Key Takeaways

- Rapid 4G/5G expansion and digital ecosystem integration are driving subscriber growth, higher margins, and non-traditional revenue streams.

- Strategic rural broadband, IoT, and enterprise solutions position Vodafone Idea for resilient, long-term growth and market leadership.

- Ongoing capital constraints, heavy debt, and intensifying competition threaten Vodafone Idea's market position, revenue stability, and ability to invest in future growth.

Catalysts

About Vodafone Idea- Provides mobile telecommunication services in India.

- While analyst consensus expects network investments to gradually stabilize subscriber metrics, the accelerated 4G and 5G rollouts are already driving the fastest improvement in churn and subscriber additions since the merger, positioning Vodafone Idea to outpace industry ARPU and revenue growth as network gains rapidly compound.

- Analyst consensus sees 5G as a way to retain and possibly win high-value customers, but this underestimates the broader impact of mass-market 5G adoption in India, which will not only lift ARPU sharply but also catalyze digital service uptake and multi-product bundling, supercharging both revenue and margin expansion well beyond current projections.

- Vodafone Idea's integration of digital payments, personal financial products, OTT content, and enterprise tech solutions into the Vi App ecosystem puts it at the forefront of digital convergence in India, creating high-margin, non-traditional revenue streams that will fundamentally transform its long-term earnings profile.

- The landmark satellite-based broadband partnership with AST SpaceMobile uniquely extends Vodafone Idea's reach to remote and underserved regions, opening a vast, previously untapped subscriber base at a time when rural digital demand is set to surge, with significant long-term implications for revenue and market share.

- Strong momentum in IoT and enterprise managed services, including multi-year government and infrastructure contracts, positions Vodafone Idea as a core digital infrastructure provider for India's businesses; this B2B growth engine will drive highly resilient, recurring revenues and bolster group net margins even in volatile consumer cycles.

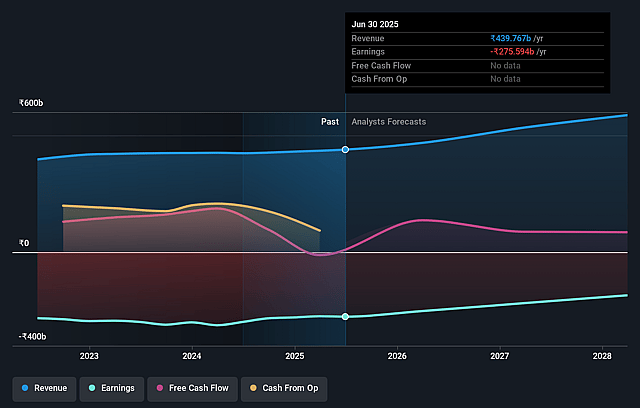

Vodafone Idea Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Vodafone Idea compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Vodafone Idea's revenue will grow by 15.7% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Vodafone Idea will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vodafone Idea's profit margin will increase from -62.7% to the average IN Wireless Telecom industry of 17.9% in 3 years.

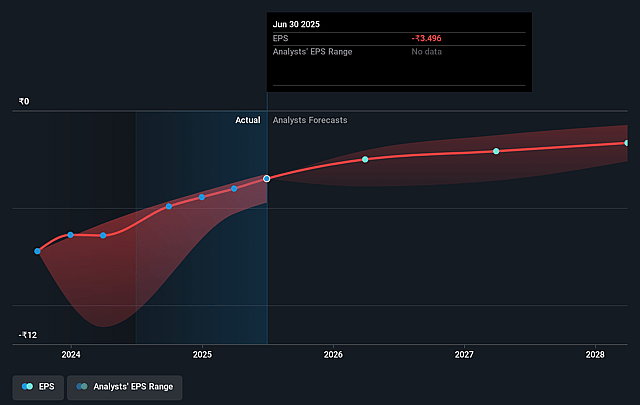

- If Vodafone Idea's profit margin were to converge on the industry average, you could expect earnings to reach ₹121.9 billion (and earnings per share of ₹0.92) by about September 2028, up from ₹-275.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.1x on those 2028 earnings, up from -2.9x today. This future PE is lower than the current PE for the IN Wireless Telecom industry at 48.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.08%, as per the Simply Wall St company report.

Vodafone Idea Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Vodafone Idea continues to face persistent capital constraints, with its ability to make critical network and 5G investments explicitly dependent on securing significant fresh funding, which remains uncertain due to ongoing negotiations with lenders and unresolved issues like AGR dues; this limitation threatens to widen network quality gaps versus better-capitalized rivals, putting future revenue growth and earnings under pressure.

- The company's substantial debt burden and high interest costs are eroding net profits and constraining its financial flexibility, with over ₹195,000 crores in debt and only modest improvements in operating metrics, creating an ongoing risk of future equity dilution or insolvency that could weigh on shareholder value and net margins.

- Though management touts improvements in subscriber loss and 4G additions, secular industry trends show intensifying price competition and ARPU pressure, and Vodafone Idea is experiencing continued overall subscriber churn, especially in a market shifting towards urban, higher-income, digital-savvy consumers who tend to favor premium offerings from stronger competitors, thereby threatening long-term market share and revenue stability.

- Digital disruption from Over-the-Top communication platforms is accelerating, as customers rely less on traditional voice and SMS services, reducing a high-margin revenue stream for all operators; Vodafone Idea, already lagging in digital consumer engagement and ecosystem strength compared to its peers, remains particularly exposed to ongoing revenue and margin compression.

- Regulatory scrutiny around digital privacy and compliance (such as data localization requirements) is increasing across the industry, a trend that could raise operational complexity and costs for all carriers, but will have a more pronounced negative impact on Vodafone Idea's already thin margins due to its weak balance sheet and limited flexibility to absorb additional expenses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Vodafone Idea is ₹12.38, which represents two standard deviations above the consensus price target of ₹7.11. This valuation is based on what can be assumed as the expectations of Vodafone Idea's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹15.3, and the most bearish reporting a price target of just ₹2.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹680.6 billion, earnings will come to ₹121.9 billion, and it would be trading on a PE ratio of 21.1x, assuming you use a discount rate of 16.1%.

- Given the current share price of ₹7.32, the bullish analyst price target of ₹12.38 is 40.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.