Last Update17 Oct 25Fair value Increased 16%

Analysts have raised their price target for RateGain Travel Technologies from ₹584.13 to ₹676.13. This change is based on much higher expected revenue growth, even though the forecast for profit margin is slightly lower.

What's in the News

- Sunrise Airways has selected RateGain's AirGain platform for real-time fare monitoring. This enables the airline to stay competitive and optimize pricing in the Caribbean market (Client Announcements).

- RateGain launched SoHo: Social for Hospitality, a rebranded AI-powered platform designed to help hotels convert social media engagement into direct revenue and manage the guest journey across digital touchpoints (Product-Related Announcements).

- A strategic partnership with Oracle was announced, integrating RateGain's UNO Channel Manager into OPERA Cloud Distribution. This integration grants hotels greater control, reduced manual errors, and market expansion through over 400 demand partners (Client Announcements).

- Payless Costa Rica has deployed RateGain's AI-driven Rev-AI platform to automate car rental pricing and demand forecasting, improving operational agility and profitability (Client Announcements).

- RateGain's new Model Context Protocol (MCP) enables hotels to offer conversational AI booking experiences via platforms like Claude. This positions the company as an AI-first innovator in travel technology (Product-Related Announcements).

Valuation Changes

- Fair Value increased from ₹584.13 to ₹676.13, reflecting a substantial upward revision.

- Discount Rate decreased slightly from 15.45% to 15.40%.

- Revenue Growth nearly doubled, rising from 24.7% to 48.4%.

- Net Profit Margin declined notably from 15.36% to 9.76%.

- Future P/E marginally increased from 32.67x to 35.32x.

Key Takeaways

- Accelerated expansion into new geographic and industry verticals, paired with robust subscription revenue, boosts growth visibility and market opportunity.

- Ongoing AI-driven product innovation and integrated analytics strengthen competitive positioning, drive customer retention, and support improved earnings quality.

- Increased reliance on lower-margin, variable revenue streams and exposure to competitive pressures risk constraining long-term growth, profitability, and predictability of earnings.

Catalysts

About RateGain Travel Technologies- A Software as a Service (SaaS) company, provides solutions for hospitality and travel industries in India, North America, the Asia-Pacific, Europe, and internationally.

- Strong growth in new contract wins and a robust pipeline, especially in APAC and North America, position RateGain to capitalize on the ongoing digitization and expansion of the global travel industry, which is likely to drive sustained revenue growth over the coming quarters and years.

- Continued strategic investment in AI-powered product innovation (e.g., UNO VIVA, RG Insights, Smart ARI) and integrated, real-time analytics aligns RateGain's offerings with industry demand for data-driven decision-making and automation, supporting higher average contract values, improved product stickiness, and potential EBITDA margin expansion.

- Expansion into high-growth ancillary verticals (beyond hotels to airlines, car rentals, etc.) and a focus on integrated suites (like UNO) significantly broaden RateGain's addressable market and wallet share within client organizations, which can accelerate revenue growth and lead to improved operating leverage and net margins.

- The shift toward recurring, subscription/hybrid revenue streams now making up nearly half of total revenue, coupled with high renewal rates north of 35% in Adara, increases visibility and predictability in future earnings, which should support higher valuation multiples as the market recognizes improved cash flow stability.

- RateGain's strengthened go-to-market (GTM) execution, particularly in APAC and Middle East where digital travel adoption is surging, enhances its ability to win new logos and cross-sell/upsell to existing customers, driving both top-line growth and higher customer lifetime value, which should positively impact earnings and margin trajectory.

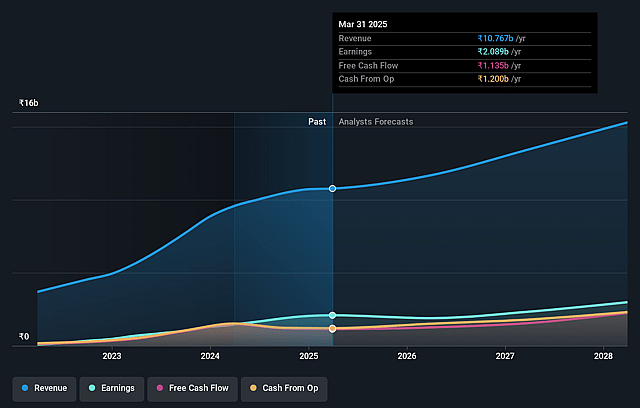

RateGain Travel Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming RateGain Travel Technologies's revenue will grow by 13.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 19.3% today to 18.9% in 3 years time.

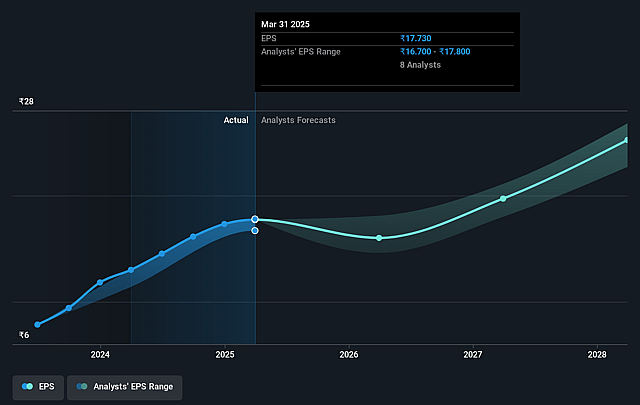

- Analysts expect earnings to reach ₹3.0 billion (and earnings per share of ₹25.8) by about September 2028, up from ₹2.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹2.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.2x on those 2028 earnings, up from 33.1x today. This future PE is lower than the current PE for the IN Software industry at 35.9x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.36%, as per the Simply Wall St company report.

RateGain Travel Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's Net Revenue Retention (NRR) has declined to 100%, indicating limited expansion sales to existing customers and potential stagnation in customer lifetime value, which may constrain long-term revenue and earnings growth if the trend persists.

- Over half of RateGain's revenue is now derived from transaction-based models, which tend to have lower gross margins and more variability compared to subscription revenue-this shift could compress net margins and make earnings less predictable over time.

- The organic growth in some legacy segments, particularly Adara DaaS and social media martech products, is flat or in decline, and the company remains exposed to revenue attrition as long-tail and legacy customers churn or are lost to consolidation, potentially limiting topline growth.

- The travel technology industry continues to see significant competition, as noted by management's openness to new competitors (e.g., "Guestara") and admission of 50% of new wins being displacement deals; this ongoing competitive pressure may impact pricing power and keep margins under pressure in the long term.

- A heavy focus on APAC and SMB markets may introduce execution risks around pricing sensitivity, slower customer ramp-up, and localized competition, which could impact the realization of revenue from the strong order pipeline and limit overall profitability in global expansion efforts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹557.875 for RateGain Travel Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹650.0, and the most bearish reporting a price target of just ₹450.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹16.1 billion, earnings will come to ₹3.0 billion, and it would be trading on a PE ratio of 33.2x, assuming you use a discount rate of 15.4%.

- Given the current share price of ₹590.05, the analyst price target of ₹557.88 is 5.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.