Key Takeaways

- Exposure to hospitality and travel sector volatility and client consolidation threatens long-term revenue stability and bargaining power.

- Rising data privacy regulations and rapid AI-driven competition could erode product effectiveness, margins, and market share.

- AI-driven product innovation, strategic global expansion, and robust Martech growth are enhancing RateGain's competitive position, customer retention, and capacity for sustained profitable growth.

Catalysts

About RateGain Travel Technologies- A Software as a Service (SaaS) company, provides solutions for hospitality and travel industries in India, North America, the Asia-Pacific, Europe, and internationally.

- While RateGain is benefiting from a recent wave of AI-enabled product launches and strong new contract wins, future earnings may be threatened by increasingly stringent global data privacy regulations such as GDPR and CCPA; rising compliance costs and restricted data access could erode both topline growth and margins as RateGain's analytics and Martech businesses become less effective.

- Despite efforts to position RateGain as an end-to-end SaaS provider, accelerating trends of direct bookings by consumers and corporations-bypassing aggregators-may undermine the company's core connectivity, distribution, and revenue management offerings, resulting in reduced addressable market and lower organic revenue over the long term.

- RateGain's heavy concentration in the hospitality and travel sectors leaves it dangerously exposed to sector-specific volatility and longer-term downturns; even if travel rebounds short-term, any cyclical or secular decline could lead to sharp revenue drops and unpredictable earnings trajectories unsupported by its current valuation.

- As global competitors increasingly invest in advanced AI and machine learning, there is heightened risk that RateGain's R&D pace and product innovation will fail to keep up, leading to loss of market share, pricing pressure, margin compression, and challenges in retaining key clients.

- Ongoing industry consolidation, such as large hotel groups and OTAs merging, may further shift bargaining power away from RateGain; the result is the likelihood of sustained downward pressure on revenues per customer and weaker net revenue retention in the medium to long term.

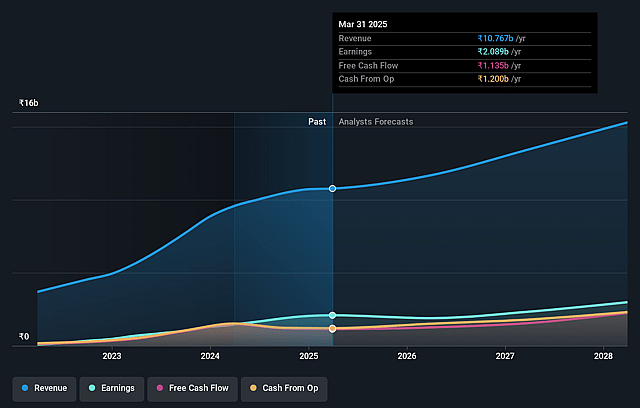

RateGain Travel Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on RateGain Travel Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming RateGain Travel Technologies's revenue will grow by 11.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 19.3% today to 17.8% in 3 years time.

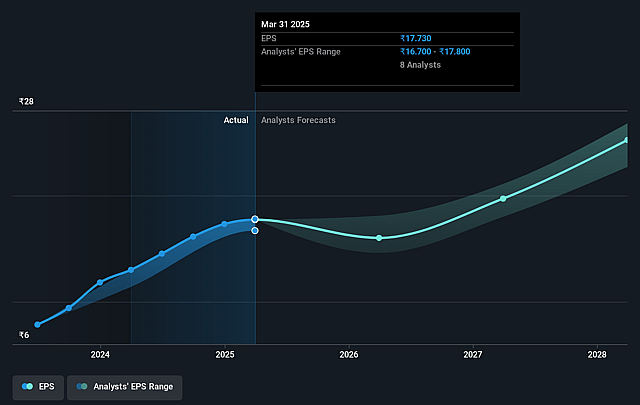

- The bearish analysts expect earnings to reach ₹2.7 billion (and earnings per share of ₹22.91) by about September 2028, up from ₹2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 30.2x on those 2028 earnings, down from 33.1x today. This future PE is lower than the current PE for the IN Software industry at 36.4x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.36%, as per the Simply Wall St company report.

RateGain Travel Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has recorded its highest ever new contract wins at ₹81.7 crores, growing 37.7% year-on-year, signaling strong customer demand and filling its order book, which could drive future revenue growth.

- RateGain is doubling down on AI-driven product innovation with early adoption and positive market traction, expanding its value proposition and increasing the likelihood of higher margins and competitive differentiation over the long term.

- Strategic investments in go-to-market resources, especially in high-growth regions like APAC and Middle East, have resulted in significant revenue increases and expanding client base, which could support sustained earnings and top-line growth.

- The Martech business, particularly the Adara segment, is experiencing robust expansion, with steady renewals growing by 41% year-on-year, suggesting increased customer stickiness and resilience in key revenue streams that could boost future profit stability.

- Healthy balance sheet strength, with ₹1,281 crores in cash and equivalents and strong net worth, positions RateGain for further investment or acquisitions, enabling continued growth and potentially supporting higher net margins and earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for RateGain Travel Technologies is ₹450.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of RateGain Travel Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹650.0, and the most bearish reporting a price target of just ₹450.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹15.2 billion, earnings will come to ₹2.7 billion, and it would be trading on a PE ratio of 30.2x, assuming you use a discount rate of 15.4%.

- Given the current share price of ₹590.05, the bearish analyst price target of ₹450.0 is 31.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on RateGain Travel Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.