Key Takeaways

- The transition to decentralized renewables and advanced storage threatens SJVN's core business, legacy assets, and future revenue stability.

- Persistent execution delays and rising competition are expected to compress margins, raise risks, and weaken long-term profitability.

- Expanding renewable and hydro capacity, strong future cash flow visibility, and policy support position SJVN for growth with improved margin resilience and business diversification.

Catalysts

About SJVN- Engages in the generation and sale of electricity in India and internationally.

- The accelerating adoption of distributed solar and rooftop renewables is expected to steadily reduce demand for centralized utility-scale projects, directly threatening SJVN's core business and long-term revenue growth even as its project pipeline expands.

- Increasing deployment of advanced energy storage solutions and microgrids will diminish the grid-dependence that large hydro and thermal projects depend on, eroding market share and leaving SJVN's legacy asset base at structural risk, with negative consequences for asset utilization and margins.

- Prolonged project execution delays, fueled by recurring regulatory bottlenecks and geological challenges-as seen in Arun 3 hydroelectric and Bikaner solar projects-are set to continue, causing cost overruns, delayed revenue recognition and compressing net margins.

- SJVN remains highly exposed to hydrological variability due to continued hydro dominance; climate-related rainfall unpredictability and water stress are likely to introduce volatile earnings cycles and undermine stable cash flows, impacting both top-line and long-term earnings visibility.

- Intensifying competition from private and international players in solar and wind, coupled with the shift to direct power purchase agreements and open access, is likely to push tariffs lower on new projects and reduce SJVN's profitability and returns on capital employed in the medium to long term.

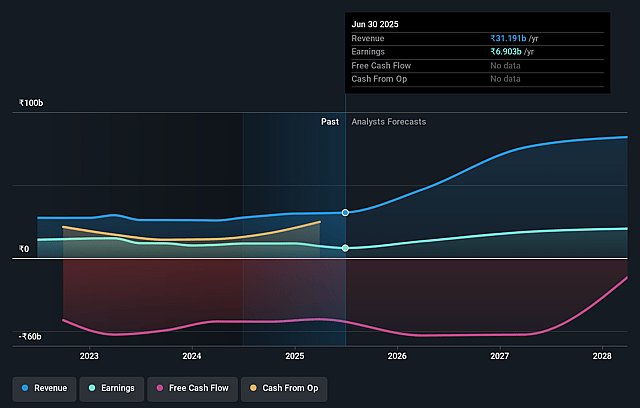

SJVN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SJVN compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SJVN's revenue will grow by 40.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 22.1% today to 20.1% in 3 years time.

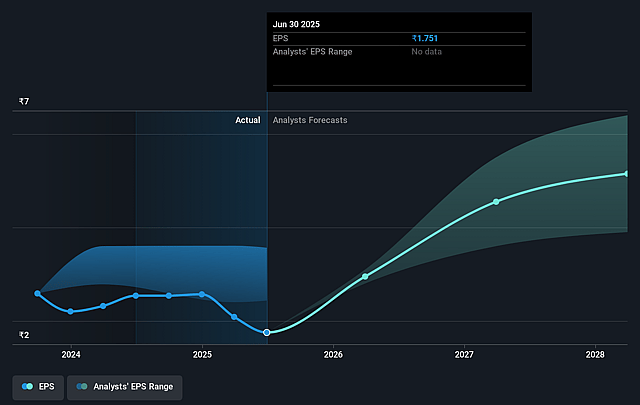

- The bearish analysts expect earnings to reach ₹17.2 billion (and earnings per share of ₹4.41) by about September 2028, up from ₹6.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.9x on those 2028 earnings, down from 53.1x today. This future PE is lower than the current PE for the IN Electric Utilities industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

SJVN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SJVN is aggressively expanding both renewable and hydro capacity, with management projecting nearly a doubling of operational capacity in the near term and a clear line of sight to several gigawatts in pipeline projects, which provides significant revenue growth potential in the coming years.

- The company has already secured Power Purchase Agreements (PPAs) for its renewable portfolio and consistently reports strong offtake and favorable tariffs, which enhances visibility into future cash flows and can support both top-line and earnings stability.

- SJVN's recognition as a Renewable Energy Implementing Agency (REIA) and its involvement in marquee national schemes like the PM Surya Ghar: Muft Bijli Yojana positions the company as a central beneficiary of long-term policy backing, which could mitigate sectoral risks and sustain revenue growth.

- Robust progress on international (Nepal, Arunachal) and domestic large-scale hydro and solar projects, as well as a growing EPC and pumped storage portfolio, points to expanded geographical reach and business diversification, both of which can improve margin resilience and ensure earnings visibility.

- The company is proactively addressing operational efficiency and cost competitiveness, for example by considering joint-venture models for O&M and leveraging integrated EPC contracts for initial years, which can help control expenses and support net margins even as capacity scales.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SJVN is ₹46.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SJVN's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹97.0, and the most bearish reporting a price target of just ₹46.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹85.6 billion, earnings will come to ₹17.2 billion, and it would be trading on a PE ratio of 14.9x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹93.31, the bearish analyst price target of ₹46.0 is 102.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.