Key Takeaways

- Structural shifts to data-based services and stiff competition from better-capitalized rivals threaten revenue stability and accelerate loss of high-value subscribers.

- High debt levels and weak funding prospects create serious liquidity risks, undermining the company's ability to modernize networks or drive profitability.

- Expanding digital offerings, improving network coverage, and strategic partnerships are driving subscriber growth, diversified revenues, and strengthening Vodafone Idea's financial position.

Catalysts

About Vodafone Idea- Provides mobile telecommunication services in India.

- Despite ongoing investments in network expansion and 5G rollout, Vodafone Idea's traditional voice and SMS revenue streams face permanent structural erosion as consumers increasingly migrate to internet-based alternatives like WhatsApp and Zoom, impairing revenue stability and undermining future earnings growth.

- The company's efforts to bridge rural coverage gaps are unlikely to offset the increasing migration of higher-value urban and affluent users toward competitors with stronger and more advanced networks, putting continued downward pressure on net margins due to a deteriorating mix of lower-ARPU customers.

- Intensifying price wars in a market now dominated by cash-rich incumbents risk triggering further ARPU compression, making it extremely difficult for Vodafone Idea to meaningfully grow profitability or defend market share, which could cause sustained earnings declines.

- Extremely elevated debt levels and persistent reliance on new external funding threaten ongoing operations, as the company still lacks secured long-term bank funding to execute its announced ₹500–550 billion CapEx plan, raising the risk of liquidity crunches, defaults, and further equity dilution all negatively impacting earnings per share and shareholder value.

- With network modernization lagging and a weaker spectrum position, Vodafone Idea remains acutely vulnerable to losing high-value subscribers to better-capitalized rivals during the industry's 5G upgrade cycle, exacerbating long-term subscriber churn and further eroding top-line revenues.

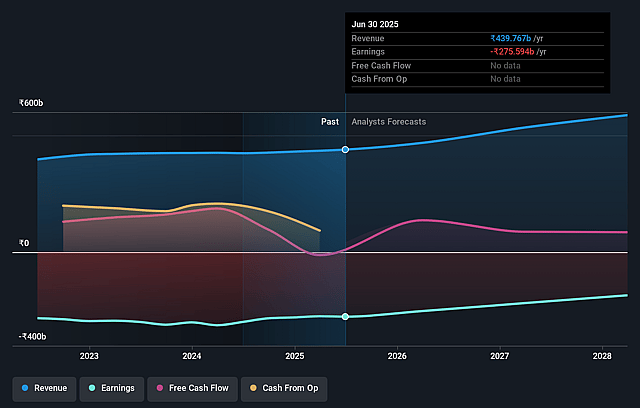

Vodafone Idea Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Vodafone Idea compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Vodafone Idea's revenue will grow by 6.6% annually over the next 3 years.

- The bearish analysts are not forecasting that Vodafone Idea will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vodafone Idea's profit margin will increase from -62.7% to the average IN Wireless Telecom industry of 17.9% in 3 years.

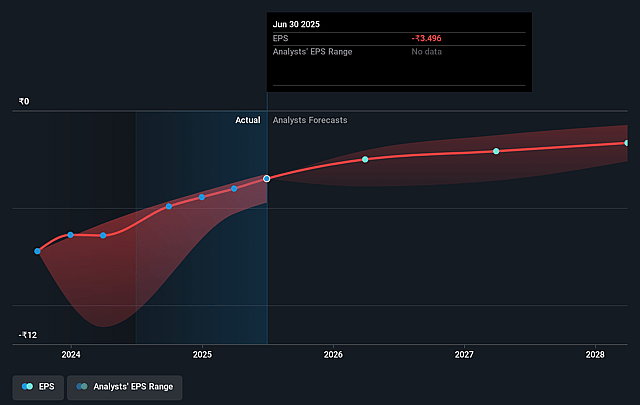

- If Vodafone Idea's profit margin were to converge on the industry average, you could expect earnings to reach ₹95.3 billion (and earnings per share of ₹0.72) by about September 2028, up from ₹-275.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 5.0x on those 2028 earnings, up from -2.9x today. This future PE is lower than the current PE for the IN Wireless Telecom industry at 48.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.08%, as per the Simply Wall St company report.

Vodafone Idea Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid expansion of 4G and 5G network coverage, combined with network densification and improved data speeds, is leading to consistent improvements in subscriber metrics and higher ARPU, which could drive revenue and margin growth over the long term.

- Vodafone Idea's strategy to monetize its large subscriber base through digital services such as OTT partnerships, Vi Finance, IoT, cloud solutions, and enterprise tech offerings creates new and diversified revenue streams, supporting top-line growth and earnings stability.

- Partnerships for satellite-based mobile broadband and advanced B2B solutions position Vodafone Idea to address untapped rural and enterprise markets, potentially expanding its addressable customer base and boosting long-term revenue potential.

- The company's demonstrated ability to add 4G and postpaid subscribers while slowing overall subscriber losses, along with effective product innovation like Non-Stop Hero plans and OTT bundles, shows potential for market share improvement, directly benefiting revenue and ARPU.

- Ongoing government support, as evidenced by debt-to-equity conversions and previous relief measures, plus recent credit rating upgrades, suggest increased access to funding and potential for further balance sheet strengthening, which can lower interest expenses and improve net margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Vodafone Idea is ₹2.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vodafone Idea's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹15.3, and the most bearish reporting a price target of just ₹2.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹532.1 billion, earnings will come to ₹95.3 billion, and it would be trading on a PE ratio of 5.0x, assuming you use a discount rate of 16.1%.

- Given the current share price of ₹7.32, the bearish analyst price target of ₹2.3 is 218.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.