Last Update29 Jul 25Fair value Decreased 15%

Despite SJVN’s net profit margin improving sharply and its future P/E ratio declining, indicating enhanced profitability and valuation, analysts have lowered their fair value target significantly from ₹84.82 to ₹72.00.

What's in the News

- SJVN Limited’s board recommended a final dividend of INR 0.31 per equity share for FY 2024-25, subject to shareholder approval.

- The board scheduled a meeting to approve financial results for the year ended March 31, 2025, consider the dividend, and discuss raising funds through securitization of assets.

- Shri Bhupendra Gupta was entrusted with additional charge as Managing Director for three months or until a full-time incumbent is appointed, succeeding Shri Raj Kumar Chaudhary.

Valuation Changes

Summary of Valuation Changes for SJVN

- The Consensus Analyst Price Target has significantly fallen from ₹84.82 to ₹72.00.

- The Net Profit Margin for SJVN has significantly risen from 18.05% to 28.43%.

- The Future P/E for SJVN has significantly fallen from 24.64x to 15.70x.

Key Takeaways

- New solar, hydroelectric, and thermal projects are expected to significantly increase SJVN's energy output, boosting future revenue and earnings growth.

- Strategic projects and government initiatives position SJVN for long-term growth in renewable energy, enhancing revenue and supporting margin improvements.

- Delays and rising costs in renewable projects, coupled with high borrowing and operational uncertainties, pose significant risks to financial sustainability and earnings.

Catalysts

About SJVN- Engages in the generation and sale of electricity in India and internationally.

- The commissioning of new solar and hydroelectric projects, such as the Omkareshwar and Raghanesda solar power projects and ongoing progress in other solar initiatives, is expected to significantly boost SJVN's energy output capacity, positively impacting future revenue growth through increased sales of generated power.

- The planned development of the Hathidah Durgawati pumped storage plant in Bihar and the significant MOU for renewable energy projects in Rajasthan are likely to enhance SJVN's capacity and peak energy generation capabilities, supporting future revenue streams and earnings.

- The expected completion and commercial operation of the Buxar Thermal Power Project by the end of this fiscal year are crucial steps in enhancing SJVN’s thermal energy output, which can favorably impact revenue and earnings growth.

- Ongoing progress in hydropower projects like Arun 3 hydroelectric project and expanding capacity of existing hydro stations indicate a strong future for hydro energy contributions to SJVN’s portfolio, potentially increasing revenue and achieving higher net margins due to efficient production.

- The strategic allocation of projects under the PM Surya Ghar: Muft Bijli Yojana and recognition as a Renewable Energy Implementing Agency for the Indian government's 500 gigawatt target by 2030 align SJVN for substantial growth in solar power generation, which can increase long-term revenue and support margin improvements.

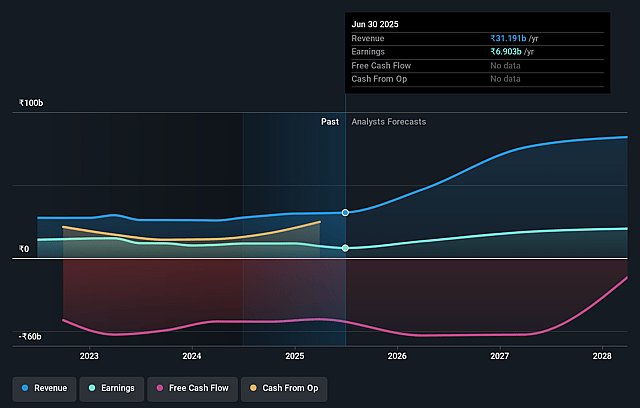

SJVN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SJVN's revenue will grow by 51.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 33.1% today to 18.0% in 3 years time.

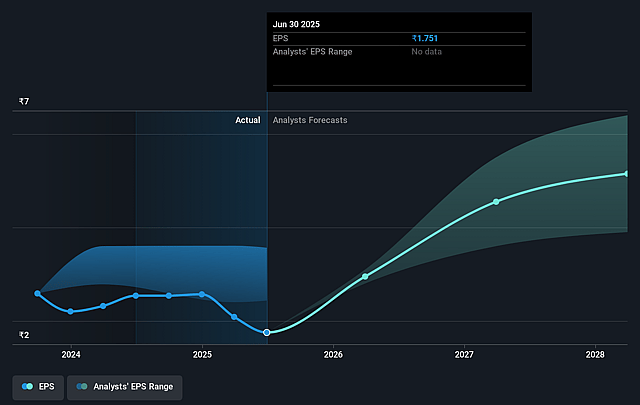

- Analysts expect earnings to reach ₹19.0 billion (and earnings per share of ₹4.83) by about April 2028, up from ₹10.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, down from 35.1x today. This future PE is lower than the current PE for the IN Electric Utilities industry at 32.2x.

- Analysts expect the number of shares outstanding to decline by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.53%, as per the Simply Wall St company report.

SJVN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The delay in signing power purchase agreements (PPA) for renewable projects, such as those under the REIA vertical, could impact revenue generation timelines and increase uncertainty in projected cash flows.

- High project costs, like those associated with the ₹5,663 crore Hathidah Durgawati pumped storage plant with a levelized tariff of ₹9.39 per kilowatt hour, could affect net margins and make the projects financially less attractive if costs rise or tariffs are uncompetitive.

- Significant geological challenges at major projects, such as Arun 3, could delay completions and impact earnings, as seen with potential commissioning delays to the last quarter of FY '27.

- An increase in interest and depreciation expenses due to ongoing capital expenditure projects could dilute net income if projects do not become operational as planned or if there are further cost overruns or delays.

- High reliance on external borrowing for rapid expansion could increase financial risk if financing costs rise or renewable asset revenues do not meet projections, impacting net earnings and financial sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹84.25 for SJVN based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹129.0, and the most bearish reporting a price target of just ₹46.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹105.4 billion, earnings will come to ₹19.0 billion, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹90.03, the analyst price target of ₹84.25 is 6.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.