Key Takeaways

- Unique government partnerships and early leadership in renewables position SJVN to capture premium margins and secure long-term growth.

- Structural shifts, including value unlocking through a renewables subsidiary and operational efficiencies, are set to boost margins and earnings quality.

- Heavy reliance on hydro power, project execution delays, rising finance costs, and regulatory risks threaten earnings consistency, market relevance, and long-term revenue visibility.

Catalysts

About SJVN- Engages in the generation and sale of electricity in India and internationally.

- Analyst consensus expects added capacity from new projects to drive revenue, but this view materially understates how quickly SJVN's annual operating capacity could double by fiscal 2026, which would trigger a sustained step-change in topline and forward earnings as the company achieves unprecedented scale in a compressed timeframe.

- Analysts recognize the positive impact of project commissioning and government renewables targets, but underestimate the company's unique positioning as a Renewable Energy Implementing Agency and first-mover in India's PM Surya Ghar program, which may enable SJVN to secure a disproportionate share of high-margin government-backed power sales-sharply enhancing long-term net margins and cashflow visibility.

- SJVN is on track for a structural re-rating as India's accelerating electrification and infrastructure buildout drives persistent, above-trend power demand, allowing the company to lock in premium PPA contracts well above current portfolio average tariffs and to monetize new storage/peak capacity at outsized spreads, directly boosting forward revenue and margin expansion.

- The planned listing and likely demerger of SJVN Green Energy opens a path for material value unlocking; a pure-play, growth-oriented renewables subsidiary could attract far higher valuation multiples and lower cost of capital, fueling aggressive future portfolio expansion and compounding earnings growth.

- SJVN's early adoption of large-scale battery storage and O&M cost optimization-with potential insourcing or JV arrangements for solar and wind O&M-will drive structural cost reductions, reduce risk, and support superior long-term EBITDA margins versus PSU peers.

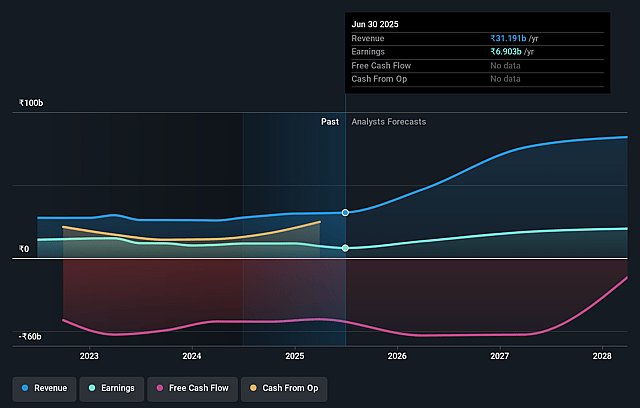

SJVN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SJVN compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SJVN's revenue will grow by 48.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 22.1% today to 28.2% in 3 years time.

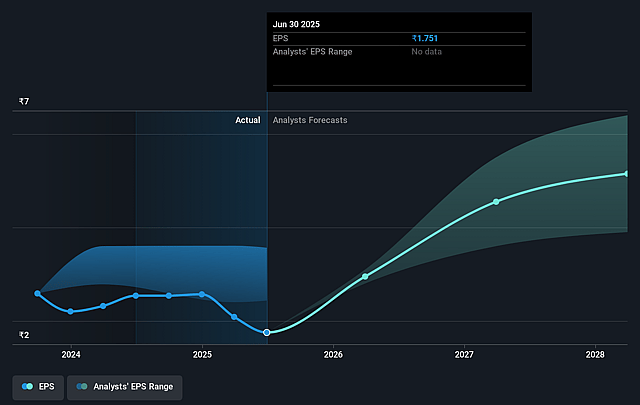

- The bullish analysts expect earnings to reach ₹28.5 billion (and earnings per share of ₹7.24) by about September 2028, up from ₹6.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.0x on those 2028 earnings, down from 53.1x today. This future PE is lower than the current PE for the IN Electric Utilities industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

SJVN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SJVN remains highly dependent on hydroelectric projects, which makes its revenue stream vulnerable to rainfall variability, climate change impacts, and potential water scarcity, leading to inconsistent power generation and fluctuating earnings.

- The company has faced execution delays and cost overruns in major projects such as Arun 3 and Buxar, caused by geological surprises, supply chain issues, and land acquisition problems, risking both slower capacity addition and reduced net margins through higher capital expenditure.

- Accelerating advances and policy shifts in favor of newer technologies like battery storage, green hydrogen, and distributed renewables could erode the long-term market relevance of SJVN's traditional large-scale grid-based generation model, ultimately pressuring both future revenue growth and market share.

- Rising interest expenses, largely driven by increased borrowing for capital expenditures and global rate hikes, have already begun to pressure net profits; continued leverage for expansion amid uncertain project timelines could further erode profitability.

- Regulatory uncertainties, including environmental clearances, cross-border project approvals, and high tariffs for new pumped storage projects, raise the likelihood of higher compliance costs and disruptions, negatively affecting both revenue visibility and overall earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SJVN is ₹97.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SJVN's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹97.0, and the most bearish reporting a price target of just ₹46.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹101.2 billion, earnings will come to ₹28.5 billion, and it would be trading on a PE ratio of 19.0x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹93.31, the bullish analyst price target of ₹97.0 is 3.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.