Key Takeaways

- New U.S. tariffs and fees could increase operational costs, impacting revenue if Höegh Autoliners absorbs or passes them on, affecting demand.

- Prioritizing long-term contracts over spot market gains may limit revenue growth, especially if cargo mix shifts reduce net margins without increased contract volume or rates.

- Höegh Autoliners' stable contract portfolio, financial resilience, and sustainability initiatives position it well against market volatility and future environmental regulations.

Catalysts

About Höegh Autoliners- Provides ocean transportation services within the roll-on roll-off (RoRo) cargoes on deep sea and short sea markets worldwide.

- The imposition of new tariffs and port fees in the U.S. could significantly increase operational costs starting October, potentially leading to reduced revenue as Höegh Autoliners may need to absorb some of these costs or pass them on, affecting demand.

- The strategic decision to prioritize long-term contracts at slightly lower rates in favor of stability over higher short-term gains from the spot market may limit revenue growth potential, especially if spot rates remain lucrative.

- The switch in Höegh Autoliners' cargo mix towards more cars and away from higher-margin break bulk could pressure net margins and earnings if the trend persists without a compensatory increase in contract volume or rates.

- Potential disruptions in U.S. import and export flows due to tariffs could risk important long-term contracts, ultimately affecting revenue stability and earnings if trade patterns alter unfavorably.

- Increases in charter expenses due to newly chartered vessels to meet expected demand could strain short-term cash flow and earnings, especially if anticipated cargo volumes do not materialize due to geopolitical uncertainties.

Höegh Autoliners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Höegh Autoliners's revenue will decrease by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 48.0% today to 22.8% in 3 years time.

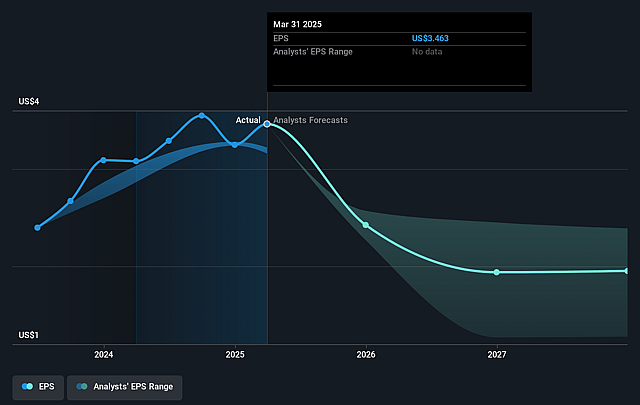

- Analysts expect earnings to reach $281.6 million (and earnings per share of $1.91) by about August 2028, down from $659.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $438 million in earnings, and the most bearish expecting $243.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.9x on those 2028 earnings, up from 3.1x today. This future PE is greater than the current PE for the NO Shipping industry at 3.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

Höegh Autoliners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Höegh Autoliners has a robust contract portfolio with 82% of its cargo rate committed over an average duration of 3.3 years, providing stable and predictable revenue streams, which can mitigate potential market volatility impacts on revenue.

- The company has demonstrated financial resilience, maintaining an equity ratio of 59% and strong cash reserves, which provides a buffer against potential financial shocks, thus supporting stable earnings.

- Despite potential tariff-related disruptions, Höegh Autoliners' long-term relationship with U.S.-based large OEMs and its ability to integrate into logistics chains may allow it to maintain or recover volumes, protecting future revenue.

- Höegh Autoliners' strategic decision to secure larger contracts and expand its contract portfolio at slightly lower rates increases its operational stability and lowers risks associated with spot market fluctuations, potentially stabilizing net margins.

- Successful sustainability initiatives such as reduced carbon intensity and investment in energy-efficient vessels could position the company favorably for cost reductions in the long term and compliance with environmental regulations, positively affecting future financials.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK85.141 for Höegh Autoliners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK94.93, and the most bearish reporting a price target of just NOK65.76.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $281.6 million, and it would be trading on a PE ratio of 6.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of NOK110.4, the analyst price target of NOK85.14 is 29.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.