Key Takeaways

- Structural advantages in capacity, yield management, and adjacencies position GMR for strong earnings outperformance and sustained margin expansion over time.

- Regulatory, technological, and ESG tailwinds enhance capital access, asset utilization, and resilience, reinforcing premium growth and valuation potential.

- Aggressive expansion, high debt, shifting non-aero revenues, regulatory risks, and evolving travel patterns threaten margin stability and increase volatility in earnings and cash flow.

Catalysts

About GMR Airports- Operates and develops airports in India.

- Analyst consensus expects meaningful uplift in passenger growth and revenues, but this likely understates the potential for double-digit sustained annual passenger growth and outperformance on international traffic, with near-term upside on capacity utilization as IndiGo and other airlines ramp up fleets-supporting a strong beat on topline income and EBITDA over consensus estimates.

- While most anticipate a positive margin reset at Delhi Airport from tariff hikes, the actual impact could be more transformative than expected, as Aero yield per passenger increases by over twofold, with much of the uplift dropping to the bottom line given largely fixed cost structures-setting the stage for rapid operating leverage and an early break-even at Delhi plus group-wide FCF inflection.

- GMR is uniquely positioned to dominate airport adjacency profit pools, with direct control over in-terminal retail, duty-free, cargo, parking, and commercial real estate, now rolling in-house and scaling at high EBITDA margins-unlocking multi-year margin expansion and a structurally higher return on capital profile.

- Regulatory and industry tailwinds, including technology-led airside operational enhancements and government push for infrastructure privatization, allow GMR to sweat existing assets beyond design capacity, supporting further throughput-driven revenue growth and delaying new capex requirements-enabling outsized near-term earnings growth and free cash accumulation.

- GMR's best-in-class sustainability credentials and carbon leadership are catalyzing lower cost of capital, higher credit ratings, and access to green finance, all while reinforcing growth-winning positioning in ESG-conscious airline and tenant selection-translating into expanding earnings resilience and potential premium valuation multiples.

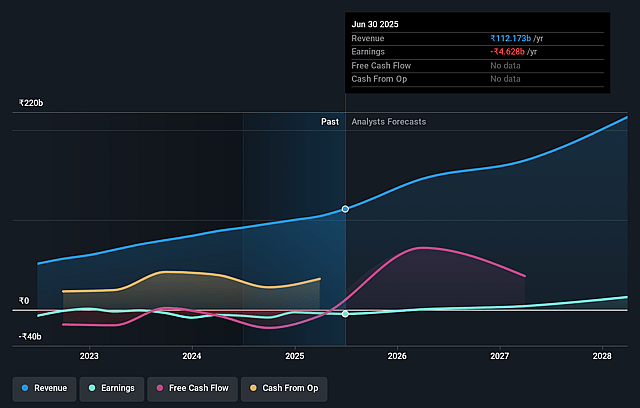

GMR Airports Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on GMR Airports compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming GMR Airports's revenue will grow by 27.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -4.1% today to 8.3% in 3 years time.

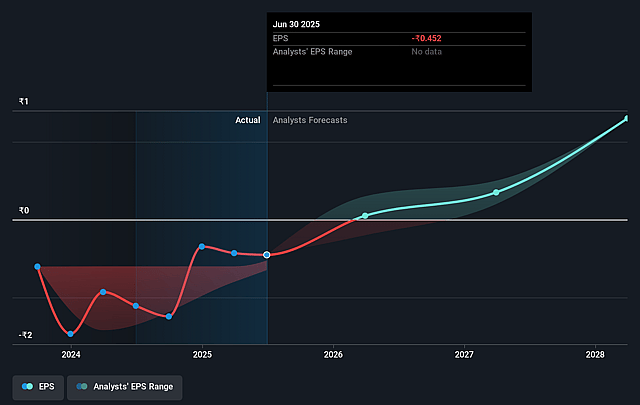

- The bullish analysts expect earnings to reach ₹19.1 billion (and earnings per share of ₹1.75) by about September 2028, up from ₹-4.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 114.3x on those 2028 earnings, up from -198.8x today. This future PE is greater than the current PE for the IN Infrastructure industry at 17.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.04%, as per the Simply Wall St company report.

GMR Airports Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- GMR Airports' persistent high leverage and rising interest and depreciation costs due to aggressive CapEx, as reflected in the steady increase in both net and gross debt, could suppress net margins and threaten free cash flow generation even if revenues increase.

- The company's growing reliance on non-aero revenue streams, such as real estate, retail, and duty-free, is at risk from changing consumer behavior, increased e-commerce penetration, and regulatory changes (for example, removal of certain ITC credits), all of which have already led to visible compression in EBITDA margins and declines in PAT in these segments.

- Long-term secular risks such as stricter environmental regulations, rising global decarbonization pressures, and potential carbon taxes could increase operating costs and limit airport profitability, putting downward pressure on earnings over time.

- The growth in air passenger traffic, which underpins the company's bullish projections, may be structurally constrained by the adoption of remote work and digital meetings, which reduce high-margin business travel and could slow growth in revenue per passenger.

- Expansion into new geographies and airport projects, such as Bhogapuram and Crete, poses execution risk and could delay revenue realization, exacerbate earnings volatility, and generate further pressure on the balance sheet, especially if ramp-ups are slower than anticipated or initial passenger growth underperforms.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for GMR Airports is ₹108.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GMR Airports's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹108.0, and the most bearish reporting a price target of just ₹80.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹229.7 billion, earnings will come to ₹19.1 billion, and it would be trading on a PE ratio of 114.3x, assuming you use a discount rate of 16.0%.

- Given the current share price of ₹87.13, the bullish analyst price target of ₹108.0 is 19.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.