Key Takeaways

- Expanding 4G/5G networks and digital services positions Vodafone Idea to capture growing demand and diversify its revenue base.

- Strategic shifts toward enterprise solutions and debt reduction aim to improve profitability and long-term financial stability.

- High debt, limited funding, and slow network upgrades threaten competitiveness, profitability, and subscriber growth, raising long-term viability concerns against stronger rivals.

Catalysts

About Vodafone Idea- Provides mobile telecommunication services in India.

- The rapid expansion of 4G and ongoing rollout of 5G across priority circles, combined with major investments in network densification and capacity upgrades, are positioning Vodafone Idea to better capture the surge in demand for mobile internet and data services-improving subscriber retention and driving ARPU and revenue growth.

- As India's digital economy accelerates-with government initiatives like Digital India, growing broadband penetration in rural and underserved areas, and a rising appetite for smartphone-driven streaming, fintech, and digital transactions-Vodafone Idea stands to benefit from an expanding addressable market, supporting long-term revenue and subscriber base increases.

- The company's shift toward a digital-first business model, including new OTT content bundles, fintech offerings on the Vi App, and value-added services for both consumers and enterprises, creates multiple incremental monetization streams that should lift top-line revenue and diversify earnings.

- A strategic push in the enterprise segment-leveraging partnerships, cloud, IoT, and managed services-capitalizes on increasing B2B digital adoption, which can drive higher-margin enterprise revenue and improve overall blended EBITDA margins.

- Progressive reduction in debt through government equity conversion and operational refinancing, alongside ongoing efforts to secure new funding for capital investment, has the potential to relieve interest burden and improve net profit/earnings trajectory over time.

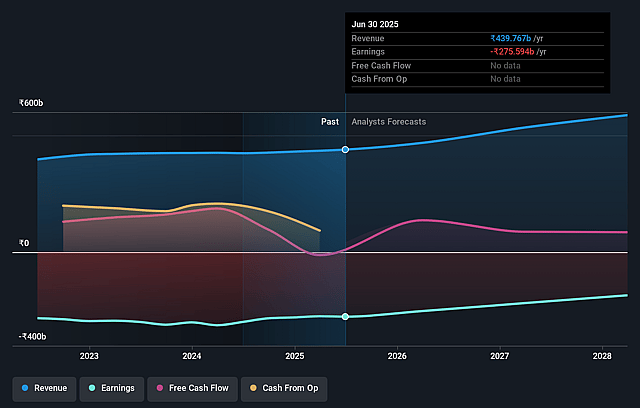

Vodafone Idea Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vodafone Idea's revenue will grow by 11.3% annually over the next 3 years.

- Analysts are not forecasting that Vodafone Idea will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vodafone Idea's profit margin will increase from -62.7% to the average IN Wireless Telecom industry of 18.0% in 3 years.

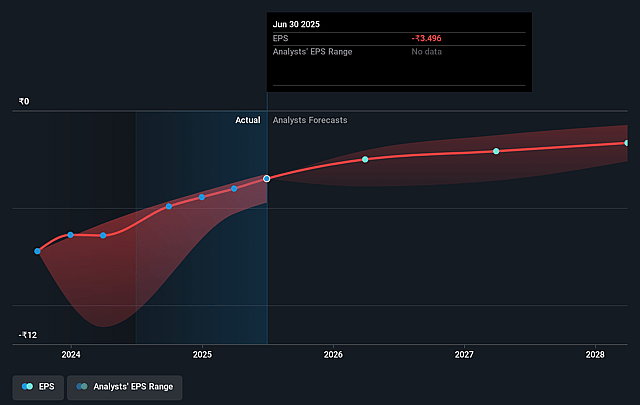

- If Vodafone Idea's profit margin were to converge on the industry average, you could expect earnings to reach ₹108.9 billion (and earnings per share of ₹0.82) by about August 2028, up from ₹-275.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, up from -2.7x today. This future PE is lower than the current PE for the IN Wireless Telecom industry at 48.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.65%, as per the Simply Wall St company report.

Vodafone Idea Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent capital constraints and overreliance on yet-to-be-secured bank debt for major CapEx could delay critical 4G/5G network expansion and upgrades, impeding competitiveness and hindering revenue growth relative to better-funded peers.

- Chronic high debt levels, recurring finance costs, and large upcoming Spectrum and AGR liabilities threaten to erode net margins and profits, increasing insolvency risk and limiting capacity for technology investment.

- Ongoing customer churn and lagging subscriber additions in key urban and profitable segments could result in gradual revenue stagnation and sustained negative cash flows, particularly if network improvements fall behind Airtel and Jio.

- The minimum ARPU trap, due to continued reliance on price-sensitive customer segments and aggressive promotions, may cap revenue growth and suppress overall earnings recovery, making margin improvement difficult.

- Threat of technology leapfrogging by competitors and continued spectrum price inflation may leave Vodafone Idea lagging in both service innovation and cost structure, accelerating subscriber attrition, further affecting top-line revenue and net profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹7.227 for Vodafone Idea based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹15.3, and the most bearish reporting a price target of just ₹2.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹605.6 billion, earnings will come to ₹108.9 billion, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 16.7%.

- Given the current share price of ₹6.79, the analyst price target of ₹7.23 is 6.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.