Key Takeaways

- Fleet decarbonization and tightening environmental rules will raise costs, strain capital, and challenge profitability amid shrinking funding options for carbon-intensive shipping companies.

- Trade tensions, weak shipping demand, and increased geopolitical risks threaten revenue growth and earnings stability through persistently low freight rates and potential market disruptions.

- Strategic focus on stable gas businesses, vehicle transport growth, digital transformation, and clean energy leadership is strengthening earnings stability, margins, and shareholder returns.

Catalysts

About Mitsui O.S.K. Lines- Engages in the marine transportation business worldwide.

- The ongoing global shift toward carbon neutrality and increasingly strict environmental regulations are set to significantly raise compliance costs and require Mitsui O.S.K. Lines to allocate substantial capital for fleet modernization, which will strain free cash flow, limit reinvestment capacity, and compress net margins over the next decade.

- The trend toward regionalization of supply chains and reduced cross-border trade triggered by tariff escalations and heightened trade friction between major economies like the U.S. and China threatens to structurally suppress shipping volumes well below historical trends, directly impacting the company's future revenue base.

- Persistent overcapacity in global shipping, as evidenced by new vessel deliveries even amid softening demand, is likely to keep freight rates depressed for the container, bulk, and tanker segments alike, undermining MOL's ability to sustain profit growth as industry-wide price competition intensifies and asset utilization declines.

- Ongoing and worsening geopolitical instability in key maritime zones such as the Red Sea and the South China Sea raises the risk of chronic trade disruptions, higher insurance premiums, and unreliable schedule integrity, all of which undermine both the stability and predictability of Mitsui O.S.K. Lines' operating earnings.

- The capital-intensive transition to greener fleets, coupled with declining investor appetite for carbon-intensive industries, will make it increasingly difficult and costly for Mitsui O.S.K. Lines to secure long-term, affordable funding in debt and equity markets, resulting in a sustained rise in the company's weighted average cost of capital and a potential decline in future earnings per share.

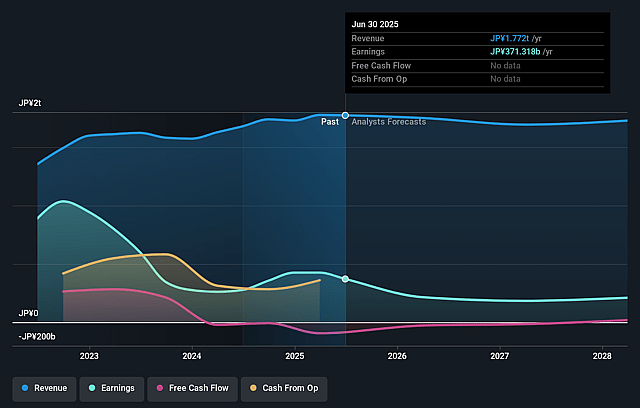

Mitsui O.S.K. Lines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Mitsui O.S.K. Lines compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Mitsui O.S.K. Lines's revenue will decrease by 8.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 21.0% today to 9.6% in 3 years time.

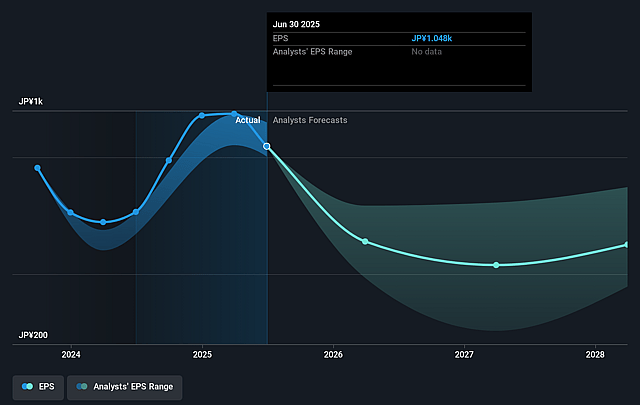

- The bearish analysts expect earnings to reach ¥128.4 billion (and earnings per share of ¥375.81) by about September 2028, down from ¥371.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, up from 4.5x today. This future PE is greater than the current PE for the JP Shipping industry at 6.9x.

- Analysts expect the number of shares outstanding to decline by 4.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

Mitsui O.S.K. Lines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MOL's strategic expansion in the LNG, ethane carrier, and gas infrastructure businesses, supported by stable long-term charter contracts even amid short-term market volatility, is likely to provide consistent revenue streams and offset weakness in cyclical business segments, supporting overall earnings stability.

- Continued growth in the Vehicle Transport business, as evidenced by an upward revision in projected volumes and profits due to unexpectedly strong demand for completed cars and improved operational efficiency, may result in higher-than-anticipated revenues and margins.

- Successful investment in digital transformation, operational efficiency, and stable revenue asset acquisitions such as the LBC Tank Terminals and a Central London property have the potential to enhance net margins and expand long-term income sources, positively impacting net earnings.

- Industry-wide regulatory pressure for decarbonization combined with MOL's early leadership in clean energy shipping (LNG dual-fuel VLCCs, offshore wind, and green fleet modernization) could allow MOL to capture premium contracts and market share, raising long-term revenue and potentially lowering financing costs.

- Upward revisions in performance forecasts, plus the company's clear commitment to increasing dividends and maintaining payout ratios, reflect strong capital management and may signal resilient profitability and robust free cash flow, directly benefiting shareholder returns and share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Mitsui O.S.K. Lines is ¥4080.7, which represents two standard deviations below the consensus price target of ¥5510.91. This valuation is based on what can be assumed as the expectations of Mitsui O.S.K. Lines's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥7000.0, and the most bearish reporting a price target of just ¥3920.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ¥1344.0 billion, earnings will come to ¥128.4 billion, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 7.7%.

- Given the current share price of ¥4878.0, the bearish analyst price target of ¥4080.7 is 19.5% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.