Key Takeaways

- Commoditization and pricing pressures in core segments are expected to suppress profitability, while revenue remains vulnerable to client and sector concentration risks.

- Competition from in-house AI solutions and external shocks threaten market relevance and growth outlook, with acquisition reliance adding further risk to stable returns.

- AI-driven product innovation, diversified global expansion, and favorable industry trends are positioning RateGain for resilient, scalable revenue growth and sustained margin improvements.

Catalysts

About RateGain Travel Technologies- A Software as a Service (SaaS) company, provides solutions for hospitality and travel industries in India, North America, the Asia-Pacific, Europe, and internationally.

- Ongoing pricing pressure in core DaaS and Distribution segments-highlighted by the need to reprice legacy contracts and renegotiate with major accounts-signals continued commoditization of travel technology services, which is likely to lead to stagnant gross margins and declining profitability as RateGain struggles to command premium pricing in a market with increasing bargaining power for customers.

- Heightened revenue and customer concentration risk-demonstrated by significant topline losses associated with sunsetting or contract renegotiation at a major OTA client-means the company remains exposed to abrupt contractions in revenue, and lack of diversification increases the likelihood of future earnings volatility.

- As large hotel chains, OTAs, and travel intermediaries accelerate the development and adoption of in-house and proprietary AI-driven technology, RateGain faces eroding demand for third-party SaaS solutions, resulting in a shrinking addressable market and diminishing long-term secular growth opportunities, thus exerting persistent pressure on revenue expansion.

- With global travel exposed to exogenous shocks including geopolitical instability, regulatory tightening on data privacy, and the ongoing risk of pandemics, RateGain's core customer base is vulnerable to structural declines in transaction volumes, directly undermining medium-to-long-term revenue forecasts and the growth assumptions embedded in current valuations.

- Reliance on inorganic growth through acquisitions continues, but as the company faces increased integration risk, potential earnings dilution, and uncertain realization of expected synergies, shareholder returns and reported profitability are likely to remain under pressure, even as cash balances are deployed, constraining future value creation.

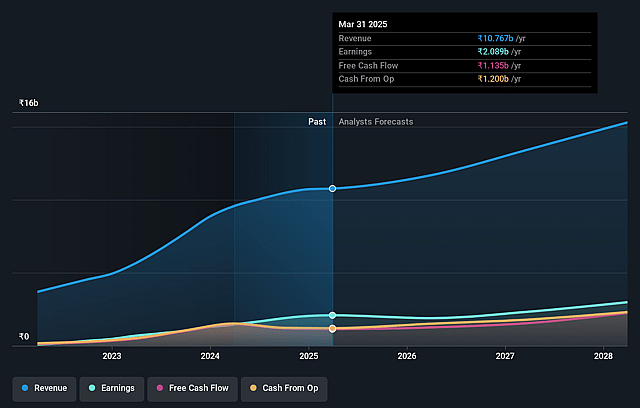

RateGain Travel Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on RateGain Travel Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming RateGain Travel Technologies's revenue will grow by 12.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 19.4% today to 18.3% in 3 years time.

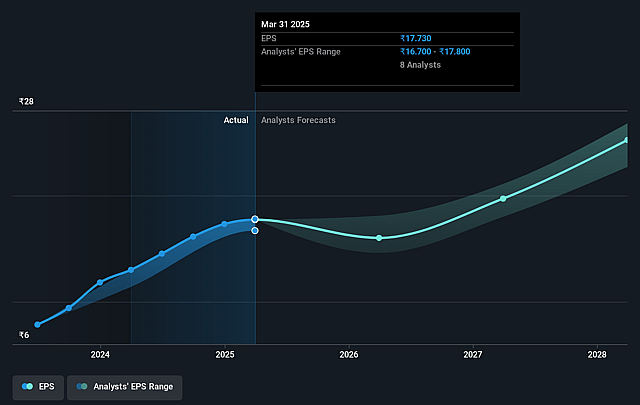

- The bearish analysts expect earnings to reach ₹2.8 billion (and earnings per share of ₹23.44) by about July 2028, up from ₹2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.0x on those 2028 earnings, up from 25.5x today. This future PE is lower than the current PE for the IN Software industry at 39.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.03%, as per the Simply Wall St company report.

RateGain Travel Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- RateGain has demonstrated sustained double-digit revenue growth across its core segments, including 19% growth in Martech for the year and strong performance in the DaaS vertical, indicating robust demand and customer traction that could support long-term revenue expansion.

- The company's strategic transformation to an AI-first platform is already yielding record EBITDA margins, boosting developer productivity, and enabling faster deployment of new features, which could drive both topline and margin expansion over time.

- Investments in international markets, particularly APAC, Middle East, Europe, and North America, are resulting in increasing revenue contributions from these geographies, diversifying RateGain's customer base and reducing reliance on any single region, which can make revenue growth more resilient.

- The pipeline remains healthy with ₹516 crores in deals, and customer retention is strong, as evidenced by a Net Revenue Retention rate of 105% and top 10 customer revenue growth of 17.3% year-to-date, supporting the potential for stable earnings and scalable net margins.

- Persistent industry tailwinds, such as the digitalization of travel bookings, increased adoption of cloud-based SaaS, and the recovery and secular growth of global travel and tourism, are likely to bolster long-term demand for RateGain's products and mitigate risks to long-term revenue and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for RateGain Travel Technologies is ₹450.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of RateGain Travel Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹690.0, and the most bearish reporting a price target of just ₹450.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹15.2 billion, earnings will come to ₹2.8 billion, and it would be trading on a PE ratio of 29.0x, assuming you use a discount rate of 15.0%.

- Given the current share price of ₹451.9, the bearish analyst price target of ₹450.0 is 0.4% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.