Last Update 15 Dec 25

Fair value Increased 27%RATEGAIN: AI Travel Solutions Will Drive Long Term Upside Potential

Analysts have raised their price target on RateGain Travel Technologies from ₹690 to ₹875, citing sharply upgraded long term revenue growth expectations despite slightly lower margin and discount rate assumptions.

What's in the News

- Launched Rev-AI Clarity, an intelligent revenue assistant for car rental operators that converts complex demand and pricing data into conversational insights and decision ready recommendations (company announcement)

- Renewed a long term AirGain pricing intelligence contract with Singapore Airlines, extending a seven year partnership to support real time fare monitoring and revenue optimization (client announcement)

- Formed multiple strategic hotel tech partnerships, including integrations with Arpon Enterprise, HotelIQ, FLYR, and Oracle OPERA Cloud, to embed RateGain channel management and rate intelligence tools directly into partner platforms (client announcements)

- Expanded its relationship with Royal Orchid Hotels, which adopted RateGain's AI first UNO suite across its growing portfolio to boost direct bookings and unify commercial operations (client announcement)

- Issued fiscal 2026 guidance targeting approximately 55 to 60 percent year on year revenue growth over fiscal 2025, reflecting confidence in post acquisition scaling (corporate guidance)

Valuation Changes

- Consensus Analyst Price Target has risen significantly from ₹690 to ₹875, implying a materially higher assessed fair value for RateGain Travel Technologies.

- Discount Rate has edged down slightly from 15.43 percent to 15.15 percent, reflecting a modest reduction in perceived risk or required return.

- Revenue Growth assumptions have increased sharply from about 14.8 percent to about 56.0 percent, indicating a much more aggressive long term growth outlook.

- Net Profit Margin expectations have fallen significantly from roughly 19.9 percent to about 10.1 percent, suggesting anticipated pressure on profitability even as revenues scale.

- Future P/E multiple has decreased marginally from 38.1x to 37.1x, indicating a slightly more conservative valuation multiple despite the higher growth forecast.

Key Takeaways

- Successful execution of large enterprise strategies and deep AI integration could rapidly accelerate revenue growth, margin expansion, and recurring revenue beyond current expectations.

- Expansion in high-growth regions and disciplined acquisitions provide significant opportunities for diversification, market share gains, and long-term topline growth.

- Overdependence on travel sector and key clients, along with increased competition and macroeconomic pressures, threatens RateGain's revenue stability and long-term growth prospects.

Catalysts

About RateGain Travel Technologies- A Software as a Service (SaaS) company, provides solutions for hospitality and travel industries in India, North America, the Asia-Pacific, Europe, and internationally.

- While analyst consensus expects RateGain's pivot to large enterprises and strategic partnerships to drive incremental, predictable growth, this may be significantly understated-successful execution and cross-sell opportunities with multi-year, high-value deals could lead to a step-change in revenue and margin expansion well beyond current forecasts.

- Analysts broadly agree that investments in AI-driven solutions and product innovation will boost efficiency and client value, but the tangible productivity gains already occurring across engineering, HR, sales, and support functions suggest the company is only at the start of a multi-year cycle of margin expansion and cost leverage, potentially transforming its earnings profile faster than anticipated.

- The company's early and deep AI integration-evident in new products like VIVA, Smart ARI, Demand Booster, and UNO-positions RateGain as a foundational technology layer for a travel sector undergoing rapid digital transformation, making large-scale client adoption and long-term recurring revenues increasingly likely as mobile and cloud-based commerce proliferate.

- RateGain's expanding presence in fast-growing APAC and Middle East markets, which currently account for a relatively small share of revenue, aligns with surging travel demand and mobile adoption in these regions, offering an outsized long-term topline growth runway as market share increases.

- With a robust cash balance, proven acquisition discipline, and an active M&A pipeline, RateGain is positioned to rapidly accelerate growth and diversify revenue across new adjacencies or geographies through strategic, multiple-accretive acquisitions, potentially lifting both revenue and valuation multiples as new platforms are integrated.

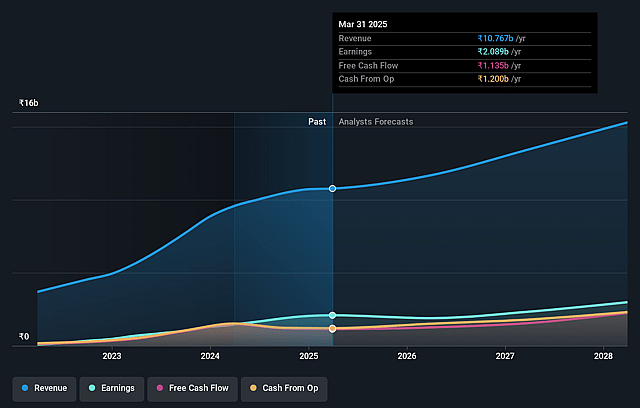

RateGain Travel Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on RateGain Travel Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming RateGain Travel Technologies's revenue will grow by 14.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 19.3% today to 19.9% in 3 years time.

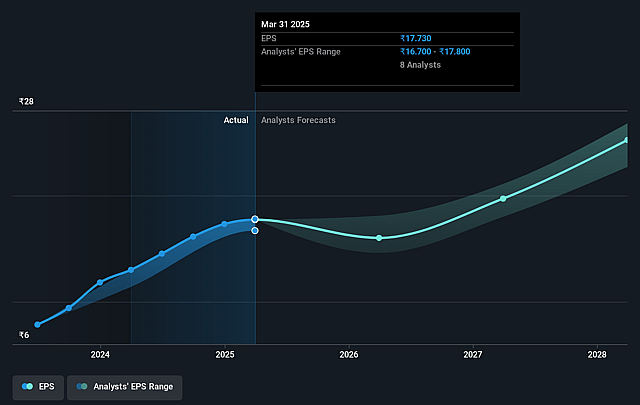

- The bullish analysts expect earnings to reach ₹3.3 billion (and earnings per share of ₹27.8) by about August 2028, up from ₹2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 38.1x on those 2028 earnings, up from 26.6x today. This future PE is lower than the current PE for the IN Software industry at 39.5x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.43%, as per the Simply Wall St company report.

RateGain Travel Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- RateGain's heavy sector concentration in travel and hospitality exposes it to cyclical downturns, pandemics, or prolonged reductions in travel demand, which could cause significant volatility in revenues and put long-term earnings growth at risk.

- Increasing pricing pressure and contract renegotiations in its DaaS and Distribution segments have led to revenue declines and margin compression, highlighting the risk of continued competitive pressure and possible deterioration of net margins.

- Macro headwinds such as global economic uncertainty, rising inflation, or recessions may cause hotels and airlines to cut discretionary spending on third-party technology, threatening RateGain's addressable market and long-term revenue growth prospects.

- The company remains reliant on winning large customer contracts and shows high client concentration in its top 10 accounts, making it vulnerable to sudden loss or churn of key customers and jeopardizing both revenue predictability and profitability.

- Rising adoption of in-house or open-source analytics solutions, as well as direct-to-consumer strategies by major hospitality brands, could accelerate industry disintermediation and erode RateGain's competitive moat, resulting in increased customer churn and potential revenue stagnation over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for RateGain Travel Technologies is ₹690.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of RateGain Travel Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹690.0, and the most bearish reporting a price target of just ₹450.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹16.5 billion, earnings will come to ₹3.3 billion, and it would be trading on a PE ratio of 38.1x, assuming you use a discount rate of 15.4%.

- Given the current share price of ₹474.0, the bullish analyst price target of ₹690.0 is 31.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on RateGain Travel Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.