Key Takeaways

- Stricter climate rules, high debt, and elevated capital needs limit profit growth and create ongoing financing risks despite steady passenger volume.

- Shifts in travel patterns and regulatory pressures threaten core revenues, while heavy reliance on aeronautical income increases vulnerability to demand shocks.

- Sustained passenger growth, expanding non-aero revenue, improved yields, lower financing costs, and ongoing capacity upgrades position GMR Airports for steady, long-term profit and margin growth.

Catalysts

About GMR Airports- Operates and develops airports in India.

- Intensifying climate change legislation and carbon reduction requirements could force GMR Airports to spend heavily on retrofitting infrastructure or adopting new technologies, leading to heightened capital expenditures and muted net margin expansion even as passenger growth continues.

- The ongoing normalization and potential permanent reduction of international business travel, fueled by increasing virtual meeting technology and remote work adoption, threatens to erode high-margin international passenger flows, impacting core revenue streams and weakening long-term earnings growth.

- GMR's structurally high debt burden, with net debt rising further due to new airport developments, exposes the company to elevated interest expenses and refinancing risks, which may continue to suppress net income and delay sustainable free cash flow generation.

- Continuing reliance on aeronautical income over non-aeronautical streams means that any full-cycle downturn in airline traffic-whether from economic shocks, lasting changes in travel behavior, or regulator-driven constraints-could result in sharp volatility in top-line revenue and earnings, magnifying downside risk.

- Mounting regulatory and competitive pressures, including the risk of increasing government controls over airport tariffs and the opening of new airports in key regions, may not only cap future revenue growth but also compress margins as pricing power diminishes in a slower-growth environment.

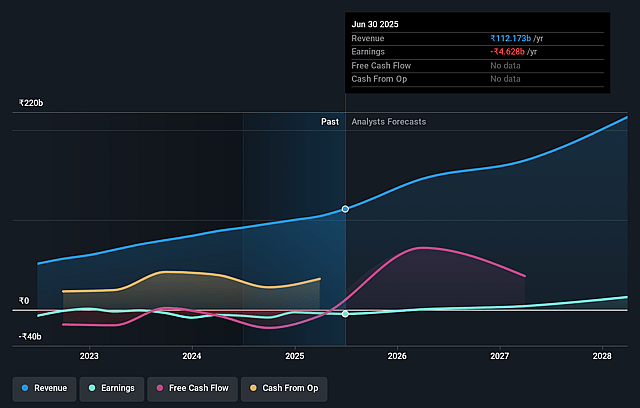

GMR Airports Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on GMR Airports compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming GMR Airports's revenue will grow by 26.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -4.1% today to 8.0% in 3 years time.

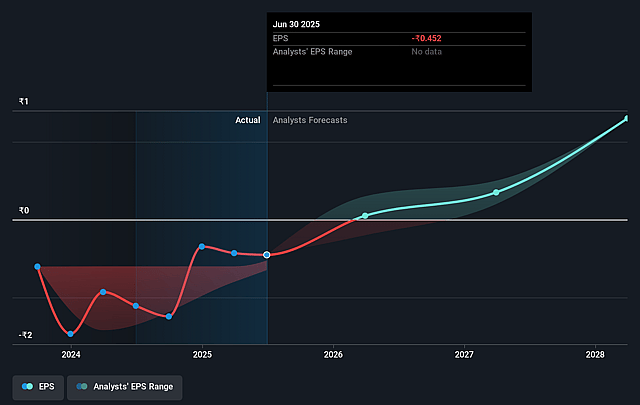

- The bearish analysts expect earnings to reach ₹18.3 billion (and earnings per share of ₹1.68) by about August 2028, up from ₹-4.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 87.7x on those 2028 earnings, up from -207.6x today. This future PE is greater than the current PE for the IN Infrastructure industry at 19.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.79%, as per the Simply Wall St company report.

GMR Airports Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust long-term passenger traffic growth, driven by both domestic and international demand, is expected to continue as evidenced by 9% year-on-year group level passenger growth and industry forecasts of nearly 8% annualized air traffic growth through 2043, supporting sustained increases in both revenue and EBITDA.

- Implementation of a sharply higher aeronautical yield per passenger in Delhi (from ₹145 to ₹360), with the potential to more than double Aero revenues, is likely to drive significant improvements in profitability, cash flow, and possibly a return to net profitability at the airport level even as interest and depreciation costs stabilize.

- Expanding non-aeronautical revenue streams, including duty-free, cargo, retail, and commercial property, are underpinning margin growth, with combined non-aero revenues climbing 13% year-on-year and new concessions (like Delhi and Hyderabad duty free) expected to further improve group EBITDA and reduce reliance on cyclical passenger traffic.

- Upgrades in credit ratings for Delhi and Hyderabad airports and successful refinancing at lower interest rates reduce future interest expenses and borrowing costs, which will help support net margins and potentially lead to earlier free cash flow and dividend distribution.

- Ongoing capacity enhancements and real estate development at key airports, coupled with positive secular trends such as rising incomes, urbanization, and tourism, position GMR to capitalize on incremental passenger and non-passenger growth, translating to steady increases in revenue and a structurally improved earnings base over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for GMR Airports is ₹80.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GMR Airports's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹108.0, and the most bearish reporting a price target of just ₹80.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹229.2 billion, earnings will come to ₹18.3 billion, and it would be trading on a PE ratio of 87.7x, assuming you use a discount rate of 15.8%.

- Given the current share price of ₹91.01, the bearish analyst price target of ₹80.0 is 13.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.