Key Takeaways

- Heavy reliance on short-term discretionary IT projects, offshore delivery, and a concentrated client base exposes Birlasoft to revenue volatility and compressed margins amid industry shifts.

- Competitive pressures, rising costs, and lagging presence in high-growth digital areas are likely to prolong margin compression and hinder sustainable earnings growth.

- Focused investment in growth areas, strong cash position, and a shift to high-quality annuity deals position Birlasoft for future revenue and margin expansion.

Catalysts

About Birlasoft- Provides software development services in India, the Americas, Europe, the United Kingdom, and internationally.

- Surging adoption of automation and AI across global enterprises is rapidly reducing reliance on traditional IT services, and with 70 percent of Birlasoft's revenue dependent on short-term, project-based discretionary spend, the company is acutely exposed to accelerating client shifts toward in-sourcing, automation, and annuity-based contracts, which will lead to sustained revenue volatility and potential revenue decline.

- Increasing client preference for local vendors due to growing data sovereignty, privacy laws, and shifting geopolitical alliances is undermining the cost advantage of Birlasoft's largely offshore delivery model, as evidenced by project ramp-downs, closures, and insourcing, which is likely to shrink the company's key client base and compress billing rates, resulting in downward pressure on top-line revenue and operating margin.

- Birlasoft's continued dependency on a concentrated set of large clients and lagging presence in high-growth cloud and digital verticals is intensifying its vulnerability to contract losses or price renegotiations, while limited traction in annuity-based deals relative to larger peers threatens both its ability to expand top-line growth rates and to sustain or improve net margins over the medium-term.

- Intensifying price competition from global IT giants and aggressive SaaS/cloud-native startups is accelerating commoditization and driving down billing rates on core services, while Birlasoft's ongoing restructuring, leadership churn, and slow recovery in its ERP business suggest it is unlikely to escape prolonged margin compression and below-industry earnings growth.

- Escalating wage costs and persistent high attrition in the Indian IT sector, when combined with a soft demand environment and necessary ongoing investments in sales, capability building, and new client acquisition, are expected to erode operational leverage, capping any potential net margin improvement and undermining the company's ability to consistently grow earnings per share.

Birlasoft Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Birlasoft compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Birlasoft's revenue will grow by 4.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 9.6% today to 11.2% in 3 years time.

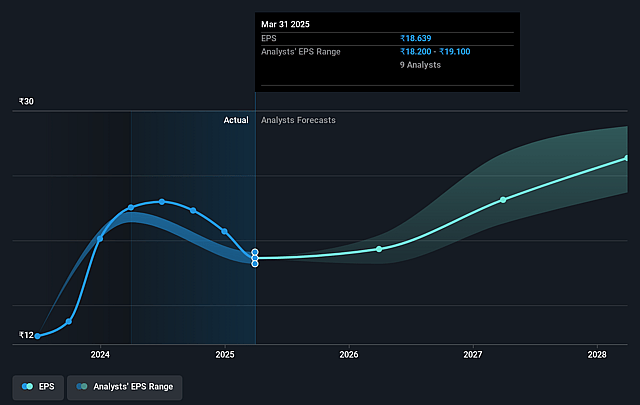

- The bearish analysts expect earnings to reach ₹6.8 billion (and earnings per share of ₹24.44) by about July 2028, up from ₹5.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.8x on those 2028 earnings, up from 21.7x today. This future PE is lower than the current PE for the IN Software industry at 38.5x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.07%, as per the Simply Wall St company report.

Birlasoft Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite current headwinds, the management highlighted a robust cash flow generation and a significant increase in new deal wins, especially multiyear annuity-based deals, which could stabilize and increase future revenues and earnings.

- The company is investing in growth areas like GenAI, advanced AI-powered delivery, vertical leadership, and strategic partnerships, with expectations that these investments will start driving revenue and margin improvement from FY27 onward.

- Birlasoft's balance sheet remains strong with no debt, growing cash reserves, and industry-best days sales outstanding, providing substantial capacity for continued investment or strategic acquisitions that could fuel future top-line and margin growth.

- Structural industry trends such as increasing digital transformation, rising demand for AI-powered and cloud native services, and continued IT modernization initiatives among enterprise clients could revive demand in Birlasoft's core areas and lead to revenue acceleration and margin expansion.

- The management's focus on shifting the business mix towards higher annuity revenues, increased operational efficiency, and the resumption of growth in core verticals like BFSI and MedTech could result in a return to sustained revenue and earnings growth over the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Birlasoft is ₹350.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Birlasoft's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹560.0, and the most bearish reporting a price target of just ₹350.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹60.5 billion, earnings will come to ₹6.8 billion, and it would be trading on a PE ratio of 21.8x, assuming you use a discount rate of 15.1%.

- Given the current share price of ₹403.85, the bearish analyst price target of ₹350.0 is 15.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.