Last Update 20 Nov 25

Fair value Increased 5.82%GMRAIRPORT: Upcoming Board Review Will Address Margin Outlook And Rate Shifts

Analysts have raised their price target for GMR Airports from ₹98.75 to ₹104.50. They cited improved profit margin projections and a lower discount rate as key reasons for the upward revision.

What's in the News

- GMR Airports Limited will hold a Board Meeting on November 13, 2025, at 17:00 Indian Standard Time to consider and approve the unaudited financial results for the quarter and half year ended September 30, 2025 (Board Meeting notice).

- The meeting agenda may also include other unspecified matters for the company's consideration (Board Meeting notice).

Valuation Changes

- Consensus Analyst Price Target has risen from ₹98.75 to ₹104.50.

- Discount Rate has fallen significantly from 15.88% to 13.55%.

- Revenue Growth projection has decreased from 22.18% to 20.49%.

- Net Profit Margin estimate has increased from 6.63% to 9.55%.

- The future P/E ratio is now much lower, dropping from 146.39x to 55.13x.

Key Takeaways

- Expansion projects and improved tariffs at key airports likely enhance revenue and earnings growth for GMR Airports.

- Non-aero revenue and reduced debt costs position the company for stronger profitability.

- Delays in tariff notifications, high debt levels, currency sensitivity, and reliance on airline expansion pose risks to GMR Airports' financial stability and growth.

Catalysts

About GMR Airports- Operates and develops airports in India.

- Expected growth in Indian airline seat capacity and increased international travel by Indian tourists suggest strong future passenger growth, potentially boosting airport revenues for GMR Airports.

- The narrowing of losses and positive cash generation, along with expected tariff revisions at Delhi Airport, indicate potential improvement in margins and overall profitability.

- The completion and increased utilization of expansion projects at airports like Hyderabad and Mopa, along with improved tariffs, are likely to enhance revenue and earnings growth.

- Increased non-aero revenue from commercial developments, Duty Free operations, and airport adjacency businesses can significantly contribute to higher net margins.

- Reduction in debt-related costs through refinancing and hedging strategies, coupled with a stabilized capital expenditure post major expansions, positions GMR Airports for stronger earnings growth.

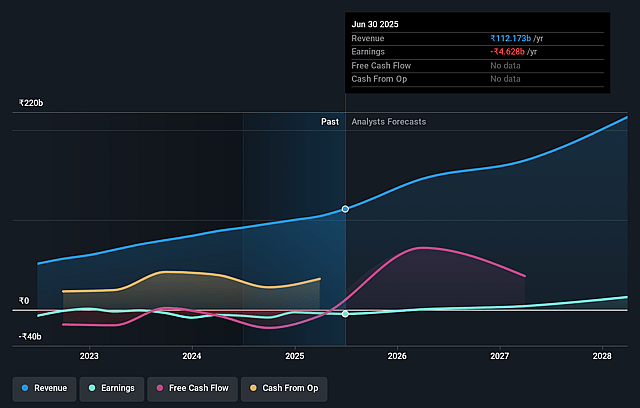

GMR Airports Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GMR Airports's revenue will grow by 22.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -4.1% today to 6.6% in 3 years time.

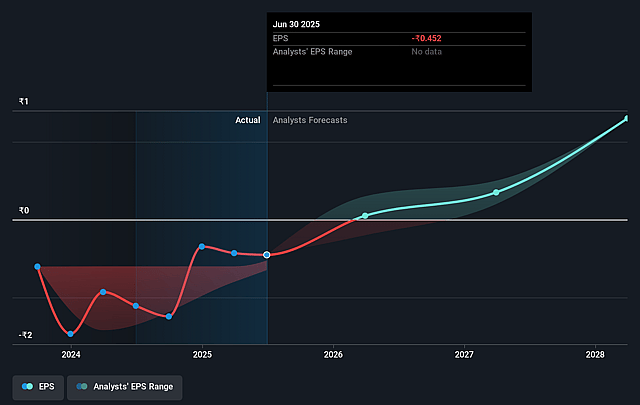

- Analysts expect earnings to reach ₹13.6 billion (and earnings per share of ₹1.06) by about September 2028, up from ₹-4.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 146.4x on those 2028 earnings, up from -199.3x today. This future PE is greater than the current PE for the IN Infrastructure industry at 16.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.88%, as per the Simply Wall St company report.

GMR Airports Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays in the tariff notification at Delhi Airport could impact future revenue and earnings as the anticipated increase in charges has not yet been realized.

- High levels of consolidated net debt (₹297 billion) could pressure interest costs and net margins if not managed or if refinancing becomes necessary.

- Dependency on the expansion of international networks by Indian airlines like Air India and IndiGo, restricted by current supply chain constraints, may slow international traffic growth, potentially affecting revenue.

- Sensitivity to currency fluctuations due to USD bond exposure, despite hedging, could lead to accounting impacts and affect reported net income and financial stability.

- Continued large capital expenditures, particularly at Bhogapuram Airport, while indicative of growth plans, could strain cash flows and impact net margins until revenue from new operations materializes.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹98.75 for GMR Airports based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹108.0, and the most bearish reporting a price target of just ₹80.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹204.6 billion, earnings will come to ₹13.6 billion, and it would be trading on a PE ratio of 146.4x, assuming you use a discount rate of 15.9%.

- Given the current share price of ₹87.37, the analyst price target of ₹98.75 is 11.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.