Höegh Autoliners' ability to negotiate high contract coverage with top automotive OEMs actually locks in disproportionately high volumes and pricing power through supply chain volatility, supporting above-consensus growth and net margin resilience as spot market conditions normalize.

- While many analysts attribute higher charter expenses to a short-term margin headwind, this increased upfront chartering reflects strategic capacity positioning, enabling Höegh Autoliners to capture a coming surge in global automotive shipping tied to EV and hybrid vehicle exports, driving accelerated revenue and earnings expansion once normalization in capacity and trade volumes materializes.

- Global demand for vehicle shipping is set for secular growth, especially as cross-border flows of EVs and hybrids expand and automakers diversify their manufacturing, positioning Höegh Autoliners for sustained revenue growth and improved fleet utilization rates that exceed current market expectations.

- The rollout of Aurora class newbuilds and significant investments in energy-efficient technologies place Höegh Autoliners at the forefront of low-emission shipping, allowing the company to command a premium from customers seeking sustainable transport and thereby meaningfully lifting average earnings and margins over the long-term.

- Industry-wide aging fleets are driving modernization, and with Höegh Autoliners fielding one of the most advanced, dual-fuel, and future-ready vessels, the company is primed to capture outsized market share, supporting higher contract volumes and exceptional long-term cash flow generation.

Höegh Autoliners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Höegh Autoliners compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Höegh Autoliners's revenue will decrease by 0.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 48.0% today to 28.1% in 3 years time.

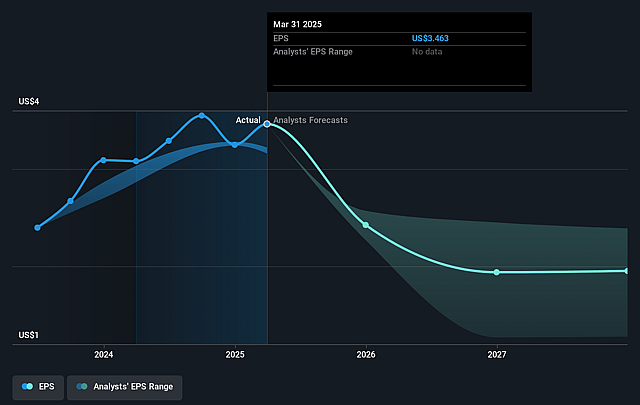

- The bullish analysts expect earnings to reach $375.2 million (and earnings per share of $1.95) by about August 2028, down from $659.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.7x on those 2028 earnings, up from 3.1x today. This future PE is greater than the current PE for the NO Shipping industry at 3.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

Höegh Autoliners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite the risks of tariffs and port fees in the US, Höegh Autoliners has a diversified global portfolio and a strong customer base both inside and outside the United States, which may help support total revenue even if certain markets face temporary trade friction or cost increases.

- The company's robust long-term contract backlog, with an 82% contract share and remaining average duration over three years, creates high revenue visibility and stability, potentially cushioning earnings and profit margins against cyclical volatility or temporary downturns.

- Management has proactively executed a fully financed fleet renewal program and invested in operational efficiency and decarbonization, which may enable lower operating costs and higher competitiveness, supporting both net margins and future cash flow generation.

- The company maintains an exceptionally strong balance sheet with a low net debt to EBITDA ratio and high liquidity reserves, providing the financial resilience to withstand macroeconomic shocks, absorb increased regulatory costs, and continue dividend payments, which underpins shareholder value.

- Höegh Autoliners' direct integration with major automotive OEMs worldwide and its critical role in supply chains indicate it may be less exposed to disintermediation or freight mode substitution, helping to mitigate longer-term risks to revenue from alternative transport modes or changing car demand patterns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Höegh Autoliners is NOK110.05, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Höegh Autoliners's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK110.05, and the most bearish reporting a price target of just NOK65.37.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $375.2 million, and it would be trading on a PE ratio of 6.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of NOK108.9, the bullish analyst price target of NOK110.05 is 1.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.