Last Update10 Aug 25Fair value Decreased 7.73%

The downward revision in Birlasoft’s fair value primarily reflects reduced consensus revenue growth forecasts, partially offset by a modest improvement in net profit margin, resulting in the price target decreasing from ₹439.93 to ₹412.14.

What's in the News

- Birlasoft's Board will consider and approve unaudited financial results for the quarter ended June 30, 2025, at a meeting on August 7, 2025.

- Chief Financial Officer Kamini Shah has resigned for personal reasons, effective at the close of business on August 7, 2025.

- Chandrasekar Thyagarajan, with over 36 years of finance experience, is appointed as the new Chief Financial Officer effective August 8, 2025.

- The Board met on May 28, 2025 to approve the audited financial results for the quarter and year ended March 31, 2025, and to consider and recommend a final dividend.

Valuation Changes

Summary of Valuation Changes for Birlasoft

- The Consensus Analyst Price Target has fallen from ₹439.93 to ₹412.14.

- The Consensus Revenue Growth forecasts for Birlasoft has significantly fallen from 7.2% per annum to 5.9% per annum.

- The Net Profit Margin for Birlasoft has risen slightly from 11.10% to 11.55%.

Key Takeaways

- Expansion into advanced AI, automation, and new industry verticals is driving higher-margin contracts and greater revenue stability amid changing global demand.

- Focus on high-value digital services, operational efficiency, and specialized sales is strengthening earnings resilience and positioning for long-term growth.

- High client concentration, persistent margin and revenue pressures, and increased tax complexity create earnings instability and challenge consistent growth amid industry-wide cost-cutting and client uncertainty.

Catalysts

About Birlasoft- Provides software development and global IT consulting services in India, the Americas, Europe, the United Kingdom, and internationally.

- Investments in advanced automation, proprietary AI platforms, and GenAI-powered solutions are beginning to drive new client wins in emerging tech areas, positioning Birlasoft to capture higher-margin annuity contracts as enterprises accelerate digital transformation initiatives-supportive of both topline growth and long-term margin expansion.

- The diversification into verticals such as medtech, BFSI, and services is starting to balance the headwinds seen in manufacturing, offering improved revenue stability; as global demand for connected, compliant, and secure solutions rises, Birlasoft's expanded focus increases its addressable market and should smooth earnings volatility.

- The company's intensified push to grow the order book, restructure sales with specialized, domain-focused hires, and pursue larger, multi-year deals is designed to better align sales execution with client demand for integrated digital transformation-critical for reigniting sustainable revenue momentum.

- Customer wins in areas like Agentic AI, quality engineering transformation, and digital/data services highlight Birlasoft's move toward high-value services that support price resilience and recurring revenues, partially insulating against pricing pressure on traditional IT outsourcing-positively impacting gross margins.

- Strong balance sheet, robust cash flow generation, and continued investments in internal automation tools (like the Optimus platform) are enabling Birlasoft to drive operational efficiency and absorb short-term macro/tax disruptions, preserving the capacity to invest for future growth and margin recovery as market conditions improve.

Birlasoft Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Birlasoft's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.9% today to 11.6% in 3 years time.

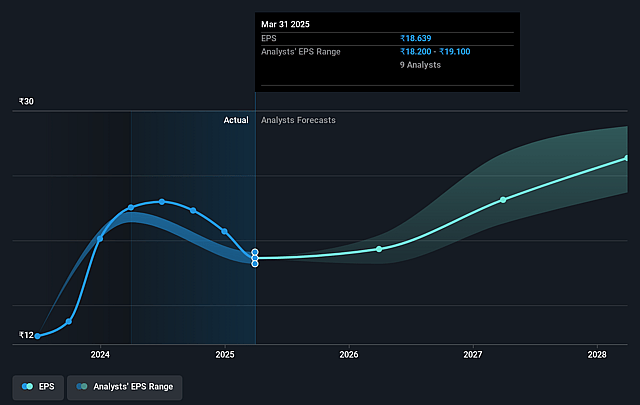

- Analysts expect earnings to reach ₹7.3 billion (and earnings per share of ₹24.1) by about August 2028, up from ₹4.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹6.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.3x on those 2028 earnings, up from 21.8x today. This future PE is lower than the current PE for the IN Software industry at 36.7x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.49%, as per the Simply Wall St company report.

Birlasoft Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High client concentration, with the top 40 customers accounting for 93% of revenue, exposes Birlasoft to significant revenue volatility if any large customer chooses to insource, reduce IT spend, or switch providers; this could materially impact future revenues and earnings.

- Prolonged weakness and uncertainty in the manufacturing and ERP verticals, driven by macroeconomic headwinds, project completions, insourcing, and delays in client decision-making-especially among mid-sized US and European firms-may persist and pressure overall revenue growth and earnings stability.

- Persistent margin pressure due to intense pricing competition, especially on new deal wins, along with ongoing risks from wage inflation, employee attrition, and the potential need for localized hiring, could compress EBITDA and net margins over time.

- A sharp, unexpected rise in the effective tax rate (from 25-26% historically to ~36% for FY26 due to contractual realignment and tax provisioning) will negatively impact net earnings and may signal ongoing complexity in Birlasoft's operational structure or compliance costs.

- Heavy reliance on winning new large deals, amid industry-wide client cost-cutting and uncertainty around the timing and closure of such deals, makes revenue visibility weak and growth highly dependent on quarterly execution rather than on secular or structural demand; this could lead to continued muted or inconsistent revenue growth and affect investor sentiment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹405.929 for Birlasoft based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹485.0, and the most bearish reporting a price target of just ₹339.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹62.6 billion, earnings will come to ₹7.3 billion, and it would be trading on a PE ratio of 24.3x, assuming you use a discount rate of 15.5%.

- Given the current share price of ₹370.8, the analyst price target of ₹405.93 is 8.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.